[ad_1]

Giselleflissak/E+ via Getty Images

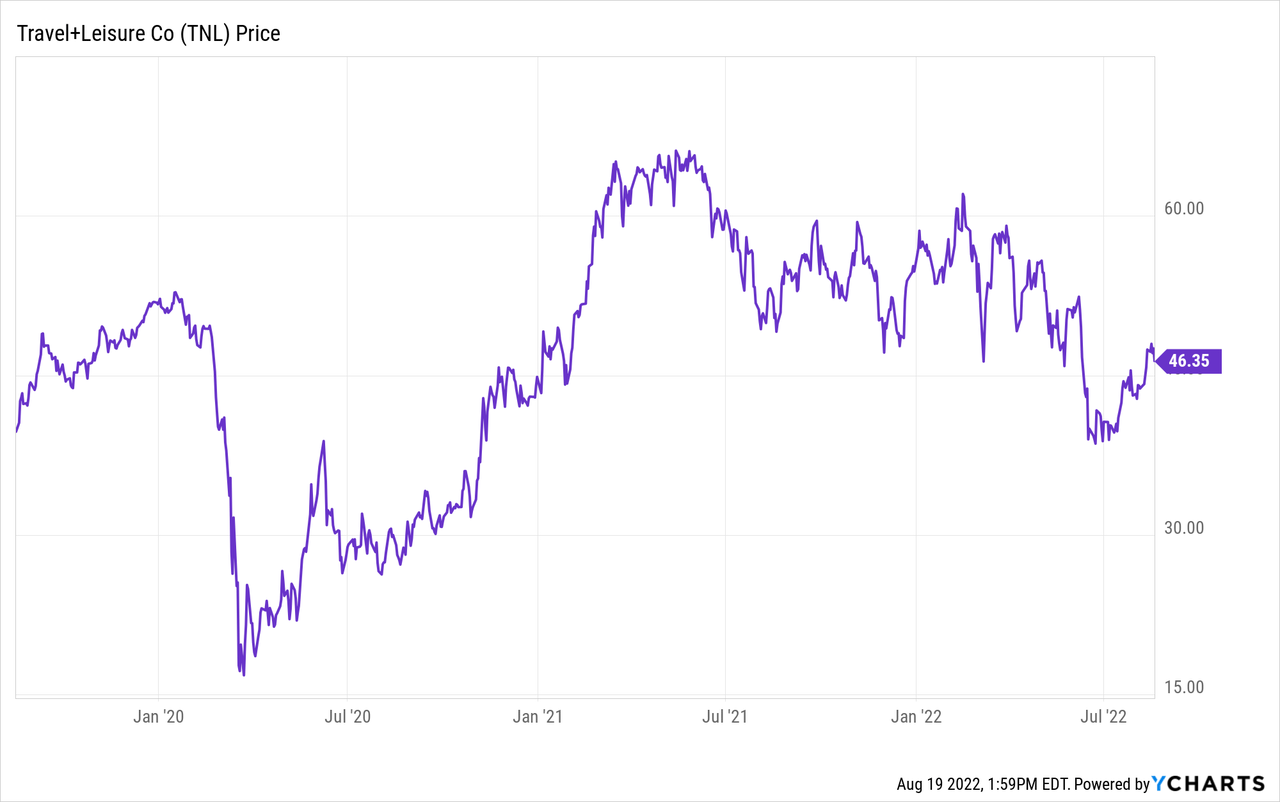

Travel + Entertainment (NYSE:TNL) is quietly rebuilding its vacation ownership business in the wake of the Covid pandemic. The company’s exit from global hotelier Wyndham has caused many to question the future of the company, some even suggesting that The decline signals the end of the timeshare industry as we know it. Things turned out differently for the company. Under the leadership of industry veteran Michael Brown, the company has weathered major structural changes and the global health crisis that has disproportionately affected the hospitality industry. As if that weren’t enough, the company now faces the prospect of a major global slowdown as central banks try to tame rampant inflation. Despite this, the company appears to be firing on all cylinders and is coming off key quarters that will give investors a sense of the company’s resilience as we look to start the next business cycle.

Today we look at Travel + Leisure and talk about what investors can expect from the company going forward (I’ve covered the company before, for a more company profile, see this article).

