[ad_1]

The annual inflation rate in the UK more than doubled in April, to 1.5%, due to higher petrol prices and higher gas and electricity bills. since the onset of the coronavirus pandemic.

As of 0.7% in March, the rise in the consumer price index coincided with the expectations of economists and the Bank of England, who see the move as a step towards inflation. exceeds the 2% target by the end of the year.

Official figures also showed that the inflation rate only remained as low as due to the temporary rate of 5% of the value added tax on hospitality, which will be extended until the end of September.

If taxes were at their normal levels, inflation, as measured by the consumer price index, would have risen to 3.2%, the highest rate in nine years.

Unlike the United States, where the measure of global inflation reached 4.2% in April, the UK figures still show no signs of a sustained rise in price rises, although economists they said there were some causes for concern in the data.

Prices for food outside restaurants, staying in hotels and clothing rose sharply in April, following the reopening of non-essential shops and authorized hospitality centers to serve outside customers.

Samuel Tombs, British economist at Pantheon Macroeconomics, said the figures did not yet show worrying signs of a reopening of inflation in the United States, but added that “CPI inflation will rise further during the coming months as the prices of air travel, domestic accommodation and holidays combined jump in response to rising consumer demand. ”

Most economists thought Wednesday’s figures suggest that the next rise in the rate of price increase would be temporary and would remain under control. Ruth Gregory, a senior British economist at Capital Economics, said inflation would rise above the BoE’s 2% target soon, but added: “We doubt it will stay there much, as the effects related to ‘Energy will be reversed next year, and reopening inflation is declining and the stronger pound is pushing inflation down.’

The underlying rate of inflation, which excludes volatile categories of energy, food, alcohol and tobacco bills, rose from 1.1% in March to 1.3% in April.

Andrew Bailey, BoE governor, said on Tuesday that he was looking at the data “very carefully” to find evidence of a persistent overflow in the bank’s target and that he would not hesitate to act by tightening monetary policy if risks manifest.

Economists said the April figures would not be enough to increase pressure on the central bank to start raising interest rates from its all-time low of 0.1 per cent.

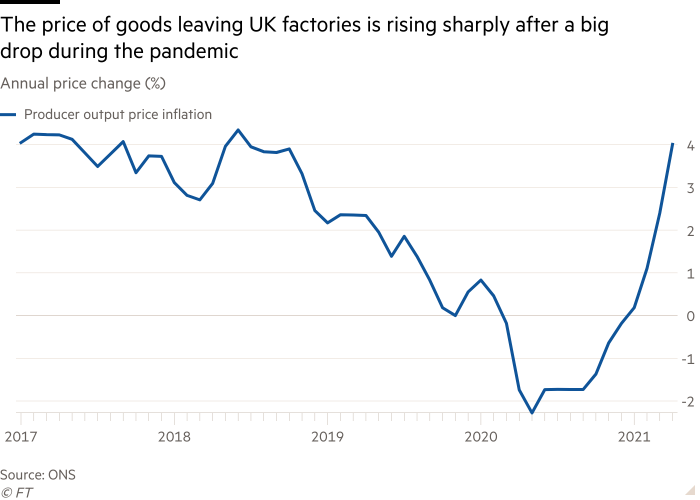

A sign that there could be more pipeline inflation than the BoE expects is that the cost of commodity and commodity prices coming out of UK factories rose sharply in April.

The ONS said that ticket prices, which included goods such as oil and raw materials, were 9.9% higher in April than a year earlier, compared to a rate of 6.4 % in March and the highest reading of this element of the index of prices to the production from February of the 2017.

The rate of inflation of goods leaving UK factories rose to 3.9% in April, from 2.3% in March, with sharp rises in inflation rates for wood products , petroleum products and base metals.

[ad_2]

Source link