[ad_1]

Historically, people who have difficulty conceiving children have been stigmatized.

A 2020 UCLA study found that approximately 15% of couples will have trouble getting pregnant, but Kindbody, which has spun up a network of fertility clinics since its founding in 2018, has taken a holistic approach to the issue.

With a focus on education that addresses the fragmentation associated with infertility care, Kindbody is growing at a remarkable pace, but it’s also helping many patients feel seen and heard for the first time.

Full TechCrunch + articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription

In a three-part series, reporter Rae Witte explores Kindbody’s origins, its business, and how it is changing the face of fertility treatments through interviews with its founding team, who have set out to transform and improve the experience of trying to have a child .

With 12 outlets in 10 US cities and unicorn status, Kindbody is poised for growth, having raised more than $ 154 million.

“We believe very much in the consumerism of healthcare, and what that means is you have to build healthcare around the consumer,” says founder and chairwoman Gina Bartasi.

- Part 1: How compassion and inclusivity are helping Kindbody change the fertility industry

- Part 2: Why focusing on holistic care helped Kindbody triple its revenue in 2021

- Part 3: Chipping away at the problems of reproductive healthcare, one patient at a time

Thanks for reading and have a good week!

Ram Iyer

Editor, TechCrunch +

@extrabrunch

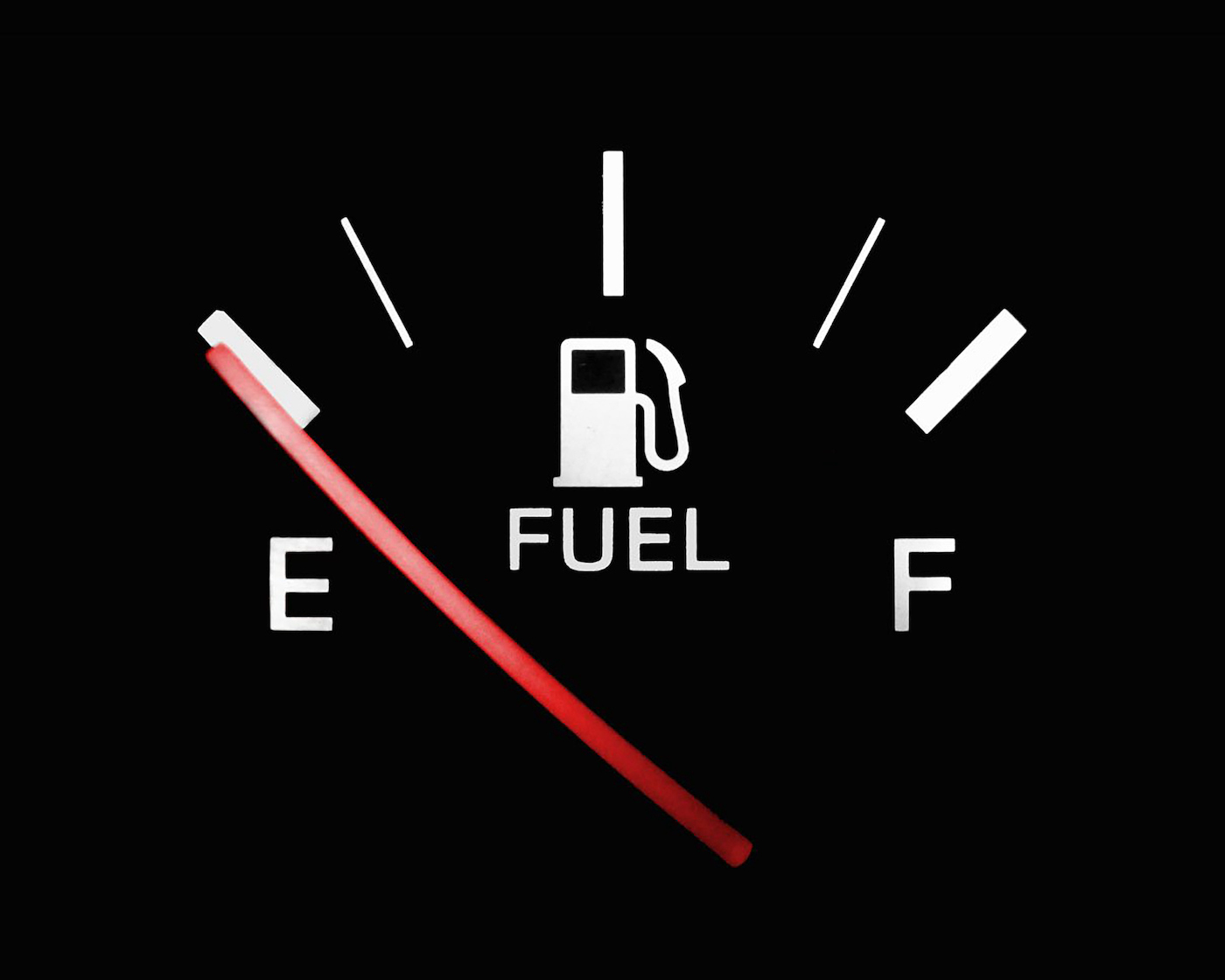

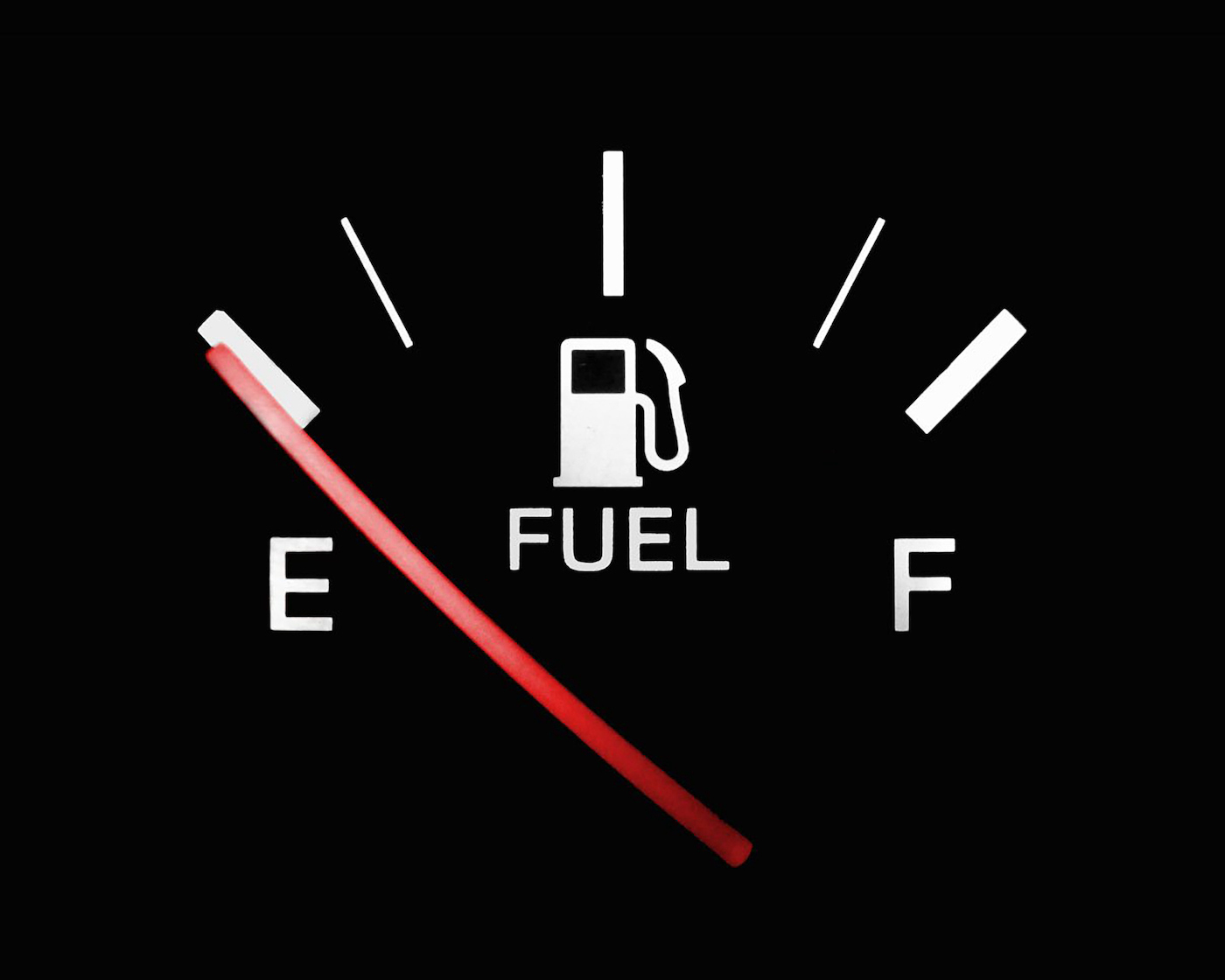

Does your startup have enough runway? 5 factors to consider

Image Credits: Jasmin Merdan (opens in a new window) / Getty Images

Myriad factors, such as fuel load, ambient temperature and sea level, determine how much runway a 747 requires to reach takeoff speed.

Startups are similar: If the landlord hikes your office rent, a very comfortable 18-month runway could easily shorten to a year. Would that still leave you enough time to get off the ground?

