[ad_1]

Introduction: UK facing recession and cost-of-living crisis

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

The UK is heading into a period of stagflation with high inflation and a looming recession dealing a double-blow to the country as a winter of economic misery approaches.

That’s the chilling warning from the National Institute of Economic and Social Research this morning, which fears that one in five households will be left without savings by 2024, as the cost-of-living crisis hits.

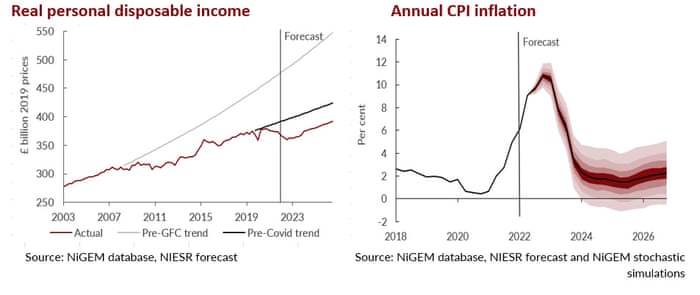

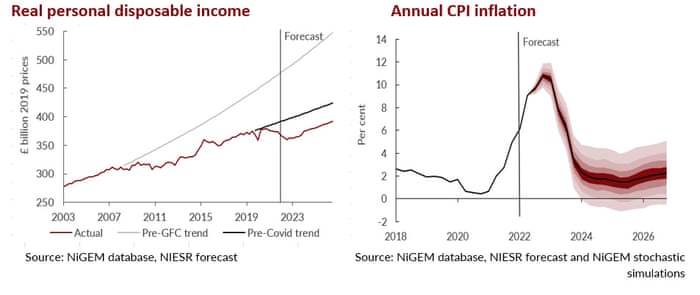

In its latest quarterly outlook of the UK economy, NIESR warns that CPI inflation is anticipated to peak close to 11 per cent in the fourth quarter of this year, when energy bills across Britain are expected to soar over £3,000 per year.

Those soaring prices mean average real household disposable incomes would shrink by 2.5% this year, as wages fail to keep up with inflation.

NIESR warns that vulnerable households will be worse hit. It predicts the UK will enter a recession this quarter – which will last until the first quarter of 2023 — pushing up unemployment.

This would worsen economic inequality across the country, scuppering the Levelling Up agenda.

NIESR sees the gap between London and the rest of the United Kingdom widening, as the West Midlands, and parts of Wales and Scotland continue to fall further behind.

The government must give more support to help struggling households through the crisis, insists Professor Adrian Pabst, NIESR’s Deputy Director for Public Policy:

“All households are facing soaring energy and food bills but too many have to resort to credit, build up payment arrears or see their savings wiped out.

The incoming administration needs to provide immediate emergency support to the 1.2 million hardest hit households and the one-in-five households that will become financially vulnerable as the energy price cap is lifted and the recession begins to bite.”

Here’s the full story:

And here are the key points from their report:

- We expect GDP to grow by 3.5 per cent this year and 0.5 per cent next year, with an ‘evens’ chance of GDP being lower at the end of this year than at the end of last year.

- We forecast consumer price index inflation to peak close to 11 per cent in the fourth quarter, falling back to 3 per cent at the end of 2023. We expect retail price index inflation to reach 17.7 per cent – its highest rate since June 1980.

- We expect the Monetary Policy Committee to continue tightening policy, with Bank Rate reaching 3 per cent in the second quarter of next year.

- We see unemployment rising above 5 per cent over the coming twelve months as firms respond to the fall in aggregate demand.

Also coming up today

Ministers from the Opec oil producers will meet today, but are not expected to agree to boost crude supply, as a possible global recession could limit energy demand.

The latest survey of purchasing managers are expected to show that service sector growth slowed in the UK, and across Europe, in July.

And the travel sector continues to struggle with the summer rush, with British Airways deciding to restrict sales for short-haul flights from Heathrow all summer, with no more tickets for departures before 15 August.

