[ad_1]

The pressure has shown signs of easing in the past few months. In June, Ant received permission to restart its IPO plans, and earlier this week, Didi Global was ordered to exit with a $1.2 billion fine, the end of which forced it to be delisted from the New York Stock Exchange a year after the probe ended. .

Here are 10 numbers that show the extent of the damage to China’s tech sector over the past 20 months.

40

Percentage of large Chinese companies that are technology companies.

1.5 trillion dollars

The price of speculation once crippled China’s tech industry. This is more than half of India’s GDP in 2020 ($2.62 trillion).

2.8 billion dollars

Record-breaking fine against Alibaba for anti-competitive behaviour. Among the harshest penalties, China’s top economic policymakers, such as Vice Premier Liu He, have called for regulators to be “standardised, transparent and predictable”.

95

Percentage of software companies among those arrested. Mainly hardware companies were only 5%.

14,000

The number of game-related companies forced to close after China suddenly stopped licensing video games.

100 billion dollars

Before the supposed collapse of China’s edtech sector.

25

Number of online education companies shut down by crackdown on private education in 2021, China research institute 100EC announced.

54.8 billion dollars

Investors outside of China have invested in 955 deals in Chinese tech companies in 2021, despite the restrictions, according to the Pitchbook Greater China Ventures report.

130 billion dollars

Total Chinese tech companies raised by 2021, including domestic venture capital funding. This is a 50% increase from 2020.

76.7

In the year Percentage reduction in investment and financing for China’s Internet sector in the first quarter of 2022 It was down 42.6% from the previous quarter as investors finally started to flee.

The main news of our reporters

Technology policy

Indian tech companies spoke to lawyers: CEOs of Indian internet firms, Flipkart, Paytm, Oyo Hotels & Homes, Ola, Zomato, Swiggy, MakeMeTrip and others addressed a high-powered parliamentary panel headed by former BJP finance minister Jayant Sinha. On Thursday to discuss ‘anti-competitive practices of big-tech companies’.

Global electronics, hardware makers seek PLI payments: Sources told us that several global electronics and hardware manufacturers are petitioning the Union government for release of delayed payments for the country’s upcoming Product Linkage Incentive (PLI).

Fintech developments

Number of prepaid cards compromised by fintech companies in July: Fintech firms like Slice, Uni and LazyPay have issued less than 100,000 prepaid cards so far this month after the Reserve Bank of India barred them from loading credit lines on wallets and other prepaid devices (PPIs) in June, multiple executives told us. .

Piece changes business model after RBI circular: Card-based fintech startup Slice offers real-time credit to customers for every transaction based on the user’s profile, the transaction and the merchant’s behavior.

RBI notes that fund raising is on hold as it raises uncertainty: Fintech company Slice’s fund raising has come to a halt after a Reserve Bank of India circular last month barred it from installing prepayment instruments (PPI) lines of credit.

Start news

Global gaming firms ask FM to provide investors with status on GST: More than a dozen global venture capital investors in Indian gaming startups have urged the government to keep the existing Goods and Services Tax (GST) on gross gaming revenue (GGR) instead of gross deposits. This comes amid concerns that the GST Council – the highest decision-making body – is considering a tax on the latter.

India’s startup ecosystem created 7.68 million jobs in the last six years. India has registered around 72,983 startups in the last six years and these companies have created around 7.86 million jobs during this period, the government informed Parliament on Wednesday.

Startups face questions from job seekers: How long will your money last? Why do you think your business model works? Can you afford to continue with your return plans? These are some of the questions hiring managers at startups face from prospective employees.

Cryptoverse

When BACC closes, Crypto companies plan to form a new industry entity: After the Internet and Mobile Association of India (IAMAI) disbanded the Blockchain and Crypto Assets Council (BACC) last week, crypto exchanges and blockchain companies are trying to merge into an independent industry body.

RBI Wants Crypto Ban, Govt Seeks Global Support For Regulation, FM While the Reserve Bank of India has made it clear that it wants a complete ban on crypto assets, the Indian government needs international cooperation if such a ban or regulation is to be implemented, Finance Minister Nirmala Sitharaman said on Monday.

ETtech Ecommerce Index

We have released three indices to track the performance of recently listed technology companies – ET Ecommerce, ET Ecommerce Profitable and ET Ecommerce Unprofitable. Here’s how they’ve fared so far.

IT corner

IT companies can rationalize real estate in big cities as small cities take center stage: Some Indian and international IT companies are looking to rationalize their real estate in big cities, even as others slow or stop their expansion in metros. Company executives and analysts told us that they are looking to expand significantly into II and III cities to tap workers who returned to their hometowns during the outbreak.

Wipro’s pipeline is growing in every sector, CEO says. Despite macroeconomic headwinds, Wipro, which was acquired in a record deal pipeline, forecast 3-5% revenue growth in the coming quarter. Thierry Delaporte, CEO of India’s fourth largest software exporter, told us in an interview that operating margins will increase to 17-17.5% in the next few quarters with new investments and additional operational efficiencies.

The IT sector is recession proof, says Wipro CEO Rishad Premji. IT sector is ‘recession-proof’: Wipro Executive Chairman Rishad Premji said the IT sector has not stopped making decisions on deals and costs amid inflation as clients spend on business transformation or spending. and the risk of recession.

TCS to build eight major campuses: Tata Consulting Services is setting up eight new large office spaces, each with the capacity to accommodate more than 10,000 employees. Some of these centers are coming up in non-metro cities, TCS chief financial officer Sameer Seksaria told ETA.

