[ad_1]

It has been a stressful period for Credit Suisse. Last year Tidjane Thiam was sacked as CEO after the bank hired private detectives to spy on his colleague and neighbor Iqbal Khan.

Credit Suisse then amassed huge losses for its customers after creating funds filled with dubious $ 10 million from Lex Greensill. For an encore, it accumulated huge losses for its investors by supporting Bill Hwang’s Archegos Capital, which exploded later in March.

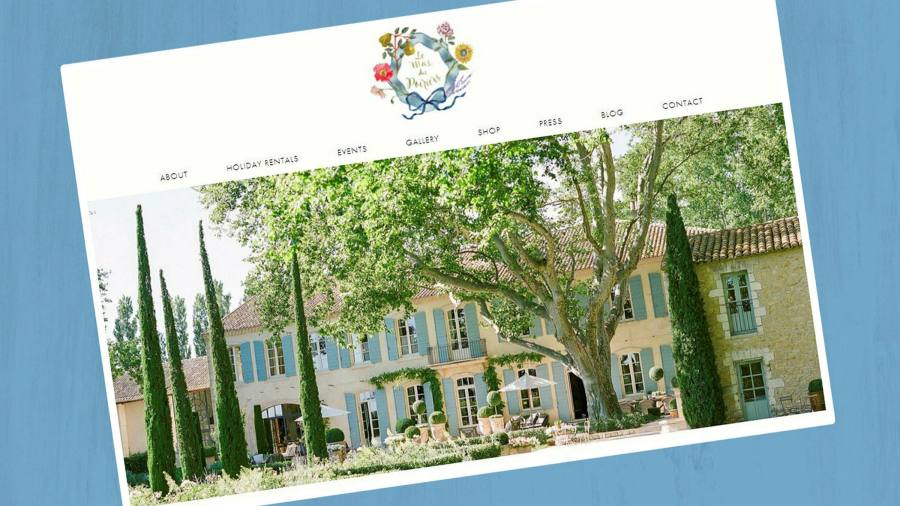

When he needs a break, Eric Varvel, a senior Credit Suisse executive who oversaw the asset management division, goes to his holiday home in Provence. We know this because his wife, Shauna, he told The Times last week before his next book on home renovation: Provencal style, decorated with French Country Flair.

The book is on sale: $ 50. The property is for rent: $ 12,000 per night. And there is even an online store where you can shop pillows: $ 350. This is a full high-end side bustle.

The timing of the publicity is unfortunate. There are many Credit Suisse customers who have lost a lot of money in Greensill. And although Varvel has been replaced as head of asset management, he remains at the bank.

Still, this is hardly one “Where are the customers’ yachts?“Situation. On the one hand, it’s Credit Suisse: customers already to own yachts. And the house Varvel was bought for only 2.5 million euros, according to property records. Even if the majestic renovation cost twice as much again, it’s not a huge amount for someone who has spent three decades at Credit Suisse, much in senior positions.

The episode, however, has once again focused on remuneration at the Swiss bank. While Varvel’s overall remuneration is not disclosed, we do know that he benefited from a radical scheme to transfer toxic assets from the bank’s balance sheet to the bonus fund.

With the benefit of retrospect, the plan, first conceived in 2008, was twisted. The goal was not to facilitate the purchase of seven-bedroom mansions that could spawn their own businesses and rent them out. the Obamas.

But while the reward-risk calculation may have been a bit off, the idea had merit. To sum it up, after the global financial crisis, banks suddenly came across a wide variety of securities secured by mortgages and leveraged loans that no one wanted.

With their crunchy balance sheets of illiquid assets, difficult to value and subject to punitive capital charges, banks were under pressure from regulators and shareholders. Credit Suisse got a great idea: get rid of them by using them to pay the bankers.

The assets were placed in a pool, with shares in the bankers. If the assets were eventually sold for more than their final value in 2008, they would be repaid. If they were sold for a lower price, bankers instead of shareholders would take success.

At the time, bankers were not entirely happy with the payment of their bonuses in the form of toxic assets. They would have preferred cash or, if absolutely necessary, Credit Suisse shares. But in general, they rolled over because it wasn’t a good time to go looking for work.

This device, known as the Partner Asset Facility, has not had many imitators, which is a shame. Stock awards help to align to some extent the incentives of executives and investors. But there are many occasions when parts of companies depress valuations. If you can eliminate them and use them to pay employees, it’s potentially a double win for shareholders.

In the case of Credit Suisse, the bankers won. As fear subsided in 2009, the market decided that there was some value in toxic assets and they were appreciated en masse. Titles full of damaged mortgages helped buy the home of the Credit Suisse executive in Provence, where he could go offline after overseeing the division that lost billions to Greensill. And so, at least, after all the trouble, there is a happy ending.

[ad_2]

Source link