[ad_1]

When can we truly say goodbye to this bear market? While Bank of America’s global fund managers are “not stupid at all,” some on Wall Street are still wary.

Add ours Call of the day To that last set. It comes from Steven John Kaplan, CEO of the True Contrarian blog and newsletter, who sees investors in what could be the longest bear market in history and “approaching the next and possibly the biggest percentage drop of this bear market yet.”

MarketWatch last spoke with Kaplan in 2015. In mid-November 2021, he was warning of an impending sell-off in stocks, especially major religions. Just days later, Invesco QQQ QQQ,

An exchange-traded fund (ETF) that tracks the Nasdaq-100 index and many other technology funds have been released. S&P 500 SPX,

A peak followed on January 4.

Kaplan attributed that November warning in part to one of his favorite indicators — the company’s insider trading and buying, which is tracked by J3 Information Services Group.

In an interview with MarketWatch on Wednesday, he rattled off a list of worrisome signs, such as renewed group selling, individual investors entering the market, the end of the bear market and the Cboe Volatility Index, or VIX VIX.

Pulling below 20 in recent days.

History also plays a big part in the current anxiety about markets.

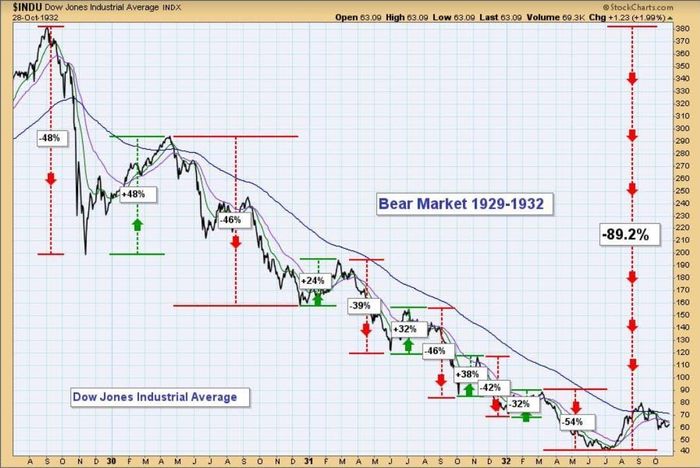

True Contradiction / Carl Swenlin, StockCharts.com

It’s amazing to see how similar the bear markets of 1929-1932 and 2000-2002 are to each other, having exactly the same types of returns and recoveries. I expect similar behavior for 2022-2025,” he said. (See the first chart link)

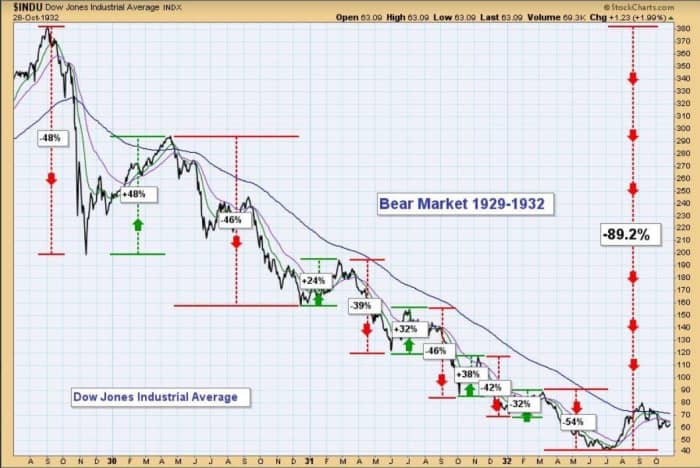

QQQ retrograde from 2000 to 2002

A real opposite/marketing view

After the bull market began in March 2009, Kaplan said it took eight years to reach the bear market of 1929, nearly 10 years for the March 2000 bear market, and he sees it continuing.

“So what they all have in common is that these very long bull markets have been going on for a long time before bear markets, because people tend to forget that they should be investing in bear markets and what they’re all about,” he said.

A classic bear market pattern throughout history has been a small drop that doesn’t convey panic, followed by a calming bump, then a big drop and a big rebound, which again relaxes investors. But in the year Depending on whether it was 1929, 1973 or 2000, the next sell-off phase could result in dramatic losses, such as 40% for a fund like QQQ.

Kaplan was concerned about Fidelity’s latest quarterly retirement survey, which showed investors clinging to hope that the market will return to higher levels if they wait long enough. Challenging that, Kaplan points to another study showing that individuals who invested in the stock market in September 1929 were still down 38% in August 1982, adjusted for inflation.

