[ad_1]

Welcome to The Interchange! If you received this in your inbox, thank you for your subscription and vote of confidence. If you are reading this as a post on our site, please register over here So you can receive it directly in the future. Each week, we take a look at the hottest fintech news from the previous week. This includes everything from funding rounds to trends to niche analysis to hot takes on a specific company or event. There’s a lot of fintech news out there and it’s our job to stay on top of it – and know about it – so you stay in the know. – Mary Ann And Christine

Busy, busy, busy

It’s been a busy week in startup and venture lands, and the fintech space was no different.

At Venture World, I reported on Peter Ackerson’s departure. Fin Capital At the beginning of this year and since then, a new venture company has been launched Venture capital. Circumstances surrounding his departure are murky, but one source speculated that tensions arose between Akerson and Finn co-founder Logan Allen during some events in the alternative finance startup’s pipeline last year. More details here.

Last year, we wrote about Tellus, a startup that raised $16 million in a seed round of funding led by Andreessen Horowitz. When I interviewed the company’s founder, Rocky Lee, last year, I admit that I was a little skeptical of any company that people agree to high-interest mortgage payments to improve their homes (think 9%!). Customer savings to finance such loans. When I asked if this was a risk, Lynn acknowledged that Tellus uses “very strict underwriting criteria” and has yet to see any delinquencies, as most borrowers will refinance their loans sooner rather than later. ” Well, last week, US Senator Sherrod Brown, Chairman of the US Senate Banking, Housing and Urban Affairs Committee, wrote in a letter to FDEC Chairman Martin Grunberg that he was concerned about Telus’ claims. In that letter, Brown pressed the FDIC to review Telus’ business practices to “protect customers from fraud and abuse.” In a twist, I found out Lee was married to a16z general partner Connie Chan (not sure if he’s still there). Neither he nor the corporate body would comment on the senator’s concerns, but Telus CEO/CEO Jerome Johnson provided me with a statement in an email. Read more here.

Infrastructure continues to be resilient, albeit at reduced levels. Just this week, I wrote about two payment infrastructure companies making a move, and my colleague Ingrid Lunden wrote about Stripe’s latest customer win. For starters, I covered Phoenix becoming an official payment processor – a truly natural evolution for a company that has been slowly expanding its offerings. In case you forgot, Phoenix Strip (an existing portfolio company) is the startup that pulled back from investing in Sequoia after expressing concerns that it was too competitive. (Phoenix gets to keep $21 million! Businesses tout “faster onboarding, improved economics and opportunities to lower interchange fees.) I spoke with CEO and co-founder Richie Serna about it and why he thinks Phoenix is built differently than previous players and Strips on the market. I’ve also written about Liquido, the Mountain View, Calif.-based startup “Latin America Stripe,” among others. Index Ventures’ Mark Fiorentino led two rounds of funding that brought the company a total of $26 million in 2021. Interestingly, before joining Index, Fiorentino worked at Stripe in business strategy and He helped build and lead Finance from 2015 to 2019. And Ingrid’s mention of the Strip landing Uber as a client was a bit unexpected, considering that rival Lyft has been the company’s longtime marquee client.

