[ad_1]

UK GDP fell 0.1% in second quarter

Good morning, and welcome to our live, rolling coverage of business, economics and financial markets.

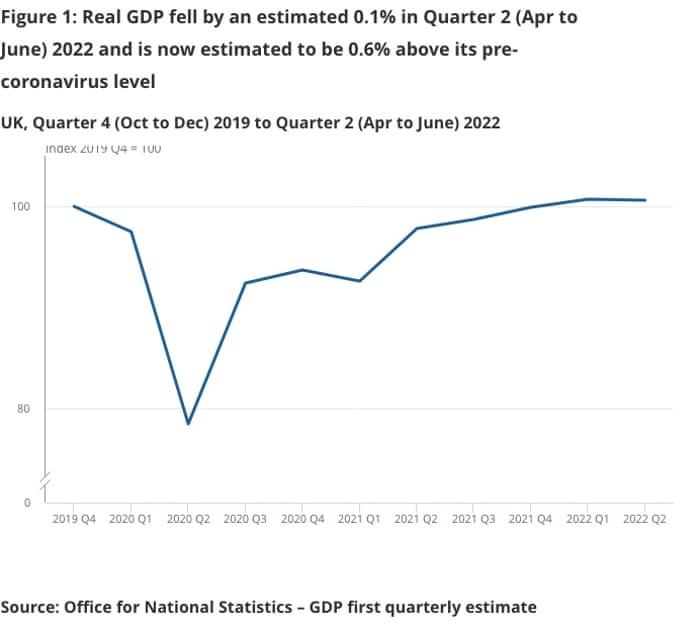

UK gross domestic product (GDP) is estimated to have fallen by 0.1% in the second quarter from April to June 2022, according to the Office for National Statistics (ONS).

The UK economy grew by 0.8% in the previous quarter, according to the ONS. However, economists had expected the economy to falter in the second quarter, with a poll this week predicting a 0.2% decline in UK GDP in the period from April to June.

The Bank of England has already predicted the UK will enter a long recession from the final three months of this year, with the economy only growing again in the first quarter of 2024.

A big reason for that expected recession is inflation and the Bank’s response to it. The Bank’s rate-setting monetary policy committee already voted last week for the biggest rate increase in 27 years in order to try to slow the pace of price increases.

Energy price rises are at the heart of the economic issues facing the UK and many other economies around the world. Annual average household energy bills are forecast to top £4,200 from January and £4,400 from April, according to forecasts from Cornwall Insights, a consultancy.

The state of the economy and the cost of living crisis are almost certain to be the top priority for the new prime minister, either Liz Truss or Rishi Sunak, once the Conservative party leadership race is decided by 5 September.

Current Prime Minister Boris Johnson has repeatedly said he will not take action on economic policy in his last few weeks as a lame duck leader, so as not to bind the hands of his successor. Johnson reiterated the message on Thursday in a meeting with energy company bosses, some of whose businesses have reported booming profits thanks in part to the invasion of Ukraine by Russia, which has raised concerns about global supplies.

However, opposition politicians, union leaders and campaigners have all urged the government to speak to the two leadership contenders’ teams about emergency actions to prepare for what is expected to be a very difficult winter for households.

The agenda

-

10am BST: Eurozone industrial production (July; previous: 0.5% month-on-month growth; consensus: 0.2%)

-

1pm BST: UK Niesr monthly GDP tracker (July; previous 0.2%)

Key events

Filters BETA

If the government response will be crucial to how the UK economy fares over the winter, then this pledge from Conservative leadership candidate Rishi Sunak could be important: he has said he will spend £10bn to help households with energy bills.

Writing in the Times this morning, he said that he was open to “limited and temporary, one-off borrowing as a last resort to get us through this winter” (to add to the temporary, one-off borrowing during the pandemic). Spending cuts are also on the table he said, without detailing them.

That would pay for a £5bn VAT on energy bills and another £5bn on giving more direct support to vulnerable households.

While that is less than the amount thought to be necessary by some analysts, the pledge will nevertheless likely raise pressure on Liz Truss, thought to be the frontrunner in the race to replace Boris Johnson as prime minister.

Some handy analysis from James Smith, developed markets economist at ING, an investment bank.

He cautions that the second-quarter GDP numbers are “very hard to read”, but that he expects July GDP to rebound sharply because of the “artificial” comparison with the extra jubilee bank holiday. July monthly GDP will rise by roughly 0.7%, and overall third-quarter GDP by around half a percent, he reckons.