Ecommerce news

.jpg)

Blinkit to integrate with Zomato Hyperpure in a new pillar: Blinkit is closing warehouses while it is in the process of merging its operations with food delivery major Zomato to launch a Gurgaon-based express business.

SoftBank, Sequoia seek portfolio firms to join ONDC: Card-based fintech startup Slice offers real-time credit to customers for every transaction based on the user’s profile, the transaction and the merchant’s behavior.

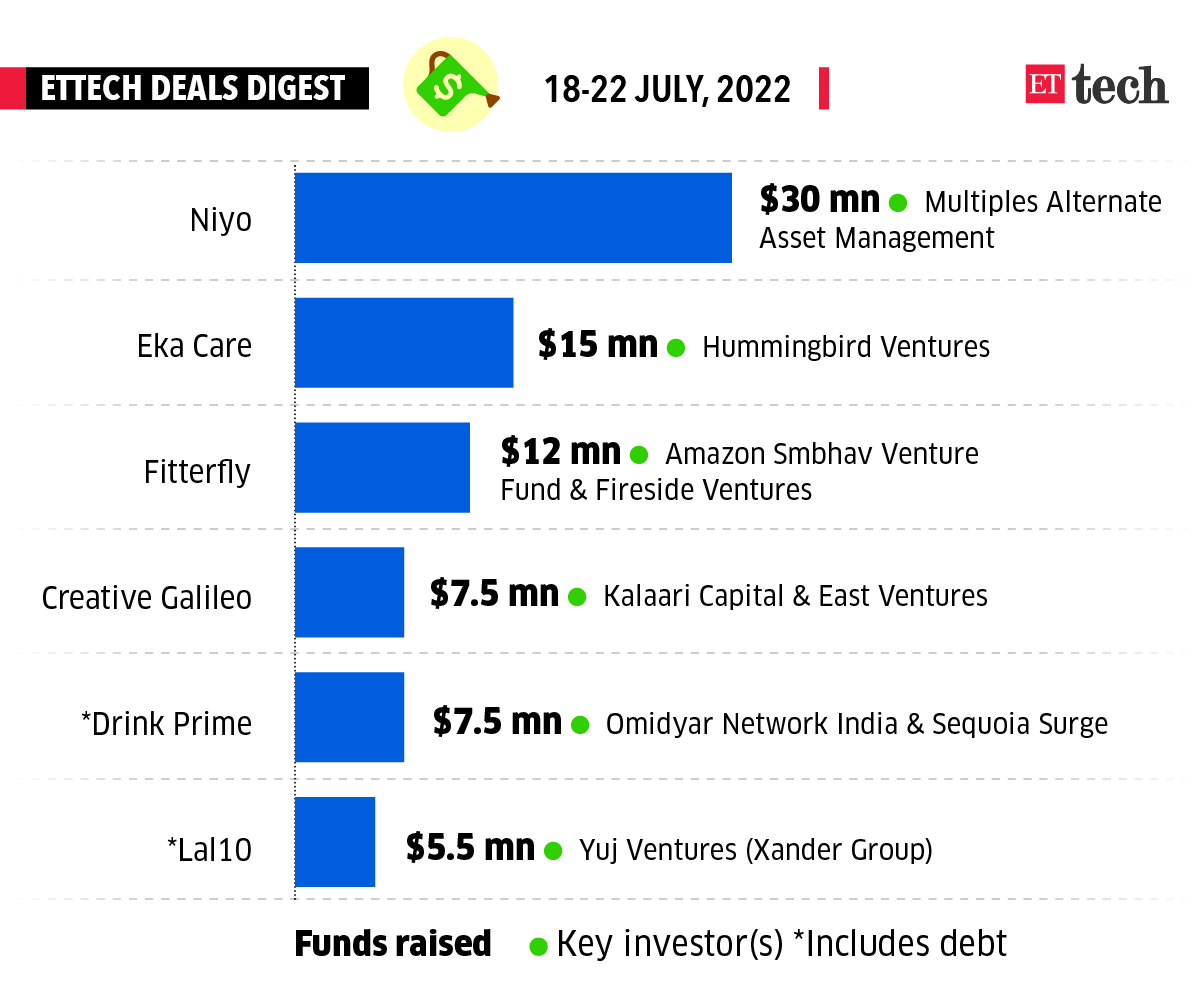

ETech Deals Digest

■ Temasek and Zomato-backed logistics aggregator Shiprocket said it has acquired Arvind Retail’s omni-channel technology business Omni in a Rs 200-crore cash-and-stock deal. This marks another attempt by Shiprocket to double down on its direct-to-consumer shipping business. Last month, it announced the purchase of Picrer in a $200 million deal.

■ Financial infrastructure provider M2P Fintech has worked as an identity verification service provider for the third time this year, aiming to strengthen its support for fintech and other financial institutions. The company earlier this month bought Bengaluru-based cloud lending platform Finflux.

VC funds

LetsVenture CEO Launches MicroVC: Shanti Mohan, founder and CEO of early stage investment firm LetsVenture, has launched a new micro venture capital (VC) Propel with an investment corpus of Rs 50 crore. Founded last year, Propel focuses on early-stage investments in e-commerce, software services, D2C brands and technology enablement platforms.

B Capital Raises $250 Million in Pre-Stage Fund Raise: Global tech-focused investment firm B Capital said it has raised $250 million as part of its first-ever early-stage vehicle Ascent Fund.

[ad_2]

Source link