[ad_1]

Seven years after Beijing launched its Made in China 2025 plan to promote advanced manufacturing in the country, the term has almost disappeared from public discussions and official documents.

But the policy itself is not dead. Pressures on local government finances in China will grow with government subsidies and subsidies that continue to dominate popular companies such as electric vehicle manufacturers and chipmakers.

In the year

Governments around the world provide funding to support technology sectors in their jurisdictions for a variety of reasons. China is no different in its efforts to deliver on this strategic policy, which ties in with President Xi Jinping’s long-term goal of creating a “modern and prosperous socialist state” that year.

The plan highlights 10 key areas for strengthening – from IT, robotics and new energy vehicles, to biotech and agricultural machinery, to aerospace, marine and rail equipment – and promises to encourage innovation by combining market-oriented approaches and government guidance.

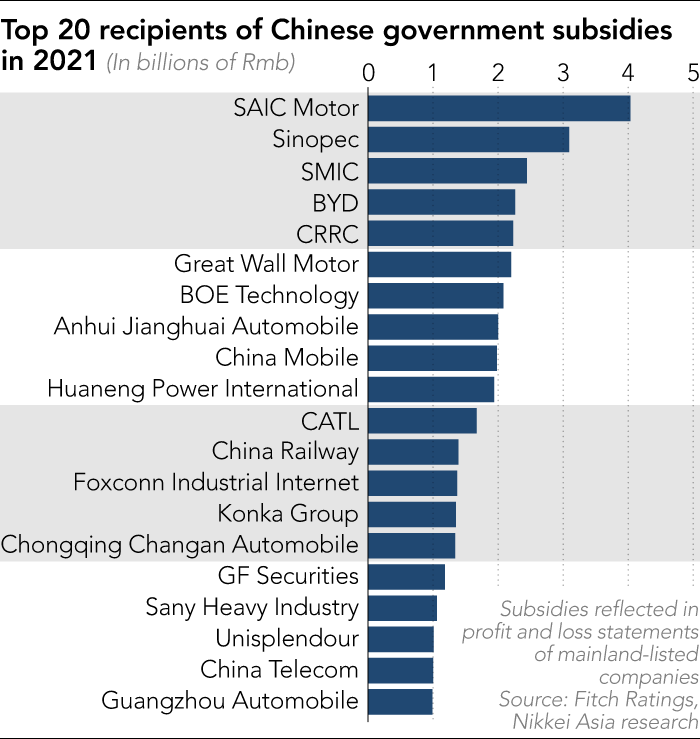

Beijing stopped using the term when the United States launched a trade war against China under President Donald Trump. But an analysis of Nikkei Asia data compiled by Fitch Ratings shows that the top recipients of government subsidies are mainly technology companies closely linked to Made in China 2025. Price stability.

In the absence of any favorable data from the Chinese government on government subsidies, Fitch collected the public disclosures of nearly 5,000 mainland-listed companies at the receiving end.

SAIC Motor, the country’s largest car manufacturer, He had been in control for years.

Three more automakers made the top 10 – BID, Great Wall Motor and Anhui Jianghui Automobile Group (JAC). Together, auto industry subsidies are Beijing’s priority to nurture domestic new energy vehicle production during the historic electrification transition.

Baidu, which recently overtook Tesla as the world’s largest EV maker by vehicles sold, announced more than 12 subsidies, including large sums from two “industrial development funds.”

This article is from Nikkei Asia, an international publication with a unique Asian perspective on politics, economics, business and international affairs. Our Asia300 section provides in-depth coverage of 300 of the largest and fastest-growing companies from 11 economies outside of Japan, as our own reporters and foreign commentators from around the world share their views on Asia.

Subscribe | Group registrations

Great Wall Motors, the maker of large SUVs, saw its subsidies jump 73 percent from last year to nearly quadruple in 2019. JAC, which mainly manufactures commercial vehicles, has announced more than 20 subsidized items, for the “biggest construction project [a] High-end electric light truck”. Government subsidies to JAC have doubled in the past three years, more than 14 times the company’s total net profit.

Not in the top 10, the world’s largest EV battery maker, Contemporary Amperex Technology (CATL) came in at number 11, with its annual dividend growing 2.6 times to Rmb1.67bn in three years. Chongqing Changan Automobile and Guangzhou Automobile Group were also among the top 20 awardees.

The chips and displays required for various tech gadgets are also top of the league. Semiconductor Manufacturing International Corporation (SMIC), China’s national chip champion, and leading display maker BOE Technology are constants in the top 10 list, while 5G network providers China Mobile and China Telecom are ninth and 19th in 2021.

Taiwan’s mainland-listed Foxconn unit was again a big beneficiary of Chinese state subsidies, a situation that has previously sparked political tensions in Foxconn’s home market.

