[ad_1]

It all started with a test. A.D. In 2012, the e-commerce landscape of Thailand grew exponentially due to the advent of the 3G mobile broadband network and the increasing use of smartphones. However, online businesses had a hard time completing transactions due to the complex checkout system.

“Consumers have not been able to store their credit cards on e-commerce sites. The payment experience was flawless. There is still no player in the market for this solution,” said June Hassegawa, founder of Thai Pay and Blockchain. CASIA.

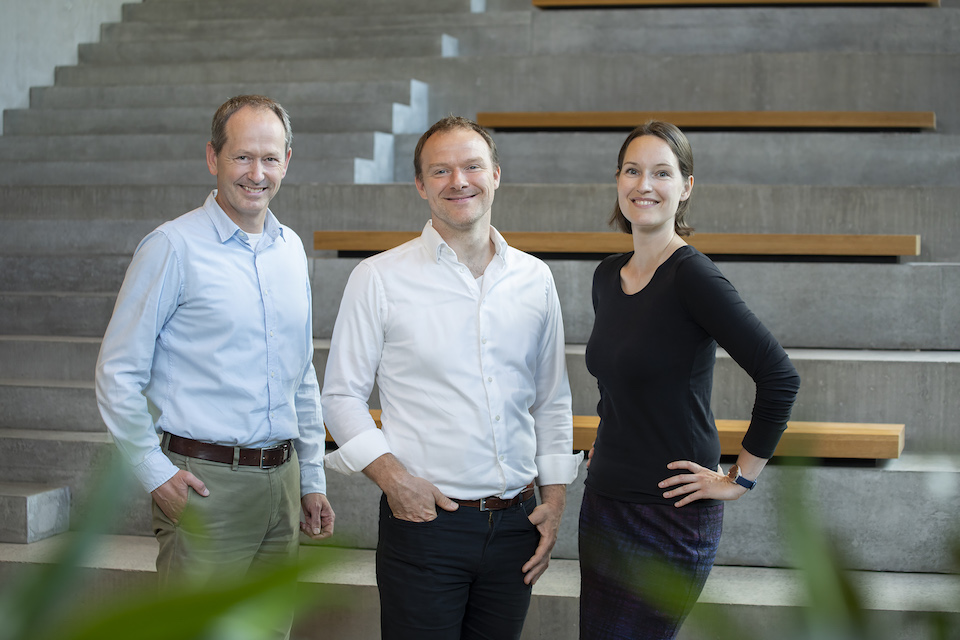

As a series entrepreneur, Hassewa moved to Bangkok in 2012 and began exploring opportunities with his local friend, Ezra Don Harrison, in the growing e-commerce sector. Initially, the idea was to build an e-commerce platform with a smooth screening process. The two Omise Holdings (in Japanese “shops”) were founded in June 2013, but financial problems soon gripped the young company, and Hassega sold her watches and shoes to keep the business afloat.

Hasegawa and the team parted ways with the original e-commerce wishes and decided to negotiate the fee. Shortly after the pillar, Omise received $ 300,000 from East Ventures in the August 2014 seed finance round. The business has grown rapidly since then. Although Hasagawa did not disclose the exact figures, he said the company had recently reported “more than 2x” annual growth.

Omise Holdings was renamed Sinka Holdings last April, reminiscent of Japanese “evolution.” A few months after the renaming, in June, Sinka bought SCB 10X, the commercial arm of SIM Commercial Bank’s PC Venture Capital arm, and the Tokyo-listed asset management group in Tokyo for $ 80 million.

Assessing financial inclusion through blockchain

The goal of democratizing financial services continues to be on Hasagawa’s mind. “Payments in our view should be available to everyone. This is a human right, not a right,” she said.