In her latest TC + post, angel investor Marjorie Radlo-Zandi shares five factors early-stage founders should bear in mind when managing resources, including her simple burn-rate calculator.

“Having 12-18 months of runway between funding rounds gives you time to implement your plans,” she says. “It’s a careful balance of keeping burn rate at a minimum while investing in key areas.”

Mayfield’s Arvind Gupta discusses startup fundraising during a downturn

Image Credits: diephosi (opens in a new window) / Getty Images (Image has been modified)

Arvind Gupta, an investor at Mayfield Fund and founder of accelerator IndieBio, reviews several hundred pitch decks each year.

“In 10 days, I can do the primary research and work with the founders to come to a conclusion there. For a larger Series A check. It could take a little bit longer than that, but not that much. ”

In a TechCrunch + Twitter Space last week with Senior Editor Walter Thompson, Gupta talked about how the downturn is affecting seed- and early-stage funding, what he’s looking for, and candid advice for first-time founders trying to raise during a correction.

“You can still finance hopes and dreams, but just with smaller dollars, and you’re generally going to give up a little bit more of your company in terms of dilution during an economic downturn,” said Gupta.

“I expect that to start happening as well in the next year.”

What Glossier got wrong

Image Credits: The Boston Globe / Bloomberg (opens in a new window) / Getty Images

Technology startup valuations are robust, so it’s only natural that entrepreneurs and investors would want to position firms as a straight tech play, regardless of the underlying business they’re in.

Once public, however, the markets will value you according to the sector in which you actually operate, writes Evan J. Zimmerman, the founder and CEO of Drift.