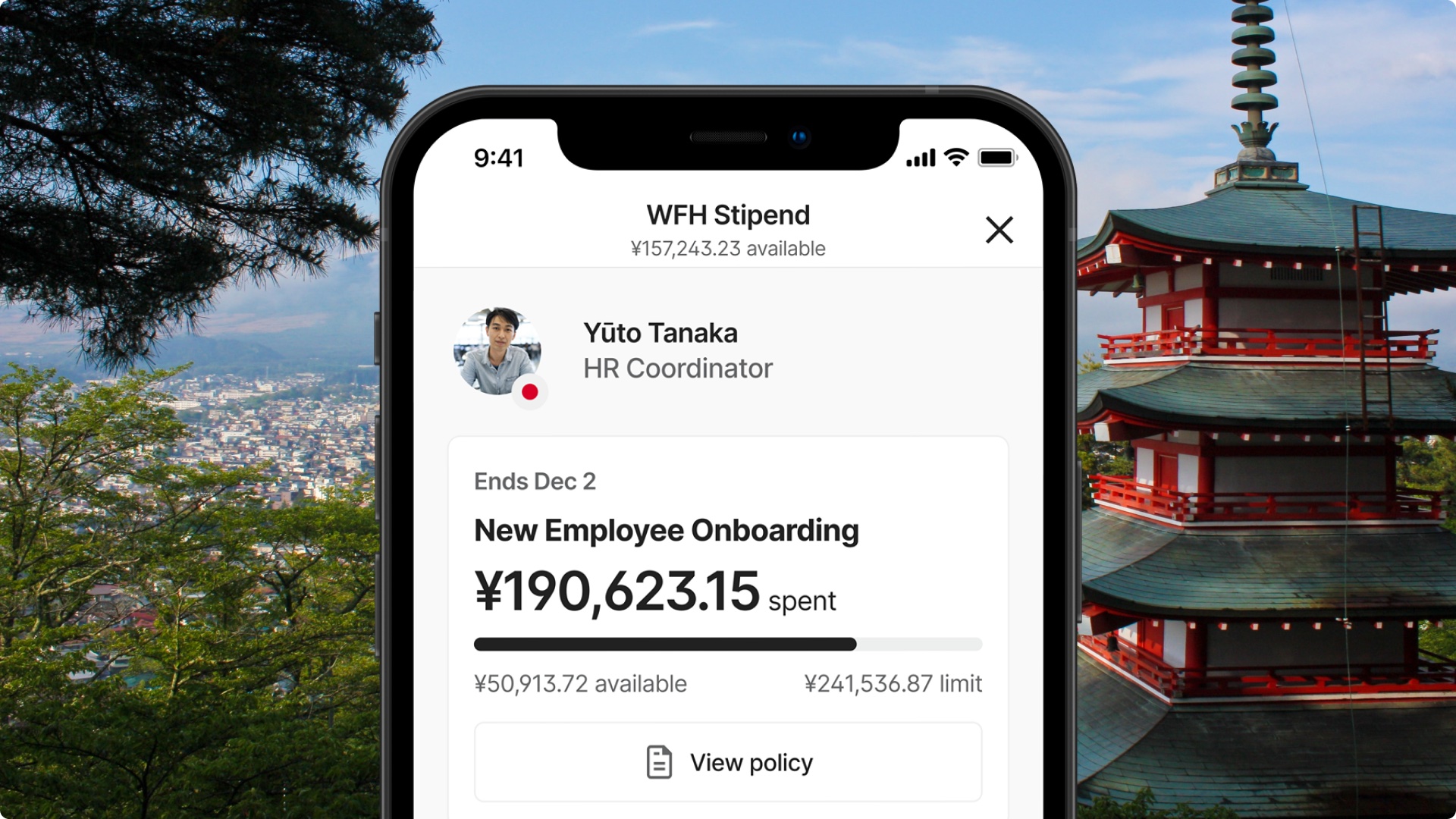

And last but not least, corporate card and expense management startup Brakes announced last week that it’s expanding its Empower product to new markets in countries like Brazil and Canada, so that its customers can now “work globally and locally.” Israel, Japan, Mexico, Singapore, South Africa and the Philippines as well as in 36 European countries. In an interview with TechCrunch, Brex founder and CEO Henrique Dubougras said the company believes the move “really opens up TAM for Brex” because many existing and prospective US customers “have some sort of global operations.”

“One of the biggest problems companies face when they’re going global is having to open accounts where they can have employees in all these different countries. Setting up all your financial systems country by country can be really complicated,” he added.

In other words, companies using BREX are giving employees working in other countries the freedom to use a corporate card in their home country, allowing the company to pay the statement in local currency from a local bank. .

“It’s something we’ve been trying to do for a while,” added Dubougras, noting that Insurtech is a Lemonade customer. – Mary Ann

Image Credits: Brakes

Other weekly news

Christine, Mary Ann, and Natasha Mascarenhas collaborated to write about Fall. First Republic BankTalking to tech founders and investors with money in the bank about what’s next. We spoke with an FRB competitor about what all these startup bank collapses mean for business. More here.

Carly Page reports: “Hackers published sensitive data stolen from payment software company AvidXchange After the company fell victim to ransomware for the second time this year. AvidXchange offers cloud-based software that helps organizations automate their invoicing and payment management processes. A ransomware group called RansomHouse has claimed responsibility for the recent cyberattack on AvidXchange. More here.