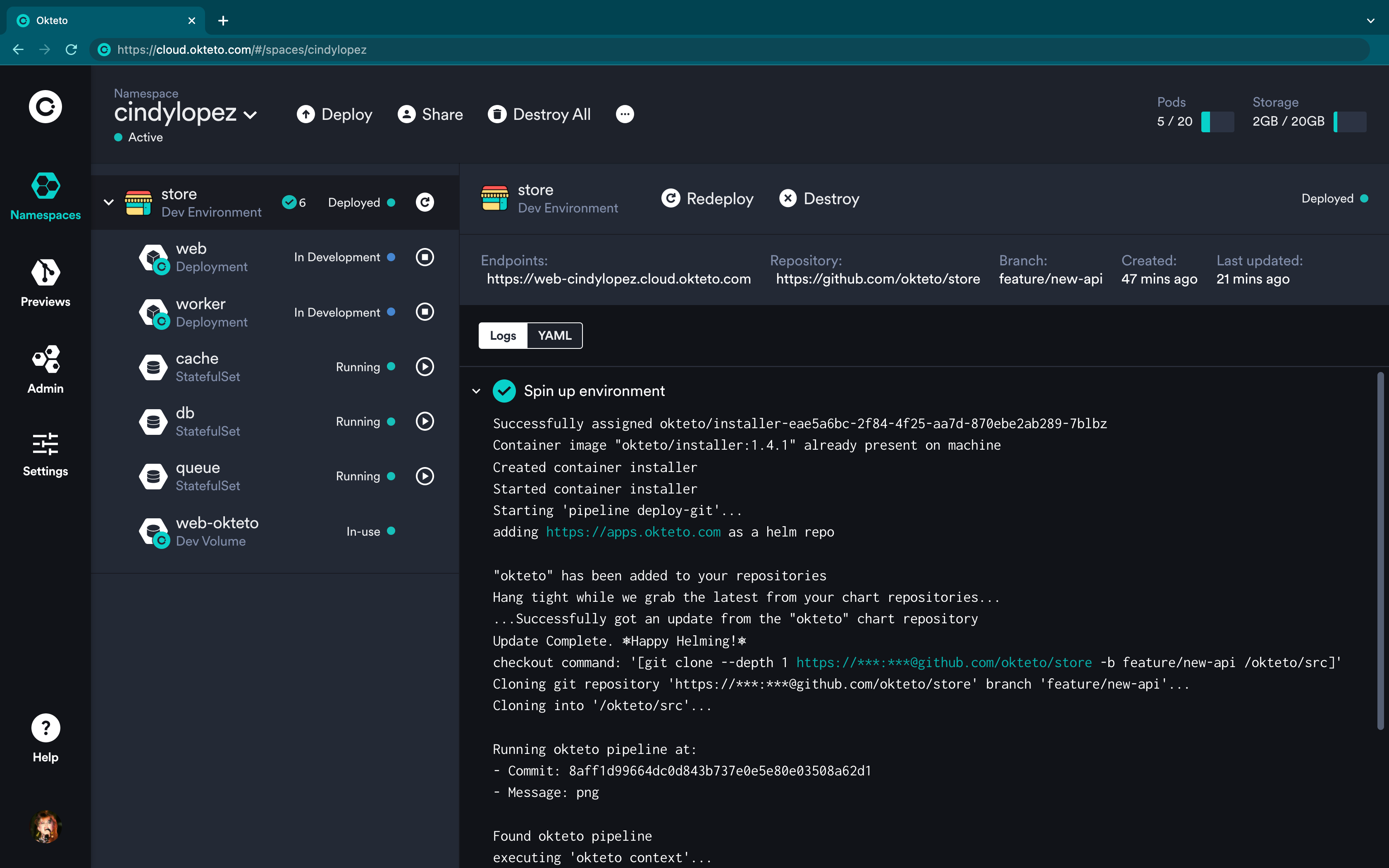

Hasagawa and the group continue to enter the main payment infrastructure, with or without access to bank accounts. Under Sinka, the company manages two business start-ups that began last March, a payment gateway business called Omise and an endtech solution called Open.

Omise is an e-payment processor that provides B2C and B2B payment services that can be accessed from websites and mobile applications. The forum currently operates in Thailand, Singapore and Japan. It considers brands such as Pomelo, Real Group, BMW and MacDonalds as customers, as well as other small and medium-sized companies. Omise generates revenue through a consumption-based system and the commission fee is based on the size of the partnership agreement, Hasagawa explained.

Sinka was the developer of the OMG network, formerly known as OmiseGo, an Ethereum-based payment and payment tool. The venue was sold to Genesis Block Ventures in Hong Kong last December.

“Bitcoin does not have smart contracts, which means there is no flexibility other than transferring its value. We also thought that Ethereum could be a technology to provide an open financial solution for everyone. It is a self-fulfilling prophecy written directly in the code lines.

After selling the OMG network, Hasagawa continued his love for blockchain technology in the open segment. While Open has not yet launched any product, Hasagawa hints that commercial services such as blockchain-based e-wallet solutions may be “coming soon”.

“If there is a business that already has 10 million end users, we can integrate our solutions and transform the company into a Fintech company. In return, we will have 10 million customers in one day. This is how the approach works,” Hassegawa said.

“The payment industry has improved. Enterprises have begun to incorporate Fintech solutions into their ecosystems. For example, in the years since Apple Pay and Apple Card to Apple Cash, Apple has started incorporating payment solutions into the ecosystem. And now, in Southeast Asia, there is Grab Finance and GoTo.

Hasagawa also outlined plans for Sinka expansion plans to enter Indonesia, Malaysia and Vietnam over the next two years. The company plans to raise additional funds.

“We will raise more money in the next round of funding. But we are not sure when and how. IPO is another way of raising money, but the question is whether this is the right way to achieve our vision. In the meantime, we must be responsible and accountable to our shareholders.” .

[ad_2]

Source link