[ad_1]

We’re only three years removed from the start of the Covid-19 pandemic, but judging by the sequence of events, it feels like a lifetime. That is also the case for investors who own stocks. Robinhood Markets (Hood -0.99%)the brokerage platform is gaining attention from Generation Z.

The world looks very different now — social restraints are greatly reduced and American government incentives are almost gone. Elsewhere, enthusiasm for Robinhood stock has been left alongside enthusiasm for the stock market among young people.

Worse for the online trading platform, the Securities and Exchange Commission (SEC) has proposed major changes to the rules surrounding order flow fees (PFOF), the stock trading practice that helps Robinhood make most of its revenue. Here’s how the company might be affected.

Here is how order flow payment works

A traditional stockbroker’s payment model is simple: A client buys or sells a stock (or any financial instrument), and the broker takes a commission based on the dollar amount of the transaction. But new-age brokers like Robinhood have found a way for their clients to trade under a zero-commission structure that uses a system called pay-per-order flow.

PFOF involves partnering Robinhood with a group of market makers who buy customer orders from Robin Hood for a fee. The market maker then executes the client’s order at a price slightly lower than the live market price and pockets the difference – all in a matter of seconds. In return, customers pay no commission and are (almost) certain that their orders will always be fulfilled.

Technically, though, the customer is paying – just hidden. Concealing the experience was grounds for the SEC to cite Robinhood for misleading advertising in 2020 and fine it $65 million.

The SEC proposed new rules this month that would ensure competition in the PFOF space, meaning Robinhood must give market makers the opportunity to bid on customer orders. This will likely reduce the amount of payments Robinhood receives. That’s good for Robinhood’s customers, but bad for Robinhood because PFOF payments are determined by the revenue market makers generate.

If marketers are bringing in less money due to the competitive landscape, Robinhood’s revenue may decrease. For context, PFOF accounts for 63 percent of Robinhood’s total revenue in the first nine months of 2022, so these changes will certainly shake up the business.

Robinhood also faced other challenges.

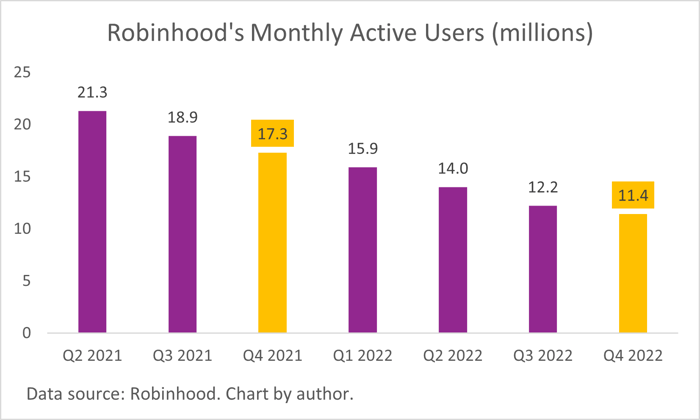

Robinhood’s user base is shrinking. As the era of ultra-low interest rates and US government stimulus ends in 2021, the stock market’s euphoria has evaporated, taking with it the enthusiasm of retail investors. Robinhood’s monthly active user base has now declined for six quarters in a row, dropping 34 percent in the past 12 months alone.

On the bright side, Robinhood’s revenue per user increased 3% year-over-year to $66 in the fourth quarter, while total revenue rose 5% to $380 million. That’s certainly not blockbuster growth, but it marks three straight quarters of consecutive increases for both metrics.

The company is riding a strong tailwind due to the recent high rate of interest rate hikes. Robinhood makes money when customers leave money sitting in their accounts, and net interest income rose 165% to $167 million in the fourth quarter.

But the dwindling assets of the company under arrest is a concern. Customers held just $62 billion in cash and financial assets with Robinhood in the fourth quarter, the lowest level since late 2020.

The dollar value of consumer cryptocurrency holdings has seen a 62% year-over-year decline, for example, in the past two years, a big Robin Hood bet, but it appears to be slowing down.

Robinhood’s future seems uncertain

The SEC is giving interested parties until March 31 to provide input on the proposed changes to the PFOF. Robinhood’s management recently voiced its opposition to the new rules, saying it would do everything possible to avoid a shift to a commission-based payment structure. Best of all, no commission trading is what sets Robin apart from most major brokerage firms.

But the company’s long-term growth trajectory has always been limited. why? Because PFOF is a banned practice in all major countries except the United States, international expansion is therefore not a straightforward proposition. And with the walls likely to close domestically, coupled with a somewhat disengaged retail investor base compared to two years ago, there are real questions about Robinhood’s future.

No wonder Robinhood’s stock is down 88% from its all-time high. Investors now value the company at $8.8 billion. But it has $6.3 billion in cash on its balance sheet, so you’re rightly implying that the business itself is only worth $2.5 billion.

Internal struggles aside, this stock may be one to avoid until a clear judgment is made on the future of PFOF. Even then, there are some very interesting growth propositions in the stock market right now.

[ad_2]

Source link