The agenda

- 7am BST: German trade balance for June

- 9am BST: Eurozone service sector PMI for July

- 9.30am BST: UK services sector PMI for July

- 10am BST: Eurozone retail sales for June

- Noon: OPEC and non-OPEC Ministerial Meeting

- 3pm BST: US factory orders for June

Key events

Filters BETA

Despite economic headwinds, German exports beat forecasts with 4.5% growth in June.

Exports from Europe’s largest economy hit a record level thanks to demand from the European Union, the United States and China, data this morning shows.

Exports rose for a third month in a row, pushing Germany’s seasonally adjusted trade surplus to €6.4bn (£5.35bn) in June, well above a forecast for €2.7bn.

Preliminary data last month had shown Germany posting its first trade deficit in more than 30 years in May, but that May figure of €-1.0bn has been revised to show a small surplus.

Eurozone ‘slips into contraction’ as inflation hits economy

The eurozone private sector shrank last month for the first time since Febuary 2021, as manufacturing output declined and the service sector slowed.

Companies across both sector blamed the damaging impact that high inflation was having on output levels, with businesses hit by a fall in new orders and growing economic uncertainty.

The latest survey of eurozone purchasing managers, from S&P Global, found that the manufacturing sector was a significant drag on the euro area economy during July as production volumes fell at the fastest rate since May 2020.

Services activity continued to rise overall, but growth slowed to its weakest since the Omicron-related disruption at the start of the year.

Lloyd’s of London insurer Hiscox is committed to a planned insurance consortium providing cover for ships travelling through a safe passage from Ukraine, its chief executive said has told Reuters.

Trade body the Lloyd’s Market Association last month said a consortium could be formed to provide cover for grain shipments transported through the Black Sea to alleviate a global food crisis.

The consortium had not yet been finalised, Aki Hussain told Reuters by phone.

“We have committed our support to the Lloyd’s market-led initiative.

“We are very supportive of it.”

Lloyd’s insurer Ascot and broker Marsh have already launched a separate facility to provide up to $50m in cover for grain shipments from Ukraine.

The first grain-carrying ship to leave Ukrainian ports since the Russian invasion began left the port of Odesa on Monday, under an internationally brokered deal to unblock Ukraine’s agricultural exports.

The Razoni safely anchored off Turkey’s coast on Tuesday, and is being inspected today:

Taylor Wimpey staff to get £1,000 to help with cost of living squeeze

Julia Kollewe

Taylor Wimpey, one of Britain’s biggest housebuilders, is handing many of its employees a payment of up to £1,000 to help them with soaring living costs.

Staff on annual salaries of up to £70,000 will qualify for the payment, to help them cope with rising inflation and the predicted increase in fuel bills this winter, my colleague Julie Kollewe reports.

Other companies have also been giving staff one-off payments to help; HSBC agreed a £1,500 payment for lower-paid staff earlier this week.

Taylor Wimpey’s move came after a solid set of first-half results with revenues of £2.1bn, down 5.4% from last year, and a profit before tax of £334.5m, up 16.3%. Excluding joint ventures, the company completed on 6,790 homes, down from 7,303 last year but ahead of its expectations.

The group, run by Jennie Daly, now expects full year operating profit toward the top end of £873-£924m. That’s driven by strong average selling prices that are expected to be 4%-5% higher than last year, fully offsetting 9%-10% build cost inflation.

Taylor Wimpey shares have risen 2.3% on the news.

Matt Britzman, equity analyst at Hargreaves Lansdown, said:

“This was a good set of numbers against the backdrop of record performance last year.

There’s still a structural supply/demand imbalance in the UK propping up prices despite consumer spending power falling. The forward order book looks strong and Taylor Wimpey’s doubling down on efforts to take full advantage, opening the check book to push more outlets and being new land plots into the fold.

Cost inflation remains a thorn, running around 9-10% but fully offset by higher prices for now. It remains to be seen how long that can continue, but while it does shareholders can continue to expect solid returns.”

Budget airline Ryanair flew almost one million more passengers in July than in June, despite the disruption at UK airports.

