[ad_1]

While the money from Uncle Sam isn’t a priority for startups, SBA loans can provide low-cost capital.

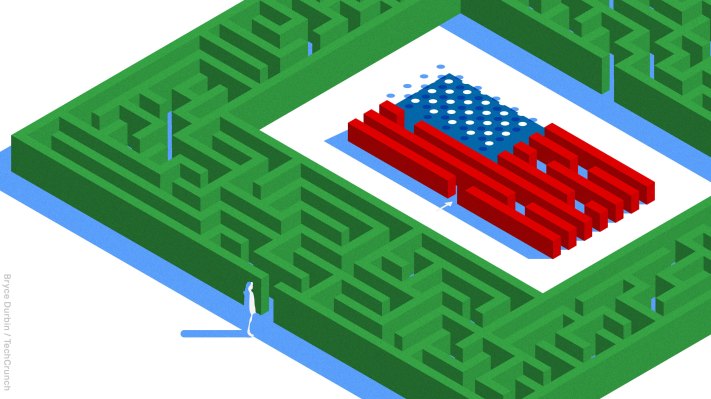

What is the difference? Between a startup and a small business? Translations, in abundance. With this year’s funding crunch, as many startups struggle to raise money from venture capitalists themselves, the U.S. Small Business Administration (SBA) can be a powerful resource for capital, although startups typically seek funding from other sources.

Chris Hurn.Fountainhead’s founder and CEO knows the benefits of taking on government financing. Fountainhead is a non-bank lender of government guaranteed loans. Hur said the current generation of entrepreneurs is laser-focused on raising equity-based funding from backers like venture capital firms — but that’s not the only option, especially since equity is more expensive in current market conditions.

“The problem is that business owners often overlook readily available debt capital,” Hurn told TechCrunch. “They should not give up any equity. [SBA loans] It can often be the perfect stepping stone they need to get to the next level.”

[ad_2]

Source link