Christine wrote about the launch of the new company by former Bolt CEO Ryan Breslow. LoveIt’s a wellness marketplace that offers the first 200 curated products, including supplements, health test kits, and essential oils, among categories such as stress and gut health. All the products on the site go through standardized procedures and evaluations developed in collaboration with the clinical trials company Radical Science, which Breslow is unique to the company. More here.

Neobank of Britain revolution It has launched in Brazil, the first in Latin America to offer customers international bank accounts and crypto investments, Silicon Republic reports. In the year In March 2022, the company had to have a presence in the country after Glaber hired Mota as CEO of its Brazil business. As Alex Wilhelm and Anna Haim reported in April, Revolt saw “a 46 percent drop per view.” Fans” more here.

Tage Kene-Okafor reports I understand, which launched YC-backed Kenyan fintech NeoBank – the first of its kind in the East African country, according to the company – in partnership with Pan-African financial institution Ecobank Kenya. “Fingo has taken a while to get here since CEO Kiiru Muhoya and co-founders James Da Costa, Ian Njuguna and Guitari Thirima created Kenya Apparel in January 2021 to provide attractive financial services to Africa’s fast-growing young population. Although it is the smallest globally, it is the most financially isolated. After a $200,000 pre-seed round, Fingo entered YC S21 and raised $4 million in seed funding later that year. More here.

As reported by Manish Singh PaytmIndia’s leading mobile payments firm posted a 13.2% rise in revenue to $285.7 million at the end of March and a 57% rise in losses to $20.5 million, marking a turnaround for a company struggling to return to profitability after a period of turmoil. A year and a half after its official debut. More here.

More titles

As the Fed continues to raise rates, Apple and fintechs like Robinhood will chase hungry depositors. Similarly, Arta Finance, an alternative assets acquisition company, unveiled its Harvest Treasuries AI-managed portfolio, which offers 4.62% APY (annual percentage yield), and the Wealthfront funds account now offers 4.55% and 5.05% APY to all clients. Customers who refer a friend.

Fintech in 2010 It is predicted to be a 1.5 trillion dollar industry by 2030In a new report from Boston Consulting Group and QED Investors

Open Technology earnings beat $0.77, the highest earnings estimate

Evere has joined the Visa FinTech Fast Track program with the Evere Visa® payment card

Funding and M&A

Featured on TechCrunch.

African payment service provider Nomba, backed by Base10 Partners and Shopify, raised 30 million

Bend is taking Brakes and Ramps with a green twist and a $2.5M seed round.

And elsewhere

Digital wallet for insurance marble wallets $4.2 million. “America’s families are in dire financial straits right now, and insurance costs are no small part of that,” CEO Stewart Winchester told TechCrunch in an email about the increase. We continue to roll out features that not only help you save money and maximize value, but also reduce the mental burden of managing multiple insurance policies. In general, we expect to see the insurance industry adopt the consumer-friendly features we helped pioneer.

Insurtech startup Novidea has raised $50 million Series C

EXCLUSIVE: Ex-Venmo COO Raises $20M in Equity for Vera

Tarabut Gateway has raised $32 million to expand Saudi open banking

Music finance startup Duetti has raised $32 million to buy old songs

Billing platform Inbox Health raises $22.5M and more in digital health funding

The Google VC firm led a $12 million Series A investment in Range, a startup that is training AI to provide financial advice.

OpenEnvoy raises $15 million to grow AP automation solution

Miami-based startup Kid Credit raises $1.4M with backing from Dwyane Wade and Baron Davis

Black-owned Greenwood acquires digital bank rival TechCrunch covered Greenwood’s last raise in March 2021 over here.

Join us at TechCrunch Disrupt 2023 in San Francisco this September to explore the impact of fintech on our world. New this year, we’ll have a full day dedicated to all things fintech featuring today’s top fintech personalities. Save up to $800 when you buy your pass now through May 15th and save 15% more with promo code INTERCHANGE. know more.

We’re done for the week and it’s a good thing because we’re tired too! See you next week – same time, same place. Until then, take care! xoxo, Mary Ann and Christine

Image Credits: Brice Durbin

[ad_2]

Source link