[ad_1]

Thomas Barwick/DigitalVision via Getty Images

thesis

Direxion Technology Bear 3x Shares (NYSEARCA: Tex) is an ETF that falls under the category of allocated funds. The vehicle from Technology Select reverse performance seeks 300% daily investment results. Sector index. When the index sells off sharply, as in 2022, TECS offers a potential profit. We think that rich funds like TECS should be used as trading instruments instead of buying and owning vehicles. We view TECS as an efficient capital allocation tool for investors with a limited sector outlook. For example, a retail investor limited by their brokerage balance but using TECS in the early 2022 technology perspective could have invested only $100 and gained exposure to $300 of capital.

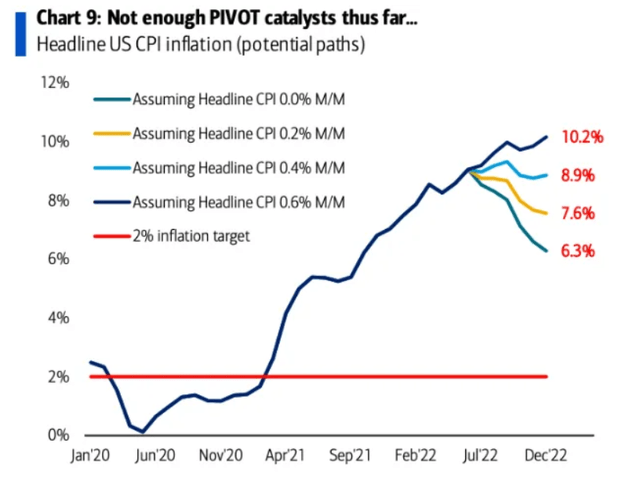

We don’t believe the equity and tech market crash is over. It is our opinion that another -10% leg remains in the market before we call it capital. That broad market movement should translate to another +30% for TECS. More importantly, we don’t believe there will be a v-shaped recovery in the tech sector. Like Credit Suisse’s Zoltan Pozár, we feel that we are instead looking at an L-shaped recession that offers the best “medicine” to fight inflation. We feel that inflation has resumed at a permanently high level and high rates are here to stay. Inflation takes a long time to come down to a desirable level:

Inflation future (BofA)

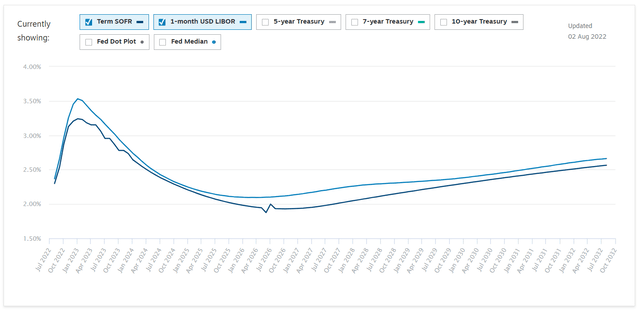

Courtesy of Bank of America, we can see that even if the CPI moves to 0% change for the month, inflation will not be close to the 2% limit by the end of the year, and the SOFR curve shows that inflation will peak:

SOFR curve (Chatham)

At 0% CPI M/M we need at least 1 year for numbers to come down to historic levels. Can we even expect a month of 0% CPI? no.

Rates are expected to remain high this time around, and the Fed is committed to seeing the inflation rate fall significantly before cutting rates, even at the cost of a mild recession. Technically we are in a recession as we speak, with two-quarters of our GDP contracting. However, the labor market is strong, the consumer balance is in good shape, and the political apparatus suggests that the “help needed” signs are not really a failure. This macro setup translates into higher discount rates and lower valuations for tech companies.

We believe that the July market closed again as a result of the sell-off conditions from June and we continue to move lower in this bear market. The catalyst for the technological gains we saw post-Covid, i.e. zero rates, no longer exists and as a result will be a headwind. In today’s inflationary environment, prices will remain high for a long time. An active, sophisticated investor can take advantage of the potential -10% leg-down in tech stocks through the leveraged TECS vehicle and make a 30% return if that vision materializes.

Performance

The fund is up more than 22% year-to-date.

YTD performance (seeking alpha)

Being an leveraged fund, TECS does not show a strong long-term return profile.

3Y performance (seeking alpha)

The vehicle has decreased by more than -97% in three years. A structural bull market period in tech will give you 3x leverage on daily moves. TECS is a trading tool used by active investors with very short timeframes in mind. A buy-and-hold investor should not consider this instrument.

But if we go back to the year-to-date chart, we can notice a very interesting performance indicator – TECS was up 100% at the beginning of the year before the July market rally. There is also a non-replicable base between XLK performance year to date and TECS performance in XLK Performance 3. This returns to our discussion as the ETF tries to triple the daily movement of the index. The fund’s fact sheet is very straightforward in describing this basis:

These leveraged ETFs seek a return of 300% of their benchmark index return for one day. The funds should not be expected to deliver three times the benchmark’s cumulative return for periods longer than one day.

Conclusion

TECS is a leveraged ETF that provides investors with daily investment returns of up to 300% of the inverse performance of the Technology Select Sector Index. An investor looking to short the technology sector in a capital-efficient way can get $300 of exposure for every $100 in TECS. The strong rally in July was a response to oversold technical levels in high beta and oversold names, and in August we witnessed the resumption of a structural bear market in this sector. We feel that inflation is unlikely to end anywhere and that prices should stay longer than the market expects. As an leveraged vehicle, TECS is a good short-term trading tool to use on the next leg down. We expect another -10% in the index in the next leg down which translates to approximately +30% performance for TECS.

[ad_2]

Source link