Company Outlook

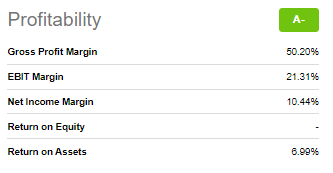

After the sale, I have to confess that I had my fair share of questions about whether the company could maintain strong sales volume without making discounts on unit prices, which would impact gross margins. The company has so far proved this fear unfounded by posting a gross profit margin of north of 60%.

Seeking Alpha

This is an amazing number. Remember, this is not a software-as-a-service type of business. Instead, the company is selling vacation ownership interests in its existing portfolio to customers. These marketing costs are mainly in the form of gifts that the company offers to persuade people to attend sales presentations. Timeshares are a tough sell, and it often takes several visits to finally convince a customer to buy. That’s why investors tend to pay more attention to gross margin and transaction cost figures, which give a greater sense of the product’s overall appeal. Now, Travel + Leisure is clearly knocking it out of the park.

In a recent earnings call, the company reported impressive adjusted EBITDA of $230 million, which was good for EPS of $1.27 cents. They also managed to set a record of $3489 per guest. Volume is the amount of money the company makes per visit. What’s surprising about this is that over 65% of new owner sales for the second quarter were to Gen-Xers and millennials. The importance of this cannot be overstated when considering the background of the timeshare industry. Airbnb and other alternative vacation options were seen as timeshare killers. The general expectation was that as these services became more popular, the timeshare industry would eventually die. It is very important that the company manages to create a profitable relationship with the young owners. It’s worth noting that new owner sales tend to have a lower VPG than existing owner sales, and new owners tend to come back and buy more titles online. The company also noted that nearly 80% of its equity base is sailing debt-free. This means that their vacation ownership is fully paid for, and their only obligations are annual maintenance fees. It’s fair to say that the company, which is currently in a good position, is showing signs that it’s mixing with its owner and growing further in the right direction. But with an economic slowdown on the horizon, there are some concerns about the business model’s vulnerability to defaults.

Debt concerns

Timeshares are first and foremost a luxury purchase. Vacations are often seen as optional endeavors, even though they should probably be a higher priority. Timeshare companies help clients vacation by purchasing an ownership interest in a property or portfolio, allowing them to lock in the value of their vacation, with occasional adjustments to annual maintenance fees. Because timeshares tend to be expensive big-ticket purchases, customers finance the purchase at least partially with debt. This practice is normally good, and the company does a good job of vetting customers to make sure they can meet the financial commitments that come with the purchase. But the collapse of the Federal Reserve’s efforts to curb inflation, for example, will not only dampen consumer confidence but provide a headwind to new purchases, but it could do more than that. Common pitfalls in funded proprietary products that can be very problematic for such companies. The good news is that these companies are getting better at working with customers during difficult times to keep their owners happy and prevent company-wide damage.

Value and forward-looking opinion

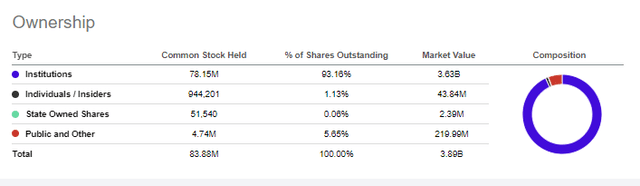

Despite these concerns, travel + leisure still attracts major investors around the world. Institutions own a whopping 93% of the shares, which is always a big sign when recession threatens.

Seeking Alpha

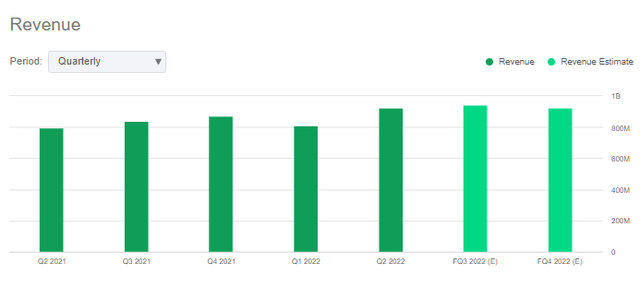

The company is recovering strongly from the Covid-19 pandemic, and despite the seasonal nature of revenue in the hospitality industry, revenue trends have been more or less stable, which is a good sign.

