[ad_1]

If blockchain technology is to reach true mass adoption, it will have to become cheaper and more efficient. Low transaction throughput on some of the most popular blockchains, most notably Ethereum, has kept gas fees high and hindered scalability. A host of new projects has cropped up to improve efficiency in the blockchain space, each with its own set of tradeoffs, including proof-of-capacity blockchain subspace, which announced its $ 32.9 million Series A last week.

Now, a team of researchers from Stanford University’s applied cryptography research group has entered the fray. The team is coming out of stealth mode with Espresso, a new layer one blockchain they are building to allow for higher throughput and lower gas fees while prioritizing user privacy and decentralization. Espresso aims to optimize for both privacy and scalability by leveraging zero-knowledge proofs, a cryptographic tool that allows a party to prove a statement is true without revealing the evidence behind that statement, CEO Ben Fisch told TechCrunch in an interview.

Espresso Systems, the company behind the blockchain project, is led by Fisch, chief operating officer Charles Lu, and chief scientist Benedikt Bünz, collaborators at Stanford who have each worked on other high-profile web3 projects, including the anonymity-focused Monero blockchain and BitTorrent co-founder Bram Cohen’s Chia. They’ve teamed up with chief strategy officer Jill Gunter, a former crypto investor at Slow Ventures who is the fourth Espresso Systems co-founder, to take their blockchain and associated products to market.

Espresso Systems CEO Ben Fisch and COO Charles Lu Image Credits: Espresso Systems

To achieve greater throughput, Espresso uses ZK-Rollups, a solution based on zero-knowledge proofs that allow transactions to be processed off-chain. ZK-Rollups consolidate multiple transactions into a single, easily-verifiable proof, thus reducing the bandwidth and computational load on the consensus protocol. The method has already gained popularity on the Ethereum blockchain through scaling solution providers like StarkWare and zkSync, according to Fisch.

At the core of Espresso’s strategy, though, is a focus on privacy and decentralization. The team originally set out a year ago to build a flexible privacy-focused blockchain solution, and has since shifted its priorities to prioritize both privacy and scalability after realizing the “most immediate pain point” for users has actually been the latter, Fisch said.

He added that the broad, industry-wide race to scale blockchain technology has been ongoing since 2018, which is when Solana and other layer-ones first started designing solutions focused on cost-effectiveness and throughput. New projects today face an even more complex challenge, according to Fisch.

“One thing that becomes evident of late is that it’s now not just a race to scale, but a race to scale and make the fewest trade-offs possible with regards to decentralization,” Fisch said.

While several different blockchain ecosystems use zero-knowledge proofs to improve efficiency today, that efficiency has come at the cost of decentralization, Fisch said.

“If you use a zero-knowledge proof to prove the validity of a large number of transactions that never get sent to the consensus protocol, then while the consensus protocol can verify their validity, they’re not able to provide data to users that is needed for constructing future transactions, ”Fisch said. Users, then, rely on the ZK-Rollup server for access to that critical data – meaning the data is centralized on that server.

“We’re working on a way of integrating the roll-up carefully with consensus so that we still achieve higher throughput and thus lower fees, but without compromising so much on decentralization,” Fisch said.

Like decentralization, privacy is another fundamental consideration for many crypto users. Public blockchains such as Ethereum record all transactions anonymously in an electronic ledger open for anyone to view. Although users’ identities are encrypted on the blockchain itself, if a particular wallet is linked to an individual, their transactions could be exposed “In real-time to anyone who might care to look, including business competitors and threatening actors looking for targets,” according to Espresso Systems.

