[ad_1]

Investors are investing money in publicly traded funds at a historic pace as equity and corporate bond markets accelerate toward new peaks and asset managers increasingly turn to vehicles to build portfolios.

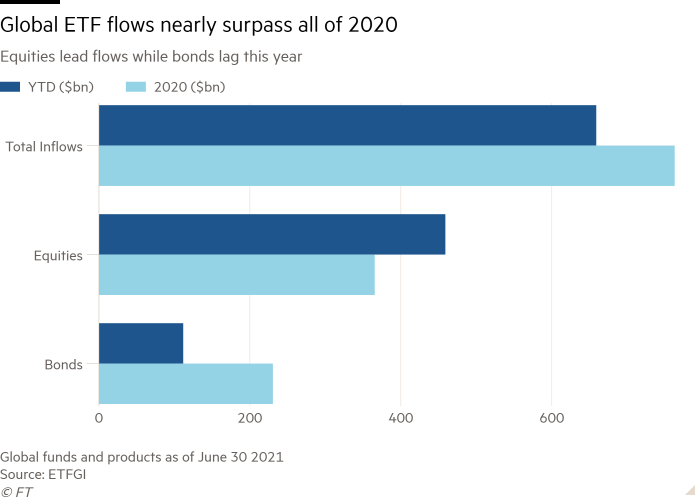

According to ETFGI, flows to ETFs are already on track to surpass the 2020 record, with a total of $ 659 billion during the first six months of 2021 compared to $ 767 billion throughout last year.

Global equity-based ETFs have already overshadowed last year’s intake and attracted net flows of $ 459 billion on June 30, surpassing $ 366 and $ 283 million for 2020 and 2019, respectively.

The boom reflects a sharp rise in asset prices since their 2020 pandemic lows, but also shows how fund managers use ETFs as an important instrument in portfolios, in some cases replacing or using them in conjunction with individual securities. .

Already with a $ 9 billion global market, the rapid growth of the ETF universe fuels a bullish outlook among big players, led by companies like BlackRock, State Street and Invesco.

“It took 15 years for iShares to reach $ 1 billion in assets, five more years to reach $ 2 million and just two more years to exceed $ 3 million,” said Salim Ramji, global head of ‘iShares and BlackRock Index Investments. The asset manager expects the global market to expand to $ 15 billion by 2025.

BlackRock’s iShares unit attracted net flows of $ 75 billion in the second quarter of this year and topped 3 billion in assets in June, the group said Wednesday. Quarterly flows increased from $ 51 billion last year and accounted for most of the asset manager’s $ 81 billion global revenue over the past three months.

The hottest areas of long-term growth include increased fixed income investor activity, a growing preference for model portfolios (such as those targeting 60% of equities and 40% of bonds) by of wealth advisors and also of the growing popularity of mandates that take into account environmental, social and corporate governance standards.

Among various growth engines, traditional stock collectors seeking to buy companies that outperform the broader market yield increase the use of ETFs in actively managed portfolios.

“Asset managers have found a way to participate in ETFs that provide them with the opportunity to use their experience in inventory and portfolio construction,” said Todd Rosenbluth, head of research for mutual funds and ETFs. CFRA. “Adoption is accelerating with insurance companies and other institutional investors.”

According to BlackRock, assets held in the U.S. model portfolio market will double more than $ 4 million over the next five years to $ 10 million. It expects half of new investor entry for its ETF branch in the United States to come from model portfolios in the future, up from a third compared to 2020.

State Street, the world’s third-largest ETF provider, is also expanding its model portfolio business.

“We are working on building partnerships with other vendors, in addition to offering portfolio models that we have developed in-house,” said Rory Tobin, global head of ETFs at State Street Global Advisors. It partnered with Natixis, the French asset manager, to offer model portfolios to US financial advisors through the Bank of America platform in late 2019.

Bond ETFs have been getting money from new clients at a slower pace than their equity peers this year. Revenues have been recorded at $ 112 billion in 2021, compared to $ 231 billion in all of 2021, according to ETFGI data.

“Fixed income is behind ten years of stocks in their respective life cycles of ETFs,” said Jason Bloom, head of Invesco’s fixed income and alternative ETF strategy.

Prior to the launch of new ETFs, fixed income areas, including asset-backed securities and bank lending, were not easily accessible to retail investors and even financial advisors, Bloom said. “You now have access to parts of the fixed income markets that you didn’t have before.”

Bond ETFs emerged from the fall of the pandemic in March 2020 with the reputation of having passed a stress test. The Federal Reserve’s decision to buy corporate bond tracking ETFs also played an important role in alleviating market turmoil and investors ’concerns about the product.

Still, Craig Siegenthaler, a senior equity research analyst at Credit Suisse, notes that if the benign market environment becomes scarcer, ETF providers could struggle to continue to grow at such a rapid pace.

“Most of the investing community is bullish on ETFs and it is seen that fixed income is rising a lot, but if we get a bearish market it will make the industry continue to grow at the pace we have seen,” he said.

[ad_2]

Source link