[ad_1]

U.S. stocks rose on Friday after a week of strong tech earnings, even as investors assessed two stronger-than-expected inflation reports that could weigh on the Federal Reserve’s May policy decision.

The benchmark S&P 500 closed 0.8 percent higher following Thursday’s rally, which represented its biggest daily gain since Jan. 6. The blue-chip index rose 0.9 percent for the week, and was up 1.5 percent for the back-to-back in April. Monthly profit.

The Nasdaq Composite Index posted a percent gain on Friday and its first three-day winning streak in a month. The tech-heavy index rose 1.3 percent for the week and rose a fraction in April.

Wall Street was buoyed this week by strong earnings from Meta, Microsoft and Alphabet. More than half of the companies on the S&P 500 have reported results so far and nearly 80 percent reported earnings that beat expectations, according to data provider FactSet.

Meanwhile, First Republic shares fell 43 percent on Friday, after the bank said on Monday that customers had pulled out $100 billion in deposits in the March turmoil and failed to plan for the bank’s survival.

Investors also weighed in on Friday’s inflation data, which suggests the Fed will continue to offer a quarter-point rate hike next week.

The Labor Department’s employment price index, which tracks wages and benefits paid by private and public sector employers, rose 1.2 percent in the first quarter, while a separate report showed the core personal consumption expenditures price index rose 4.6 percent in March. . Both were ahead of economists’ estimates.

“The Fed is in a tough spot,” said Bill Adams, chief economist at Comerica Bank. “The economy has been slowing down due to low wage growth in the last few months. [and] Annual GDP growth of just 1.1 percent in the first quarter. But inflation is still very high, and the components of inflation that the Fed worries will be the most persistent — namely, inflation in labor-intensive services — are particularly sticky.

Jack Ablin, chief investment officer at Crissett Capital, said: “I was hoping we would finally declare victory in this consolidation cycle, but I think we’ll have to wait until next month.

U.S. government bonds rallied, with the benchmark two-year Treasury yield falling 0.06 percentage point to 4.03 percent. Products, on the contrary, move to prices.

“We’re looking at half of GDP expected and spending on PCE unchanged today,” said Lou Breen, chief strategist at DRW Trading. I think the market is going along with the idea that a recession is a reality.

In Europe, the regional Stoxx 600 closed 0.6 percent higher, while Germany’s Dax added 0.8 percent. France’s CAC 40 rose 0.1 percent in April, beating economists’ expectations for French inflation, putting pressure on the European Central Bank to raise interest rates when it meets next week.

Analysts polled by Reuters had expected the ECB to raise rates by 0.25 percentage points to 3.75 percent, but said there were “no surprises.” [in inflation figures] Henry Allen, macro strategist at Deutsche Bank, said it would add pressure to stick with the fastest hikes.

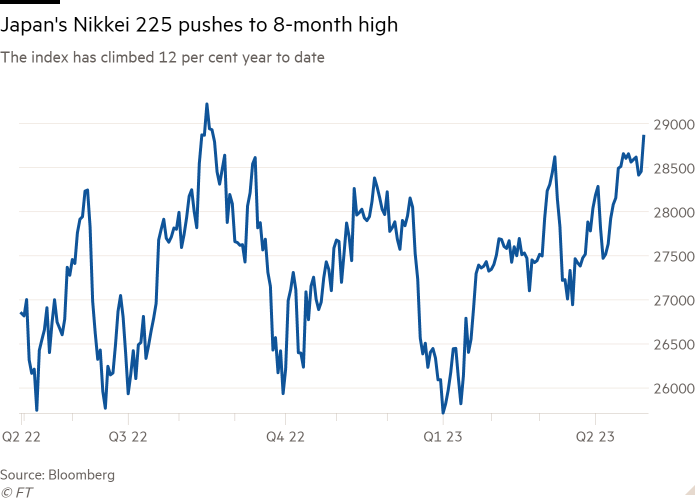

Japanese stocks rose to an eight-month high after Bank of Japan Governor Kazuo Ueda announced a review of the central bank’s ultra-loose monetary policy. The Nikkei 225 rose 1.4 percent to its highest level since late August. The yen fell as much as 1.7 percent to ¥136.23 against the dollar.

Other Asian shares also rose, with China’s CSI 1 percent and Hong Kong’s Hang Seng index up 0.5 percent.

[ad_2]

Source link