The money will also trickle down to smaller companies. The investigation of high-income recipients of government subsidies reveals biotech drugmakers such as Shanghai Yizung Pharmaceutical and Mabwell (Shanghai) Biosciences.

Foreign governments continue to be concerned about the Made in China 2025 policy. Japan’s Ministry of Economy, Trade and Industry’s (METI) annual white paper, published in late June, allocated a portion of China’s government subsidies and calculated the increase in payments to companies in 10 key sectors identified by the policy.

In the year Growth accelerated after 2018, when the word was fading, it was found. By 2025, companies awarded to Made in China will reach Rmb100bn by 2020, double that of 2015.

“The entire activity of Chinese companies has shifted to these areas,” the report said. “The funding for these sectors is becoming more generous.”

The total amount of government subsidies in 2021, according to Fitch’s calculations, was Rmb217.92bn, or 3.2% less than last year. While this is the first year-on-year decline since 2009, all experts Nikkei Asia spoke to believe that there has been no change in Beijing’s policy to support tech companies and that the decline is temporary and technical.

The decline may be due to the method of collecting the figures. The total amount is calculated by taking the sum of the government subsidies recorded in the profit and loss statement each year. There are times when grants are given, but they are only kept on the balance sheet until they are actually done.

But there are cases where some government subsidies are not provided, due to budget constraints on local governments.

CPT Technology Group, a Fujian-based LCD display maker, partly blamed a cut in government subsidies for the rise in first-half losses.

The Shenzhen-listed company was supposed to receive Rmb440mn in six annual installments totaling Rmb2.64bn in aid from the Fatian municipal government after its LCD factory in the city went online in June 2017. Yet the word was fully fulfilled. Only in the first year. For the next two years, the amount was reduced to Rmb300mn and was reduced again to Rmb100mn, which was paid out last June. This year, it was reduced to zero.

The Futian government promised to fulfill the financial obligations, the company in 2010. He said in 2020, but admitted that the city is under “financial stress”.

Workers work on the SAIC Motor car assembly line. In the year By 2021, the company has surpassed Sinopec, the largest government subsidy in China © Reuters

Visiox Technology, another Shenzhen-listed panel producer, did not receive a Rmb700mn grant due in June 2020 in a high-tech industrial development zone in Jingnan-guan district in northern Hebei province.

The grant was for a state-of-the-art factory to produce active matrix organic light emitting diode (AMOLED) displays for modern smartphones. The administrator added another Rmb200mn subsidy in December that year, but no more than Rmb400mn was paid, according to a company statement.

The company took the unusual step of writing off more than Rmb20mn of government grants, which it assumed meant those receivables were uncollectible. Similar to CPT, VisionOx said its net loss is expected to double in the first half, with one of the main reasons being a Rmb133mn reduction in subsidies.

SMIC, China’s national chip champion, is a regular subsidy recipient © Aly Song/Reuters

These may be isolated cases, but a further deterioration in local government budget conditions could affect the amount of public money that flows into even strategic technology companies. Shinichi Seki, a senior economist at a Japanese research institute specializing in China’s economy, said: “The growth rate of government subsidies will slow down due to the lack of funds from local governments.”

Although strategies are designed in Beijing, a significant amount of actual payments are made locally. While the current real estate pocket has often taken away valuable revenue from the sale of land-use rights to developers, strict adherence to Xi’s zero-covid policy requires spending less on virus testing and other related procedures. Recent tax cuts designed to stimulate the economy are draining money from domestic coffers.

Seki sees “lights and shadows becoming clearer and more distinct” in the coming years, meaning local governments will be more discriminating when awarding subsidies.

Zhang Hongyong, a senior fellow at the Japan Institute of Economics, Trade and Industry Research, predicts changes in the way local governments allocate subsidies following chronic cash shortages.

“The certification of tech companies will be selective, and there will no longer be an elegant style of craftsmanship,” he said. Subsidies may be tied to the level of research and development spending, he said.

Beijing appears to be reeling from the effects of a weakened fiscal position. In mid-June, he instructed state governments to keep their spending priorities straight, stressing that even in the current financial crisis, there were areas that could be “appropriately strengthened”. Along with education, health insurance and infrastructure, “science and technology research and development” is mentioned, hinting at continued corporate subsidies to technology companies.

version of this article It was first published by Nikkei Asia on July 22. ©2022 Nikkei Inc. all rights reserved.

Recommended stories

-

US Senate moves forward with $52 billion CHIPS bill

-

The US-China tech war: Beijing’s secret chip manufacturing champions

-

China’s high taxes hit Covid-hit local governments.

-

China has blocked Japan’s hydrogen technology patent.

[ad_2]

Source link