“A fall in fourth-quarter GDP now looks highly likely,” he says, although the extent of the decline will depend on how the next prime minister responds.

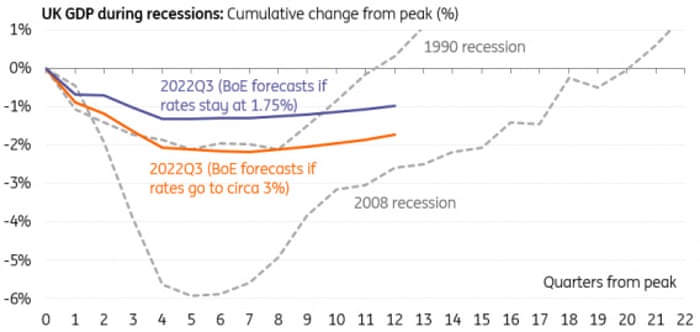

The Bank of England’s forecasts suggest the UK is in for a long slog, although hopefully not as deep as the global financial crisis, which scarred the global economy for the next decade.

The ONS said that real household consumption across the quarter fell by 0.2% in the quarter, but even then there are signs that the economy has been sustained by people enjoying themselves.

What happens to that spending in the next few months once the effects of inflation – particularly higher energy prices – come through? Remember, the energy price cap is due to increase from £1,971 to an expected £4,200 come January. That is an extra £2,000 that households will just have to find (unless the government steps in with a bigger intervention),

Derek Halpenny, head of research for Europe at MUFG Bank, said:

This weakness in services was partially offset by activity in two areas where nearly all the services growth came from – accommodation and food service activities and arts, entertainment and recreation underlining the boost from the Jubilee celebrations.

Business investment jumped 3.8% Q/Q and is a welcome stronger element of the report but follows a long period of post-Brexit weakness.

The better June print doesn’t change the overall backdrop and won’t alter at all the BoE’s outlook and hence its policy outlook. The BoE was forecasting a rebound in third-quarter GDP before we enter the five-quarter period of GDP contraction and today’s data doesn’t change that.

Small businesses, particularly retailers, are worried. Martin McTague, national chair of the Federation of Small Businesses, said:

The 0.2% real-terms fall in household consumption despite rises in outlay on housing and travel is a flashing alarm for small businesses, many of whom rely on consumer spending.

With levels of fuel poverty skyrocketing, fuel and energy costs far higher than they were in the same quarter last year, and rent costs rising steadily, there is less left in people’s pockets for holidays, new clothes, meals out, and other discretionary spending, leading to lower sales for many small businesses.

The 1% fall in the wholesale and retail trade over the quarter is deeply concerning, with supply chain disruption causing huge headaches and extra expense for businesses.

UK economy has ‘likely entered recession’ – Niesr thinktank

The analysts have had a bit more time to digest the figures. The National Institute of Economic and Social Research, a respected thinktank, thinks that the UK has already entered a recession.

It said: “It now looks like the UK economy entered a recession in the second quarter of this year as GDP fell by 0.1%, and we expect output to continue falling over the next three quarters.”

⚡️It now looks like the UK economy entered a #recession in the second quarter of this year as GDP fell by 0.1%, and we expect output to continue falling over the next three quarters. On the expenditure side, the fall in Q2 was driven by a 0.2% fall in consumption; on the…

1/2

— National Institute of Economic and Social Research (@NIESRorg) August 12, 2022

output side, by a 0.4% fall in services, particularly, health & social work. #GDP fell by 0.6% in June after a revised rise of 0.4% in May as the Platinum #Jubilee celebrations affected the monthly profiles.

Watch out for our full analysis, out shortly 📈

2/2

— National Institute of Economic and Social Research (@NIESRorg) August 12, 2022

Pharma company GSK and its recently spun-off consumer goods arm Haleon have risen this morning, bouncing after a steep sell-off related to liabilities for heartburn pills that probably contained a cancer-causing chemical.

Shares in GSK and Haleon fell heavily on Thursday, by 10% and 4.9% respectively, as investors became increasingly concerned about litigation from 3,000 former users of the medicines.

GSK has told Haleon that it too could be liable if the plaintiffs are successful – not an auspicious start for a newly independent company.

