[ad_1]

Small businesses are called the backbone of the economy for a reason. They employ 46 percent of U.S. workers and account for nearly half of GDP, and new business applications have soared during the pandemic as they set records. But things took a turn last year, first with high inflation and then with the collapse of major regional banks—the second and third largest ever, Silicon Valley Bank and Signature Bank. The growing prospect of bank consolidation, and a more challenging economic climate for small businesses, raises questions: What will happen to the entrepreneur if their local bank goes? Is the banking system stable? And is a credit crunch on the horizon? Emphasizing the clarity of this argument, the opinion of experts is divided.

Treasury Secretary Janet Yellen said the banking situation is “stabilizing,” and Citigroup CEO Jane Fraser said the recent turmoil “isn’t a credit crisis,” just banks with specific problems. But “Dr. Doom” himself, economist Nouriel Roubini, warned this week that the banking crisis could lead to an economic “trilemma” of collapse and ultimately higher credit risk. , and this will affect economic outcomes,” he warned.

Al Drago / Bloomberg – Getty Images

A credit crunch can be devastating for any company, but it’s especially deadly for a small business with limited resources. “Big companies have a lot of internal storage that they can turn to. They have other sources of financing,” said David Odresch, executive producer of the organization. Small business economics Academic Journal, he said ChanceSmall businesses tend to get “hit” when interest rates rise and liquidity dries up.

The problem is exacerbated by the problems facing many small banks, the lifeblood of small businesses. Years of bank consolidation have made lending dominated by Wall Street behemoths unaffordable for small businesses, and the recent banking crisis has made that trend even worse.

“The bottom line is … small businesses are going to be hurt,” Odresch said. “This is a bad time to be a small business.”

Big problems for small business

Unlike large corporations, which can use the equity and bond markets for financing, small businesses rely primarily on loans to cover everything from payroll costs to rent. Between 86 percent and 94 percent of small businesses use loans to finance their expenses, and 52 percent of financing comes from community banks, according to the Institute for Local Self-Reliance, an advocacy nonprofit group.

“I’ve talked to small businesses who know they’re in trouble because the loan isn’t available or costs too much. And I think it’s going to get worse before it gets better,” said Odretsch, a developmental economist at Indiana University.

In some ways, the credit crunch accentuated an earlier trend. Credit availability has been declining for five years, and only 49% of small business owners say their current access to capital is good, according to a survey released this week by the American Chamber of Commerce. Owners view the U.S. economy as being in good health. Lack of finance has led to a growing share of entrepreneurs, with 75% of owners employing fewer than five people and 59% of large and small businesses using their own personal savings to tap into their own bank accounts.

“Small businesses have been preparing for credit consolidation for more than a year,” said Tom Sullivan, vice president of small business policy at the Chamber of Commerce. Chance. “We did not foresee that a set of banking challenges would cause this credit crisis. The recession we’ve been waiting for for over a year will cause a credit crunch.

But while more volatile funding pressures small businesses, experts agree the sector’s biggest challenge is inflation. Last year, 85 percent of small business owners said rising commodity and fuel prices had affected their business, and although inflation has recently slowed from a 40-year high since last summer, 54 percent of small businesses cited it. According to a recent survey by the Chamber of Commerce, their biggest concerns are related to rising profitability and interest rates.

“Inflation is a long-term problem. The credit crunch is a short-term problem, but you have to deal with both, said Tom Quadman, CEO of the Chamber’s Center for Capital Markets Competitiveness. Chance. “Smart businesses are going to plan to deal with both.”

Dealing with a credit crunch in the short term may mean focusing more on fundamentals and efficiency and keeping an eye on inflation and inflation. Smart use of finance will be key, but where the money comes from post-banking crisis is another matter.

Another problem: the disappearance of small banks

In the face of stubborn inflation and an ailing economy, America’s small businesses are slowly losing some of their most important partners: community and regional banks. The recent banking crisis exacerbated decades of consolidation in the US financial industry. Since 1984, according to the Federal Reserve, roughly two-thirds of U.S. banks have disappeared due to regulatory changes and new technologies that allowed large institutions to service loans nationwide at lower costs.

FDIC

And when regulators stepped in to bail out SVB and Signature Bank depositors, even those whose money wasn’t covered by the FDIC, consumers felt that “the big banks have something that the smaller banks don’t,” said Stefan Weiler, a professor of economics at Colorado State University. Chance– “Warranty” close to full warranty. This guarantee, he said, “made the attraction of the big banks tremendous.”

SVB losses at smaller banks fell by $119 billion last week, according to Fed data, while deposits at larger banks increased. For example, Bank of America raised $15 billion that week alone.

If deposits continue to flow out of America’s regional and community banks, it will put pressure on small businesses, Wheeler said.

Weiler, who serves as director of the regional Economic Development Institute, noted that community and regional banks provide more small business loans than their larger peers.

“In terms of equity, community banks do three times as much business lending as big banks,” the minister said, adding that this is because smaller banks have a better understanding of local customers’ businesses, allowing them to offer loans that larger lenders pay. I don’t even think.

Small banks’ willingness to lend makes them “critical to entrepreneurship and job growth” across the country, Weller argues. And more to the point, published by the American Economic Association in 2011.

“The more community banks there are, the more opportunities there are for relationship lending, and the more stable the credit base will be, which will lead to economic stability, especially in rural areas,” Wheeler said.

‘Armour’ in difficult times

As financing becomes increasingly difficult, small businesses must be innovative and flexible to stay ahead of the market. Fortunately, as many organizations have proven during the pandemic, small business knows how to adapt.

“There’s no doubt that small businesses that are able to take advantage of the opportunities of this crisis climate will need to be nimble and flexible,” Odresch said.

It is not yet clear how contagion a banking crisis can cause in the financial system, but looking at what happens to small businesses in terms of vulnerability can be a telling sign. “Increasing layoffs and losses” in the sector are a sign of a looming recession or financial stress, Odresch said.

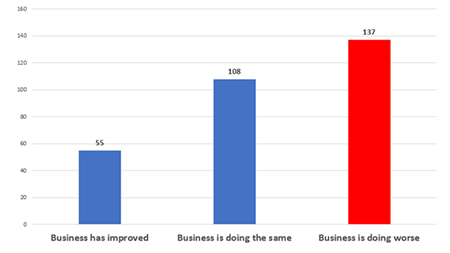

But so far, despite the credit crunch and the potential for inflation to linger, small businesses have held on despite the pessimism about the overall economy. Two-thirds of business owners surveyed by the Chamber of Commerce say their businesses are in good financial health, with 69% saying they are keeping the same number of employees as last year.

“Many of these successful small business owners who have survived Covid have this armor,” said Chamber’s Sullivan. “They say if we can get through Covid, we can get through anything, and there is a lot of truth to that.

The small businesses that have emerged from Covid are innovative and adapted to the new conditions. Similarly, last year’s market environment saw unsustainable tech startups and crypto companies uprooted. Entrepreneurship may also be on the wane now—thriving small businesses in a way that hasn’t been the case for years, may be about survival.

[ad_2]

Source link