[ad_1]

Working in the service industry can be tough. And it’s even more difficult for many who rely on tips thanks to an increasingly cashless society. All this makes it difficult for service-based businesses to retain top talent.

Luckily, Tippy is working to solve this problem. Read about the company’s digital tipping solution for employee retention in this week’s Small Business Spotlight.

What the Business Does

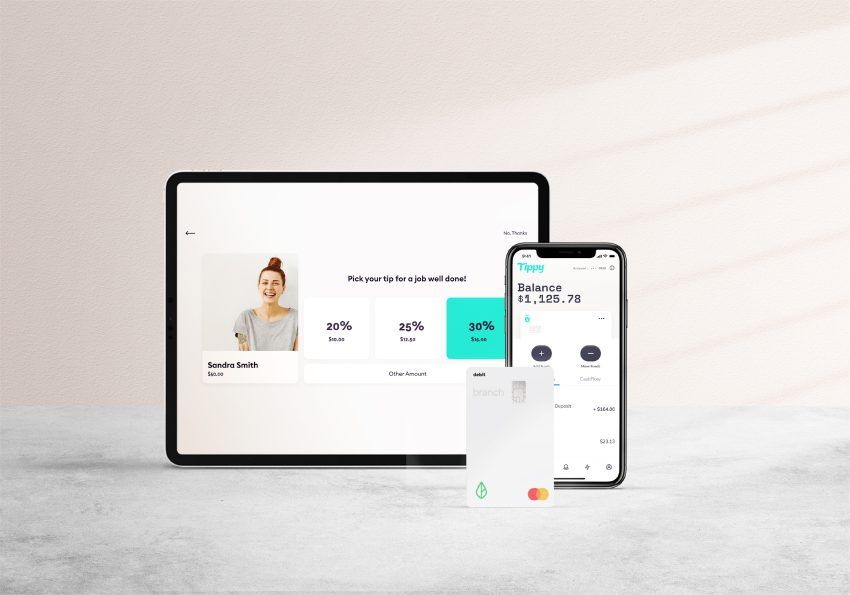

Offers digital tipping solutions.

CEO David Tashjian told Small Business Trends, “As customers carry less and less cash, the frequent question asked at front counters these days is…” Can I put the tip on my card? ” And the payments industry has done a poor job of providing convenient ways to keep up with this. A good example -hotel housekeeping staff – twenty years ago over 80% of hotel guests would leave a cash tip. Today – less than 30%. And when an owner of a hotel, salon or spa allows tips on credit cards, two more issues arise -1) expensive credit card processing fees; and 2) delayed receipt of their tips as the service professional now has to wait 1-2 weeks to receive through payroll.

“Tippy’s disruptive technology provides digital tipping solutions for all industries, from hospitality to beauty to pet groomers! We provide owners a suite of tools that shows they care about their staff, and that’s what retention is all about. Tippy results in 22.3% higher tips, gets them INSTANTLY to the service professionals, and btw, saves the owner the processing fees on tips. And all while providing a convenient, personalized experience for the customer. Happy customers, happy employees ha ..happy business. ”

Business Niche

Providing excellent customer service.

Tashjian says, “When we formed Tippy, we determined that the best way to solve a problem was by hiring team members who had experienced it first hand. Everyone one of our Customer Success Managers that works with salons and spas, for example, worked behind-the-chair at one point in their career. Thus they understand first-hand the problems and can best relate our solutions. ”

How the Business Got Started

By mixing different skills and experience.

Tashjian explains, “Two brother-in-laws founded the company. One from fintech and one in the salon / beauty industry. It was a match made in heaven! ”

Biggest Win

Growing a team with a cohesive goal.

Tashjian says, “I know this may sound cliche, but our biggest“ win ”in our company’s history is putting together a team of individuals that ALL have the same definition of winning. Sounds easy but it’s hard as you grow. Everyone at Tippy is focused on the customer and defines “winning” as providing the best solutions for them. Thus we all work so well together – and that makes work fun. ”

Biggest Risk

Bringing in an external partner to build the solution.

Tashjian explains, “We are a technology company and of course believe we build things the best. We developed our own digital wallet but were struggling to offer the robust features our customers deserved. And in-the-end, that’s what we should be all about – offering our customers the best! So, after an extensive search, we teamed up with Branch. This partnership held multiple risks- would our cultures clash? Did we have similar commitments to customer service? etc. If the partnership failed, it would have meant upseting customers and a potentially disastrous loss of time in our forward roadmap. Fortunately, we not only chose a good partner… we chose a great one! We are getting wonderful customer reviews and are working fantastically together. This is one decision we will never doubt! ”

Lesson Learned

Get enough funding early.

Tashjian says, “Don’t be scared to take more money in your early funding rounds. Every financing round requires a substantial amount of time and focus, and while more early money means more dilution, the benefits of not having to return to the market so many times allows you to focus more time on what’s the most important – porting and growing your business! ”

How They’d Spend an Extra $ 100,000

Sales and marketing.

Tashjian adds, “These days valuations are driven more by growth and less by bottom line. In the fintech space you must focus more on the top line every day. ”

Team Strategy

Open communication.

Tashjian says, “We off course hold normal weekly meetings, but we go a step further. We hold quarterly company-wide Town Halls. It’s here we share our full financials as well as all significant discussions we are having in the industry. Both our wins and our stumbles are heard by all in the company. It keeps everyone rowing in the same direction, minimizes surprises, and creates a wonderful work environment in this world of flexible and virtual workspaces. ”

* * * * *

Image: Tippy, David Tashjian and Terry McKim

[ad_2]

Source link