GSK has come out swinging this morning, with a statement saying there is no link between its product and the cancers suffered by customers. It said:

GSK, independent cancer researchers, the US Food and Drug Administration, and the European Medicines Agency, have all undertaken extensive reviews of available data and conducted numerous investigations into this issue since 2019.

Based on these investigations and experiments, GSK, the FDA, and the EMA have all independently concluded that there is no evidence of a causal association between ranitidine therapy and the development of cancer in patients.

The overwhelming weight of the scientific evidence supports the conclusion that there is no increased cancer risk associated with the use of ranitidine. Suggestions to the contrary are therefore inconsistent with the science, and GSK will vigorously defend itself against all meritless claims alleging otherwise.

GSK shares gained 2% on Thursday, while Haleon rose 0.2%.

As the London Stock Exchange opens for trading, here are some of the big movers.

Flutter, the owner of gambling firms Paddy Power, Betfair and Sky Bet, has said that it sees “no discernible signs of a consumer slow down currently, but we are closely monitoring key spend indicators given the uncertain macro economic outlook.”

People lost 9% more on its websites and at its shops, “driven by recreational player growth”, it said. Its shares gained 7% on the FTSE 100, leading the blue-chip index.

But slightly smaller betting company 888 Holdings, which is buying the non-US William Hill business, is one of the top fallers on the mid-cap FTSE 250 index after its revenues fell by 13%.

888 said the UK’s “more stringent safer gambling policies” had contributed to a steep 25% fall in revenues – that suggests a lot of what it was doing before was at a level not acceptable to regulators now.

The FTSE 100 has gained ground at the opening bell. It is up by nearly 0.3% in the opening trades.

It is following the trend across much of Europe, where the major indices have edged up.

Here are the snaps from Reuters:

-

EUROPE’S STOXX 600 UP 0.1%

-

FRANCE’S CAC 40 UP 0.1%

-

SPAIN’S IBEX FLAT

-

EURO ZONE BLUE CHIPS UP 0.1%

There has not been much movement on financial markets in response to the GDP reading: sterling has been barely moved.

In the below chart you can see that it jumped by a few tenths of a cent on the dollar when the data was released – the reading was slightly better than expected by economists, remember. (N.B., the chart times are in GMT, not BST.)

However, it quickly fell back, and is now slightly down for the day. One pound will buy $1.2205 on spot markets this morning, 0.07% less than at the start of the session.

The question most analysts are asking is when, rather than if, a UK recession has truly started.

One talking point we might be hearing a fair bit about from the government is how the Queen’s jubilee celebrations have had an effect (although the ONS said they didn’t have a notable effect on the quarter).

This looks bad but clearly the extra bank holiday for the Queen’s Jubilee will have temporarily depressed GDP in June as with similar royal holidays in the past.

Headlines about recession should therefore be put on ice for now

(but may need to be thawed out for use next year) https://t.co/PDcFbYTKaz— John Hawksworth (@jhawksworth5) August 12, 2022

Watch out for some contortions as people do their best not to blame Queen Elizabeth.

This is how the Treasury navigated it in its notes to editors (emphasis added, but you can just feel the tension): “It is important to recognise that the extra bank holiday in June had a one-off effect in reducing economic activity that month, although we all enjoyed the great national celebration of the Queen’s Platinum Jubilee.”

Economy began slide into recession in 2022Q2. Higher prices and collapsing real pay have led to falling household consumption (-0.2%), driving first negative GDP figure (-0.1%) since the start of 2021.

— TUC Economics and Social Affairs (@TUCeconomics) August 12, 2022

Some more reactions are coming in now from analysts and economists.

David Bharier, Head of Research at the British Chambers of Commerce, a lobby group, said the UK economy is “moving in an alarming direction”. He said:

While some consumer-facing industries have benefited from further withdrawals of Covid restrictions on travel, the retail sector saw a 1% decline in the quarter, reflecting the unprecedented pressures from inflation and global supply chain disruption.

The 0.2% fall in real household consumption reflects continued weakness in consumer confidence and a mounting cost of living crisis.

Business investment remains a serious challenge. While investment in construction has increased, other forms of investment, including for machinery and equipment, continue to fall.

Hussain Mehdi, a macro and investment strategist at HSBC Asset Management, said:

UK growth is stagnating as the economy faces challenges from a severe real income squeeze amid elevated inflation and higher interest rates. In this backdrop, it will be difficult to dodge recession, especially with upside risks to energy prices heading into the winter.