Ryanair carried 16.8m passengers last month, 80% more than in July 2021. That’s up from the 15.9m in June, when Ryanair broke its passenger record.

Planes were fuller than a year ago too, with Ryanair lifting its load factor to 96% in July, from 80% in July 2021.

The £6bn merger between British cybersecurity company Avast and US rival NortonLifeLock has been provisionally given the green light by the UK competition watchdog — sending Avast’s shares rocketing.

The Competition and Markets Authority (CMA) said it does not believe the tie-up raises competition concerns in the UK following an in-depth merger launched after the deal was announced last August.

The CMA said while concerns were first raised in its initial probe, more detailed analysis of the deal found that the merging businesses face “significant competition” from the likes of main rival McAfee and a range of other smaller suppliers.

It added security applications provided by Microsoft – the owner of the Windows operating system – are increasingly important alternatives for consumers, with the group now offering free built-in security application that “give protection which is as good as many of the products offered by specialist suppliers”.

We have provisionally cleared this #merger. We will consider any responses to this finding before reaching our final decision.

Submit your view 👇https://t.co/q7r2x8c9q6

(2/2)

— Competition & Markets Authority (@CMAgovUK) August 3, 2022

Shares in Avast have jumpd over 40%, suggesting the City didn’t expect the CMA to give provisional clearance.

The CMA has set a deadline of August 24 for responses to its provisional decision, with a final report due by September 8.

UK petrol prices not falling in line with wholesale cost – RAC

Gemma McSherry

Major retailers are moving too slowly to cut petrol prices, the RAC has warned.

Although fuel prices did drop last month, those reductions still don’t fairly reflect the fall in the wholesale price of fuel.

My colleague Gemma McSherry explains:

Over the last eight weeks, the average price paid for unleaded by drivers across the UK has only dropped by 9p a litre – all of which came off in July – despite wholesale petrol prices falling by 20p in the same time period.

According to the motoring organisation, the wholesale cost of unleaded is now back to the prices reached in early May, meaning a litre should be 167p, not 183p.

The disparity in cost from wholesale to consumer means drivers are paying nearly £9 more on a tank of petrol than they should be, it said. A tank of diesel should be lower than the end of July average, the RAC added.

RAC fuel spokesperson, Simon Williams, criticed the supermarket chains for not cutting prices faster last month:

“July has been an unnecessarily tough month for drivers due to the big four supermarkets’ unwillingness to cut their prices to a more a reasonable level, reflecting the consistent and significant reductions in the wholesale cost of petrol and diesel.”

World economy ‘fraying at edges’

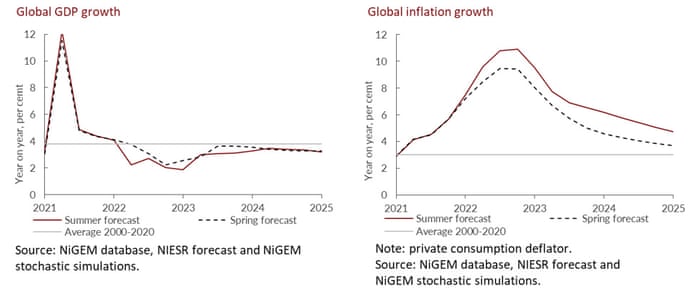

NIESR have also slashed their global growth forecasts, and lifted their inflation forecasts, warning that the world economy also risks stagflation.

Global GDP is only expected to rise by 2.8% this year, and again in 2023, down from 3.3% and 3.2% growth which was forecast in the spring.

And inflation across the OECD is now seen soaring to 9.7% this year (up from 8.2% forecast previously), and only drop back to 6.3% in 2023 (up from 4.5%).

“The world economy is fraying at the edges”, warns Corrado Macchiarelli, NIESR’s Manager for Global Macroeconomics Research:

The easing of monetary and financial conditions during Covid, continuing disruptions to supply chains and the continuing war in Ukraine have prompted us to revise global GDP growth down and inflation up even further, compared to our Spring Outlook.