Seeking Alpha

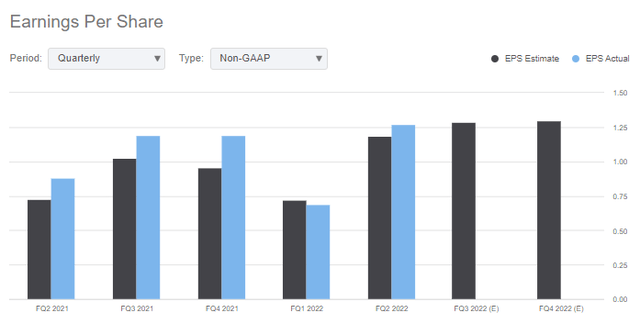

The management team has a strong track record of delivering on expected earnings, and we can see that over the past five quarters, they’ve done so exceptionally well with four hits and one small loss. It is also worth mentioning that the winter season will be one of the strongest for timeshare companies.

Seeking Alpha

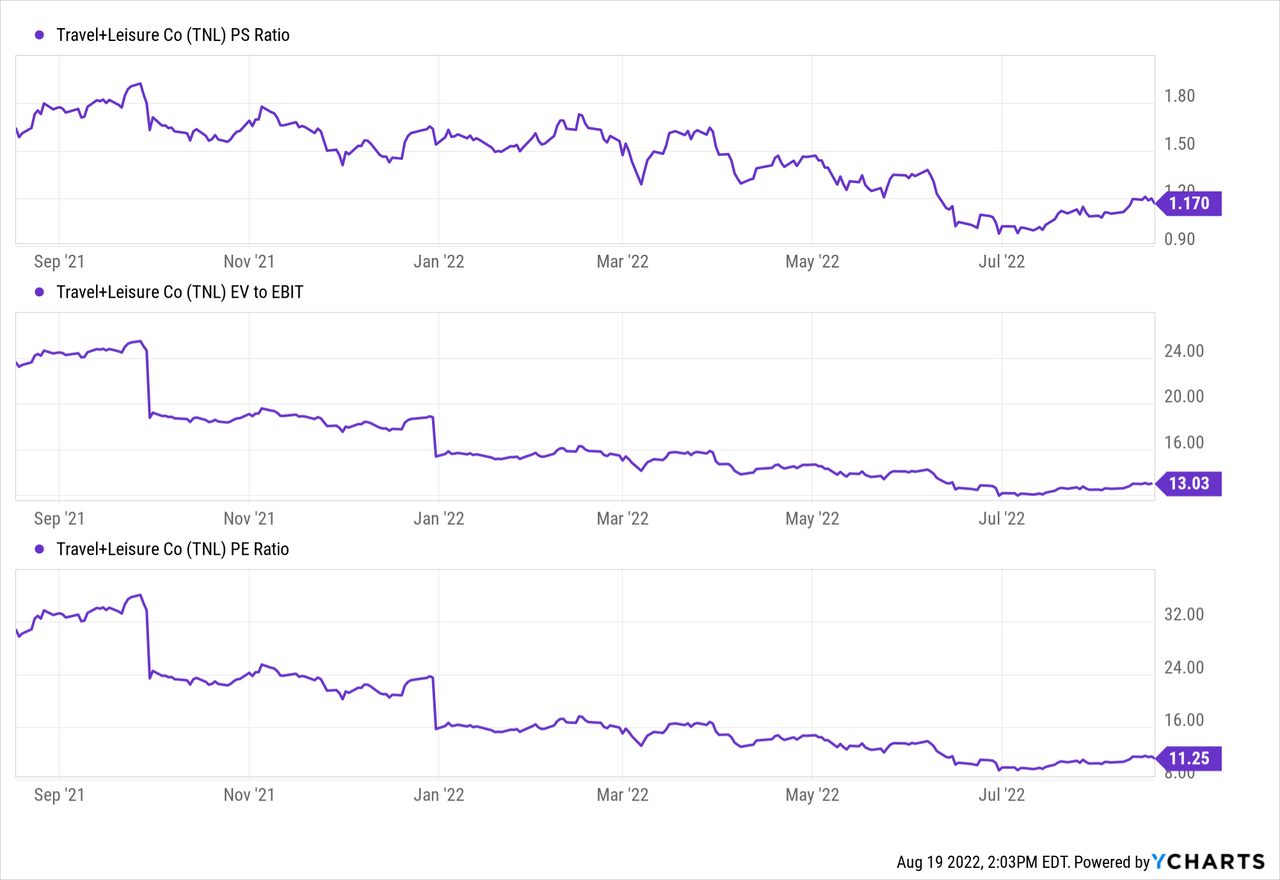

The company is trading at the lower end of its historical ranges at most important multiples, which usually indicate value.

