[ad_1]

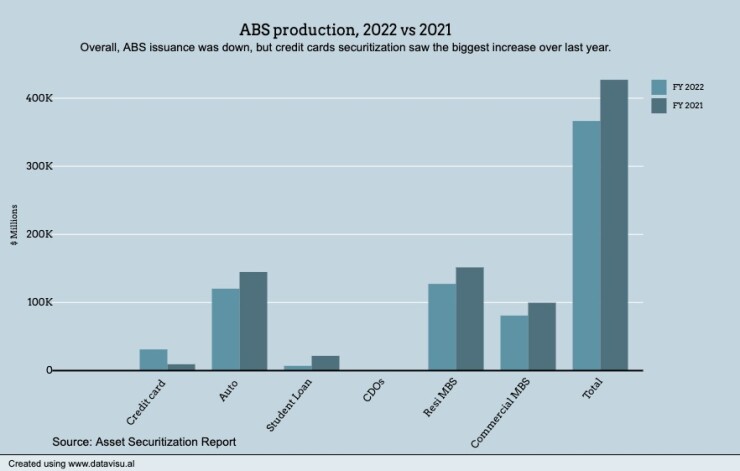

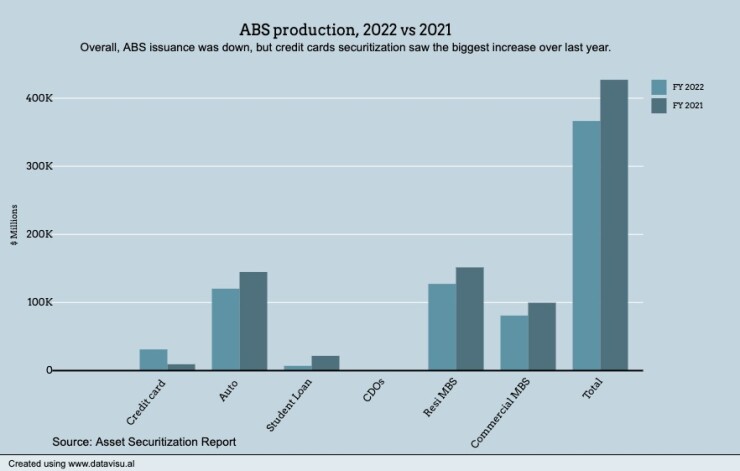

A year after Russia declared war on Ukraine, the Federal Reserve took its hawkish stance on record high inflation and as the mortgage industry began to contract, the securitization industry brought in $366.50 billion through Dec. 29, down 14.2 percent from last year’s output. According to the information compiled for Property bond report.

The dip was widely expected in the industry. For all of last year, managers handled about $427.01 billion in new securities business, according to sample data. ASR database.

For Q4 2022, output was around $50.3 billion, the database indicated.

Property bond report

The residential mortgage-backed securities (MBS) asset class was the top producer for the year, both by number of deals and volume, with $127.3 billion in new business, among 200 deals. Although the RMBS sector had the best yield in terms of assets, it was still down 16% compared to 2021 output of $151.5 billion. ASRThe database suggests.

In 2023, the industry expects no better than RMBS, largely due to pressures on the domestic mortgage industry.

“Due to the current rate environment, we expect issuance rates to remain low for at least the first half of 2023,” analysts at Kroll Bond Rating Agency wrote in their 2023 Structured Finance Outlook.

KBRA in 2010 He cited one segment of RMBS business that increased in 2022, subprime mortgages. Even that portion may not light the entire mortgage segment by 2023, the ratings agency noted.

According to KBRA’s overview, “Economics are different for major issuers, but the sector will struggle through 2023 due to high-speed and volatile expansion.”

The auto, credit card, and student loan segments followed, with yields of $120.2 billion, $31.1 billion, and $6.9 billion, respectively.

Deluge production was a typical story for 2022, but not for credit cards, where production in that segment was $31.1 billion for all of 2022. ASR Data suggests. It was especially noticeable at a time when interest rates were rising. And Inflation could have caused consumers to put down the cards. Instead, they continued to swing and tap, driving the securitization sector higher.

But credit performance in most consumer segments has weakened over the past year, KBRA analysts said. Among credit cards, 30-plus day delinquencies increased 2.6 percent in 2022. Among accounts with less than 620, the 30-day delinquency rate was 8.2 percent higher.

Among the securitization sectors that saw declines, student loan ABS appeared to decline the most. The full-year 2022 issue was around $6.9 billion, a 67.9% decrease from last year’s total of $21.6 billion.

[ad_2]

Source link