[ad_1]

Consolidating loans can be a good financial solution to narrow the gap between two points. Whether it’s to buy a new property, cover short-term business expenses, or any other situation, these loans can provide quick access. Property renovation financing. But before making any decision, it is important to understand the details of the loan, which is why this blog post provides an in-depth look at the main points to consider when it comes to bridging loan financing.

Eligibility

Before starting the loan process, it is important to understand the eligibility criteria. Most lenders require the borrower to have a good credit history and stable income. The lender may require collateral, such as real estate, to secure the loan. In addition, the lender may require proof of the borrower’s income, such as pay stubs, bank statements, and other documents. It is important to do research on different lenders and their eligibility criteria, as this will help the borrower find the best option.

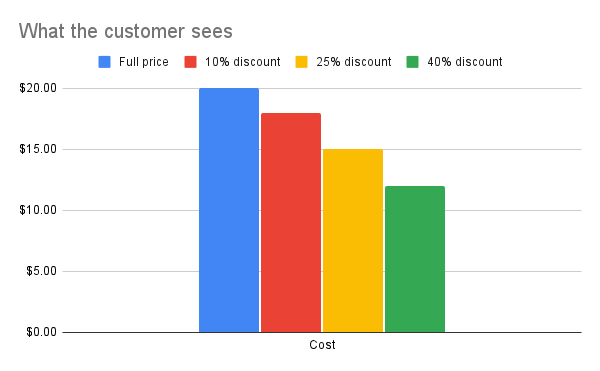

Cost

When considering a bridging loan, it is important to understand the associated costs. Interest rates on these loans vary from 8-12 percent depending on the lender and the borrower’s credit score. Additionally, it’s important to understand the additional costs associated with the loan, such as closing fees, legal fees, and other administrative costs. These fees can have a significant impact on the total cost of the loan, so they should be taken into account when budgeting for the loan.

Payment

Bridging loans are typically short-term loans, with a repayment period of 6-12 months. It is important to understand the loan repayment terms and the potential impact of late or missed payments. These can have a negative impact on the borrower’s credit score, as well as additional penalties and fees. Before taking out bridging loan financing, the borrower should thoroughly understand the loan repayment terms and the possible consequences.

Security

In some cases, lenders may require the borrower to provide some collateral for the loan, such as real estate or other assets. It is important to understand the security requirements of the loan and the associated risks, such as the possibility of foreclosure or foreclosure. The borrower should evaluate the pros and cons of providing collateral for the loan before making any decision.

Document

Most lenders require detailed loan documentation, including income and expenses. It is important to understand the requirements of the loan documents and the time to submit the documents, because this can affect the time available to approve the loan. Additionally, it is important to be aware of the impact that incorrect information can have on a loan application. The borrower must always provide correct information when completing the loan application.

Options

It is important to consider other options before entering into a bridging loan. Other options, such as a personal loan or business loan, may provide a more cost-effective solution. It is important to consider other sources of financing such as family members, friends, or crowdfunding as these may also be viable options. A borrower should research each option and compare the costs and benefits before making a decision.

Summary

A bridging loan can be a great way to get quick cash. But it’s important to understand the details of the loan, including eligibility criteria, costs, payment terms, security requirements, and documentation requirements. It is also important to consider other options before committing to a bridging loan. Taking the time to understand the details of the loan, consider other financing options, and assess potential risks can help ensure that the loan is the right choice for the borrower.

[ad_2]

Source link