“The fundamental disconnect is that software-enabled businesses don’t necessarily monetize the same way that software-based businesses do,” Zimmerman says.

And that, he says, is what beauty brand Glossier got wrong, which led to it laying off about 80 staffers, most of whom were from its engineering team.

“That is ultimately the problem that hit Glossier: it forgot what business it’s in.”

Unpacking SailPoint’s $ 6.9B sale to private equity firm Thoma Bravo

Image Credits: Nigel Sussman (opens in a new window)

Enterprise security products maker SailPoint’s agreement to be acquired by private equity firm Thoma Bravo lent a sliver of hope to tech startups looking for positive signs in a down market.

But the fact that its valuation sits at roughly 15x ARR could be mixed news for startups looking for an exit, wrote Alex Wilhelm in The Exchange.

“Yes, it is a piece of good news for unicorns worth less than $ 10 billion because they can benchmark against a recent sale – one that could help them defend double-digit multiples of their ARR. But also no, because companies sell for a premium when they exit to private equity. ”

Crypto is altering the investing landscape for even the most disciplined VCs

Image Credits: Andriy Onufriyenko (opens in a new window) / Getty Images

With more than $ 32 billion invested last year, and over $ 11.3 billion so far in 2022, fundraising at crypto startups is showing no signs of slowing, market downturn being damned.

But behind all the fervor, there is a fundamental difference in how investors write checks for startups in the space and what they get in return, reported Jacquelyn Melinek and Natasha Mascarenhas.

“In traditional equity investing, you want to have a Series A or seed-stage investor have 20% to 30% ownership of the company. But having 20% to 30% ownership of a token or of a network is very bad and frowned upon by the community. And web3 is all about the community, ”Yida Gao, general partner at Shima Capital, said.

[ad_2]

Source link