[ad_1]

After Abel Chen, a California Bay Area realtor, offered $50,000 over the $1.5 million list price, and all contingencies were removed, he was living the Wikikin’s dream, planning to buy a condo.

But Chen’s fortunes took a sharp turn three days before the closing, when the buyers killed the deal after the husband was laid off from his tech job in Silicon Valley and the family demanded a deposit back.

“I’m told their lives are being messed up,” Chen said. “They are single-income families with young children.”

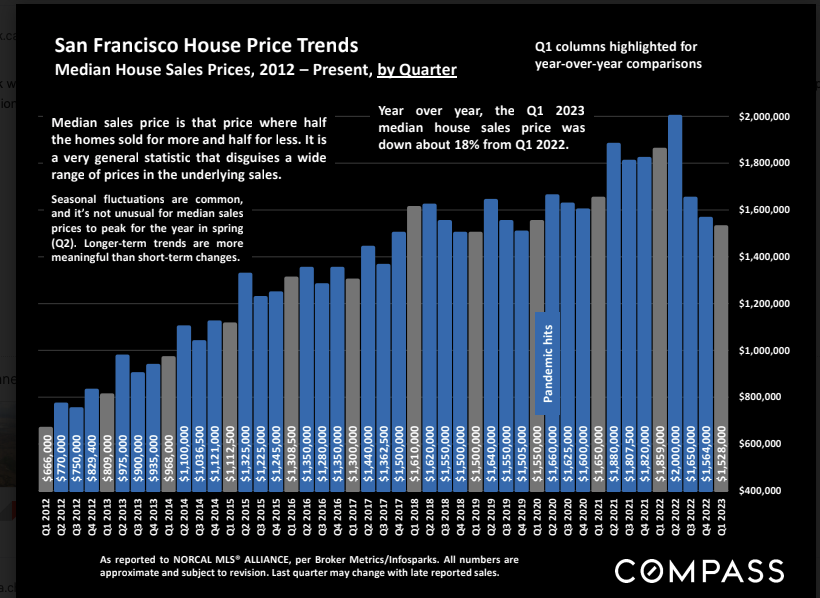

Chen’s experience is not unusual for a seller in the once-lucrative Bay Area housing market. Battered first by workers seeking remote opportunities and then by widespread technology layoffs, the San Francisco County market has seen home prices decline for the first three consecutive quarters in a decade, with median home prices down 23 percent in nine months.

“So we have macroeconomic factors that affect all areas of the country, like rising interest rates and so on,” Patrick Carlisle, senior market analyst at Compass in San Francisco, told Yahoo Finance. These very specific factors such as high tech cuts, the highest home prices in the country, and the work from home industry are affecting our industries more than others.

The problem with the market was that it was first reduced by the rise of remote work.

“All the work-from-home jobs have put the idea in people’s heads that urban areas will continue to work, but urban areas won’t pay the cost of housing,” Carlyle said.

The average home price in the Bay Area is higher than the rest of the population. According to data provided by Compass, the median home sale is $1,528,000 in San Francisco and $1,590,000 in Santa Clara. These prices are four times higher than the US median price of $375,700.

Although some companies have begun asking workers to return to the office, the city’s office vacancy rate remains at 30 percent, compared to the overall U.S. rate of 12 percent.

Loss of technology money

Exacerbating the housing slump in San Francisco is the fact that tech companies are not as confident as homebuyers.

From mid-2022, bonuses are being cut and jobs are being cut.

“A few months ago, it was completely unthinkable that Google and Meta would have this scale of discounts,” Carlisle said. “They didn’t have layoffs forever.”

The unemployment rate in Santa Clara County, a Silicon Valley geographic location, is expected to rise from last year to 3.2% in March 2023. Other Bay Area areas such as Alameda, San Francisco, San Mateo and Marin have seen unemployment rates rise over the past six months, according to Compass data.

Not only have job opportunities in the Bay Area declined, but venture capital (VC) investments and initial public offerings (IPOs) have also declined, drying up startups and the stock the region had previously experienced.

“The net worth of people in the tech industry has gone down and stock prices have fallen, IPOs have stopped, a lot of startups are based on these things and that money just isn’t there,” said Ken Rosen, chairman of Berkeley. Hass Fischer Center for Real Estate.

According to a report published by Ernst & Young, IPO deal volume fell 8% and revenue fell 61% year-over-year. That’s a far cry from nonprofits like Peloton raising more than $1 billion in 2019.

“If you don’t have the work and you don’t have the wealth, you’re going to be bullied as a ruler.” Rosen added.

While big tech companies beat earnings and outperformed analysts last week, insiders don’t expect the positive quarterly financials to impact Bay Area markets in the short term.

“The positive result of the income did not change the big discount plans,” Rosen said.

Carlisle agreed.

“While financial markets can move very quickly and dramatically, the housing market is like a large ship that changes course slowly,” Carlyle said. “People don’t suddenly decide to buy or sell a house based on short-term changes in quarterly income.”

Still, this is a region that screamed back from the dot-com punch. And since 2012, home prices have still increased by 130%, according to Compass Statistics.

“If you believe the intrinsic value of this area is the company and the people, it’s a good place to invest for the long term,” said Adam Tunney, a broker at Resolve Group, a Bay Area-based real estate firm.

Just ask Chen, who told Yahoo Finance that he received a universal funding offer just days after his initial offering ended.

Chen said, “I’m worried now, but after what happened last time, I’m still worried.”

Rebecca is a Yahoo Finance reporter and previously worked as an investment strategist. Certified Public Accountant (CPA).

Click here for the latest personal finance news to help you invest, pay off debt, buy a home, retire and more.

Read the latest financial and business news from Yahoo Finance

[ad_2]

Source link