“It explodes the myth that if you hang in there when things get tough, you have to come out ahead,” he said.

Read: Most pension savers ‘stay the course’ – even when they’re under a lot of stress

So how to deal with another big drop. Reiterating November’s advice, he recommends I-Bonds or Series I savings bonds that can be bought directly from the government and are currently yielding over 9%. U.S. Treasuries are also currently paying 3% to 3.5%, which is another way to go for years to come, he said.

Read: This law, which has a perfect record, has not brought the market down, says Bank of America star analyst

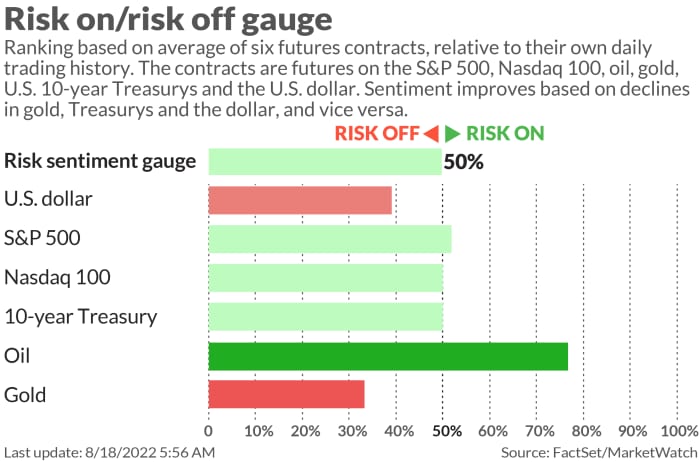

The markets

Shares DJIA,

SPX,

COMP,

As bonds yield TMUBMUSD10Y, they are drifting south following Wednesday’s Fed-induced losses.

TMUBMUSD02Y,

As the Dollar DXY falls,

It moves high. Fuel price CL.1,

BRN00,

They are coming out, and bitcoin BTCUSD,

It’s hovering just under $24,000.

Read: Why One Economist Fears the Japanese Yen Could Be Heading for a Destabilizing Downward Cycle

The noise

Stocks beyond the bedroom and the BBB;

It’s been on a crazy meme ride lately, slowing down after GameStop GME.

Chairman Ryan Cohen announced plans to offload his majority stake in the retailer months after the purchase. The company said Thursday that it had been ‘working quickly’ for weeks to strengthen its balance sheet.

Meanwhile, this 20-year-old has made huge gains on the stock, according to Securities and Exchange Commission filings.

Retailer Kohl’s KSS;

After a loss of profit and a reduced view, it is declining to cut the number of inventory

Cisco CSC Co., Ltd.

The tech giant’s stock is surging after surprisingly outperforming earnings and revenue forecasts.

Apple Apple

It plans to unveil the new iPhone 14 and smartwatches on September 7, according to a new report.

“The End of an Age” Stellants STLA,

Unit to discontinue two popular ‘muscle cars’ as Dodge leans toward electric vehicles

Jobless claims fell 2,000 to 250,00 last week, while the Philly Fed index rose to 6.2 from a forecast negative 5.0. Existing home sales and leading economic indicators are still to come, at 1:45 p.m. Eastern and Minneapolis Federation President Neel Kashkari will speak with Kansas City Federation President Esther George at 1:45 p.m.

The best of the web

Big Oil is optimistic that a gradual transition away from carbon will be enough to stop global warming.

Risks of psychotic disorders and dementia persist two years after covid infections.

It is reported that the Kremlin fired the head of the Black Sea fleet following the Crimean attack

High tickers

As of 6 a.m. ET, the most sought-after tickets on MarketWatch were:

|

Ticker |

Security name |

|

BBB |

Bed bath and beyond |

|

GME |

Stop the game |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

BBY |

Best buy |

|

BBG |

Vinco Ventures |

|

AAPL, |

Apple |

|

NO, |

NIO |

|

AMZN, |

Amazon |

|

blue, |

Bluebird Bio |

It is read randomly

Tourists Behaving Badly: Two arrested in Venice for cruising the waterways on motorized surfboards.

An extinct giant shark was faster, bigger and hungrier than scientists first thought.

Cambodia finds its lost antiquities – at Mt

What we need to know starts early and will be updated right up until the opening bell, but sign up here to get it delivered to your inbox once. The emailed version will be sent around 7:30 am Eastern.

[ad_2]

Source link