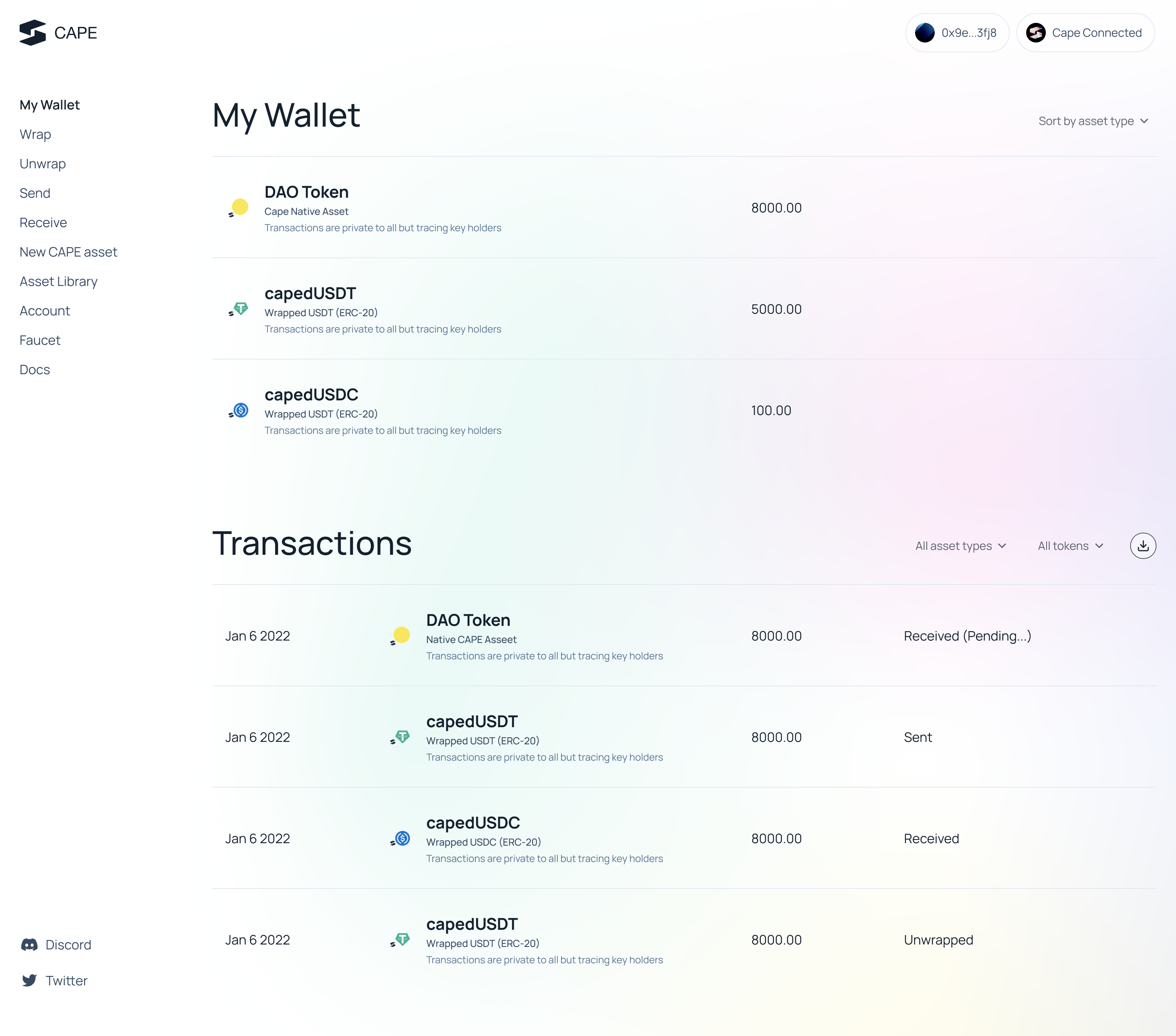

The company’s core privacy solution is a smart contract application called Configurable Asset Privacy for Ethereum (CAPE), which allows asset creators on the blockchain to customize who can see what information regarding the ownership and movement of those assets.

Fisch said CAPE is particularly well-suited for financial institutions or money service businesses that create blockchain-based assets because it allows them to balance the customer’s need for privacy with the institutions’ need for risk management and compliance. He shared the example use case of a stablecoin issuer that could create a private version of their coin that allows users to transact privately, while the issuer can still view transaction data.

Espresso Systems’ CAPE application interface Image Credits: Espresso Systems

“CAPE allows asset creators to consider configuring a flexible viewing policy, or even a pricing policy, that gives them more visibility and control over assets that are totally confidential and private to the rest of the public viewing of the blockchain,” Fisch said.

CAPE is designed to run on any Ethereum Virtual Machine (EVM) blockchain, and will first debut on the Ethereum testnet in a few weeks so its creators can receive user feedback, though eventually, the application will run directly on the Espresso blockchain, according to Fisch. Espresso is also leveraging Ethereum’s popularity as the most widely-used blockchain by building a bridge directly to Ethereum that will allow assets to be moved away from Ethereum onto Espresso, according to Fisch.

In addition to its public debut, Espresso Systems also announced today that it raised a $ 32 million Series B round led by Greylock Partners and Electric Capital, with participation from Sequoia Capital, Blockchain Capital, and Slow Ventures. Greylock’s Seth Rosenberg, who also backs Chia, led the firm’s investment in Espresso Systems.

Espresso Systems CSO Jill Gunter and chief scientist Benedikt Buenz Image Credits: Espresso Systems

Espresso Systems raised its seed round in November 2020 led by Polychain, bringing its total funding to $ 65.5 million including the latest round. Its other investors include Alameda Research, Coinbase Ventures, Gemini Frontier Fund, Paxos, and Terraform Labs, as well as angel investors Balaji Srinivasan and Meltem Demirors, according to the company.

The team employs 26 people today, 18 of whom are engineers, Gunter told TechCrunch. She added that many of these cryptography-specific engineers joined the Espresso team because of her co-founders’ connection to Stanford and the world of academia more broadly (in fact, Fisch was recently hired as a professor of computer science at Yale University).

Gunter said she is confident Espresso can compete against other layer one solutions working on the same set of issues.

“One advantage that we have is that we have the benefit of getting to design for this and build for this from the outset, whereas a lot of the other systems that are working to scale right now have these big, sort of backward compatibility issues where they’re having to design around the existing systems, ”Gunter said. “If you look historically, other blockchain projects like Solana have had a lot of success being able to start fresh.”

[ad_2]

Source link