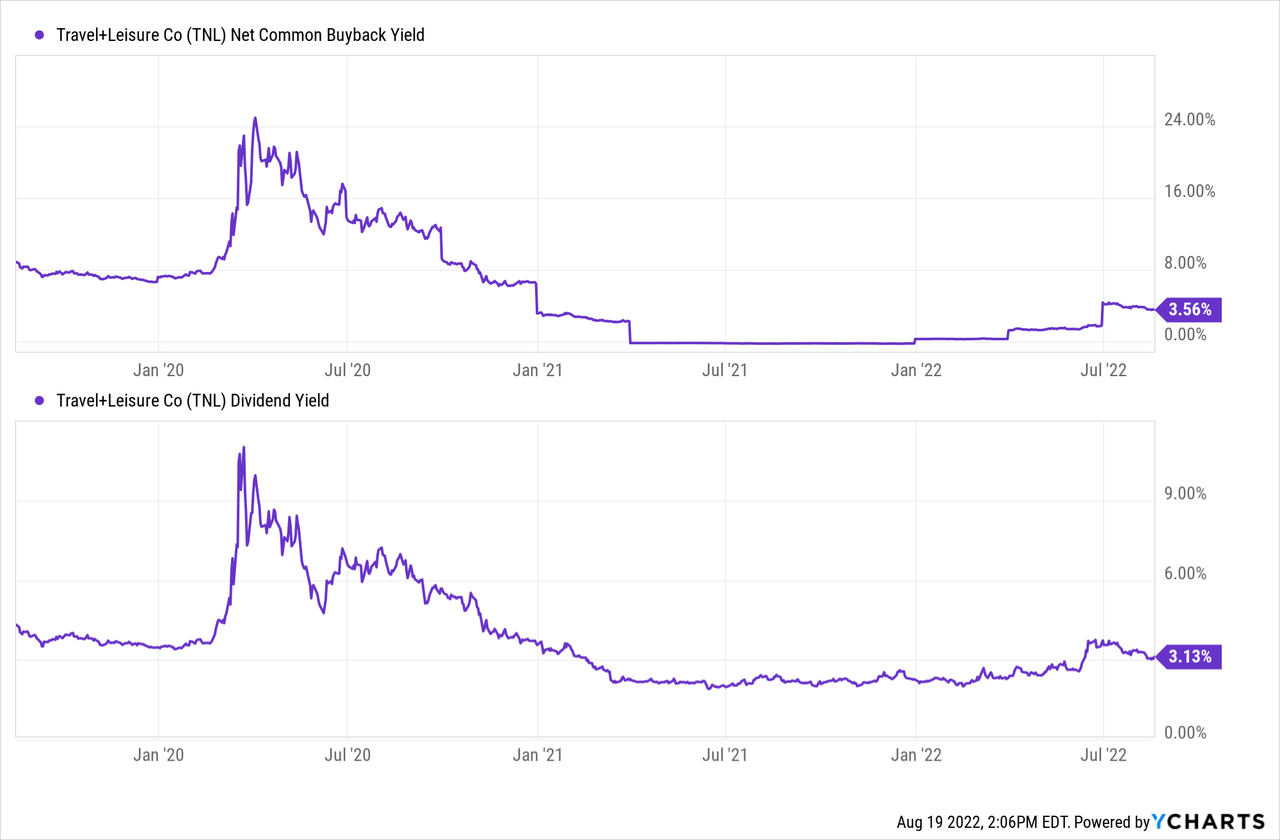

There is also a solid dividend and good buying track record in this space, giving investors some incentive until the end of the trade.

which should be taken

In closing, the main focus here is the penetration of the youth sector. The risk of bankruptcy increased for the time being but the owners of the company paid off their loans. In the long term, I believe that Travel + Leisure will be higher than the current level, but in the short term, there are some serious risks that the investor should consider before taking a position. For this reason, travel + rest Long term purchase.

[ad_2]

Source link