Uncertainty around Russia’s supply of gas to the Euro Area, the effect that higher policy and market interest rates will have on global demand, and the impact of higher fuel and food price rises on emerging markets are among the key downside risks to this forecast.”

The next UK prime minister should focus economic policy on redistributing resources to the most financially vulnerable households and maintain public services, NIESR adds.

They recommend:

- A Universal Credit uplift of £25 per week for at least six months from October 2022 to March 2023.

- Raising the energy grant from £400 to £600 for the 11 million low-income households.

- doubling the financial support for the Towns Fund from £4.8bm to £9.6bn and expanding the remit of the UK Infrastructure Bank; increasing its capital from £14bn to £50bn.

Professor Stephen Millard, NIESR’s Deputy Director for Macroeconomics, says families need support, while the Bank of England tries to get inflation under control.

“The UK economy is heading into a period of stagflation with high inflation and a recession hitting the economy simultaneously.

It’s now up to the Monetary Policy Committee to make sure inflation does come down next year and the new Chancellor to support those households most affected by the recession and cost-of-living squeeze.”

Introduction: UK facing recession and cost-of-living crisis

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

The UK is heading into a period of stagflation with high inflation and a looming recession dealing a double-blow to the country as a winter of economic misery approaches.

That’s the chilling warning from the National Institute of Economic and Social Research this morning, which fears that one in five households will be left without savings by 2024, as the cost-of-living crisis hits.

In its latest quarterly outlook of the UK economy, NIESR warns that CPI inflation is anticipated to peak close to 11 per cent in the fourth quarter of this year, when energy bills across Britain are expected to soar over £3,000 per year.

Those soaring prices mean average real household disposable incomes would shrink by 2.5% this year, as wages fail to keep up with inflation.

NIESR warns that vulnerable households will be worse hit. It predicts the UK will enter a recession this quarter – which will last until the first quarter of 2023 — pushing up unemployment.

This would worsen economic inequality across the country, scuppering the Levelling Up agenda.

NIESR sees the gap between London and the rest of the United Kingdom widening, as the West Midlands, and parts of Wales and Scotland continue to fall further behind.

The government must give more support to help struggling households through the crisis, insists Professor Adrian Pabst, NIESR’s Deputy Director for Public Policy:

“All households are facing soaring energy and food bills but too many have to resort to credit, build up payment arrears or see their savings wiped out.

The incoming administration needs to provide immediate emergency support to the 1.2 million hardest hit households and the one-in-five households that will become financially vulnerable as the energy price cap is lifted and the recession begins to bite.”

Here’s the full story:

And here are the key points from their report:

- We expect GDP to grow by 3.5 per cent this year and 0.5 per cent next year, with an ‘evens’ chance of GDP being lower at the end of this year than at the end of last year.

- We forecast consumer price index inflation to peak close to 11 per cent in the fourth quarter, falling back to 3 per cent at the end of 2023. We expect retail price index inflation to reach 17.7 per cent – its highest rate since June 1980.

- We expect the Monetary Policy Committee to continue tightening policy, with Bank Rate reaching 3 per cent in the second quarter of next year.

- We see unemployment rising above 5 per cent over the coming twelve months as firms respond to the fall in aggregate demand.

Also coming up today

Ministers from the Opec oil producers will meet today, but are not expected to agree to boost crude supply, as a possible global recession could limit energy demand.

The latest survey of purchasing managers are expected to show that service sector growth slowed in the UK, and across Europe, in July.

And the travel sector continues to struggle with the summer rush, with British Airways deciding to restrict sales for short-haul flights from Heathrow all summer, with no more tickets for departures before 15 August.

The agenda

- 7am BST: German trade balance for June

- 9am BST: Eurozone service sector PMI for July

- 9.30am BST: UK services sector PMI for July

- 10am BST: Eurozone retail sales for June

- Noon: OPEC and non-OPEC Ministerial Meeting

- 3pm BST: US factory orders for June

[ad_2]

Source link