[ad_1]

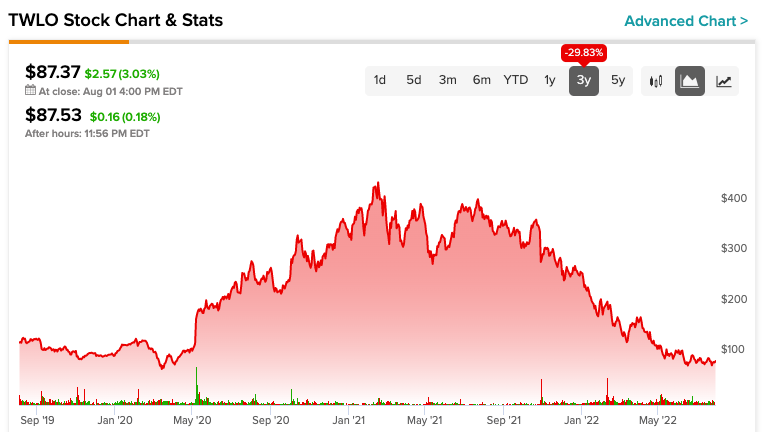

Communications device developer Twilio shares (TWLO) lost more than 80% of their value from peak to trough. The previous pandemic high-flyer felt more pain than most of the software out there playing. With the stock now hovering around $87 in the depths of the 2020 market crash, I think there will be real value (and upside) in Twilio as the tech sector recovers.

At five times sales, Twilio stock looks cheaper than many of the low-to-no growth hedgers that overshot in the first half. Arguably, the battered speculative tech scene may be where the price is right now. Twilio stock stands out to me as one of the most exciting names for big growth if the tech business is poised to enjoy a continued recovery.

Either way, I’d stay on these lows on Twilio in response to the stock’s decline in the last round of analysts downgrading the stock or lowering their price targets.

Twilio Stock: Still a Leader in Its Corner of the SaaS Space

Twilio is a unique and leading software player in the niche Communications-Platform-as-a-Service (CPaS) market. The company’s APIs (application programming interfaces) help enterprise organizations implement connectivity features without having to reinvent the wheel. Of course, the cost savings for Twilio customers are significant and may be the driver behind the company’s low leverage.

Still, the future of the CPaaS industry looks very hazy. Enterprise software is a huge market that could face increasing competition in a few years as the giants look to break into new market heights.

Either way, Twilio is well-equipped to fend off the grassroots recession. The company provides services that create value for its customers. Even though IT budgets may need to be trimmed in response to macro winds, Twilio is more resilient than most services in other non-critical day-to-day operations.

In addition, Twilio’s willingness to spend on innovation should help it expand its leadership in the communications software market. Although Twilio has its foot on the growth pedal, the company aims to be profitable by 2023.

It will not be easy to break into sustainable profitability next year. That said, I think Twilio CEO Jeff Lawson’s shift in management’s focus as they seek to find the right balance deserves investors’ attention.

Twilio: The perfect time to go bargain hunting

It’s hard to ignore Twilio’s M&A activity over the past couple of years. The company is moving outside its circle of excellence with surprise acquisitions to improve the Tivilion ecosystem and delight the company’s existing customers.

Last year, Twilio acquired cybersecurity firm Ionic Security and freeware ZipWhip. In the year In late 2020, Twilio acquired its data management tools division in a deal valued at $3.2 billion.

Undoubtedly, the latest deals come at a time when tech company valuations are somewhat elevated. Still, deals like this add to Twilio’s arsenal, and while I don’t believe the company paid a multiple, the value of the acquired firms is considered to be higher than Twilio’s capabilities.

When technology multipliers are now in the backyard, one has to think that Twilio will increase the speed of acquisition. With more than $3 billion in cash and cash equivalents as of the end of the first quarter, the balance sheet remains stable, leaving plenty of liquidity to take advantage of opportunities.

Take Wall Street on TWLO

Turning to Wall Street, Twilio has a strong buy consensus rating based on 18 buys and five holds assigned over the past three months. TWLO’s average price target of $179.48 indicates a 99.7% upside potential. Analysts’ price targets per share range from a low of $91.00 to a high of $320.00 per share.

Takeaway – Twilio wants to balance growth and profitability

Tiwilio stock has struggled to hold up amid the recent downturn in unprofitable tech companies. With interest rates rising, Twilio is no longer pouring exorbitant amounts into R&D with little regard for medium-term profitability. It’s more calculated and balanced, which makes the stock’s direction better in this turbulent environment.

While the pursuit of profitability next year may dampen innovation a bit, I think Twilio has the potential to make the changes that will help it win back the affections of investors.

Disclosure

[ad_2]

Source link