Please do remember: this is not a technical recession (yet)!

Economists generally count two successive quarters of contraction as a recession. So if activity is declining again in the current quarter then it would qualify.

The Bank of England thinks the worst is ahead, as energy price rises begin to bite properly.

Economy found a reverse gear in June but Bank of England forecasts recession won’t begin until the winter.

This is based assumption:

1) energy cap rises to £3500 in Oct + remains elevated.

2) interests rise to peak at 3% next summer

3) no additional government supportIf… pic.twitter.com/begZvphpEy

— Joel Hills (@ITVJoel) August 12, 2022

It should be remembered that the GDP reading is not quite as bad as economists had expected.

A poll of economists earlier in the week suggested there could be a 0.2% decline.

But one group who will be grimacing looking at today’s reading is the Bank of England, who did not expect a contraction in the UK economy to start until the final three months of 2022.

You can see how economic activity has peaked (at least temporarily) in the below chart from the ONS.

Nadhim Zahawi, the chancellor (for now, at least) is quick out of the blocks with a comment. He said:

Our economy showed incredible resilience following the pandemic and I am confident we can pull through these global challenges again.

I know that times are tough and people will be concerned about rising prices and slowing growth, and that’s why I’m determined to work with the Bank of England to get inflation under control and grow the economy.

The government is providing billions of pounds of help for households with rising costs, including £1,200 for eight million of the most vulnerable households.

The big contributors to the fall in activity included a 0.4% decline in the UK’s dominant services sector, in which activity slumped because of the end of many of the pandemic-related services such as test-and-trace.

There was a 0.2% decrease in real household consumption in the second quarter, the ONS said – a sign that people are feeling the financial pinch.

And of course we already know that inflation is here, but the GDP figures confirm that. The implied GDP deflator (an adjustment for inflation) rose by 6.0% year-on-year in the quarter, “primarily reflecting the 7.3% increase in the price of household consumption expenditure”.

That is the fastest annual household deflator growth rate since 1991, the ONS said.

UK GDP fell by 0.6% in June, but it isn’t quite as bad as it sounds.

Two things we need to take into account: the Queen’s Platinum Jubilee and the move of the May bank holiday led to an additional working day in May 2022 and two fewer working days in June 2022.

The ONS cautions that although this impacted on monthly GDP, there was little impact on the quarterly estimates.

UK GDP fell 0.1% in second quarter

Good morning, and welcome to our live, rolling coverage of business, economics and financial markets.

UK gross domestic product (GDP) is estimated to have fallen by 0.1% in the second quarter from April to June 2022, according to the Office for National Statistics (ONS).

The UK economy grew by 0.8% in the previous quarter, according to the ONS. However, economists had expected the economy to falter in the second quarter, with a poll this week predicting a 0.2% decline in UK GDP in the period from April to June.

The Bank of England has already predicted the UK will enter a long recession from the final three months of this year, with the economy only growing again in the first quarter of 2024.

A big reason for that expected recession is inflation and the Bank’s response to it. The Bank’s rate-setting monetary policy committee already voted last week for the biggest rate increase in 27 years in order to try to slow the pace of price increases.

Energy price rises are at the heart of the economic issues facing the UK and many other economies around the world. Annual average household energy bills are forecast to top £4,200 from January and £4,400 from April, according to forecasts from Cornwall Insights, a consultancy.

The state of the economy and the cost of living crisis are almost certain to be the top priority for the new prime minister, either Liz Truss or Rishi Sunak, once the Conservative party leadership race is decided by 5 September.

Current Prime Minister Boris Johnson has repeatedly said he will not take action on economic policy in his last few weeks as a lame duck leader, so as not to bind the hands of his successor. Johnson reiterated the message on Thursday in a meeting with energy company bosses, some of whose businesses have reported booming profits thanks in part to the invasion of Ukraine by Russia, which has raised concerns about global supplies.

However, opposition politicians, union leaders and campaigners have all urged the government to speak to the two leadership contenders’ teams about emergency actions to prepare for what is expected to be a very difficult winter for households.

The agenda

-

10am BST: Eurozone industrial production (July; previous: 0.5% month-on-month growth; consensus: 0.2%)

-

1pm BST: UK Niesr monthly GDP tracker (July; previous 0.2%)

[ad_2]

Source link