[ad_1]

SoftBank’s second Vision Fund poured about $ 13 billion into more than 50 companies during the second quarter, two people reported on the figures, marking a sharp increase in the pace of their investments.

During the first three months of the year, the fund invested less than $ 2 billion in less than two dozen companies, according to public information. One person said many of his latest investments had not yet been publicly announced.

The increase in SoftBank spending occurs as other strong investors, such as Tiger Global Management, have amassed highly valued money. start-ups, contributing to the most active first half of registered private technology funding.

The first $ 100,000 million vision fund became known for having participated in multimillions in companies such as the Chinese application Didi Chuxing and the flexible WeWork working group, subsidizing large losses while fighting competitors in large markets.

Its yields have risen recently after several companies in which it had invested reached the public market, including South Korean e-commerce group Coupang and US food delivery company DoorDash.

With the second Vision Fund, the Japanese group has changed its approach, instead of betting more modestly on healthcare and software companies instead of multimillion-dollar investments in urban mobility and heavy industries, such as construction.

The first Vision Fund needed to invest at least $ 100 million per deal as part of a deal with its investors, said one person who reported on the issue, limiting its ability to invest in relatively young companies.

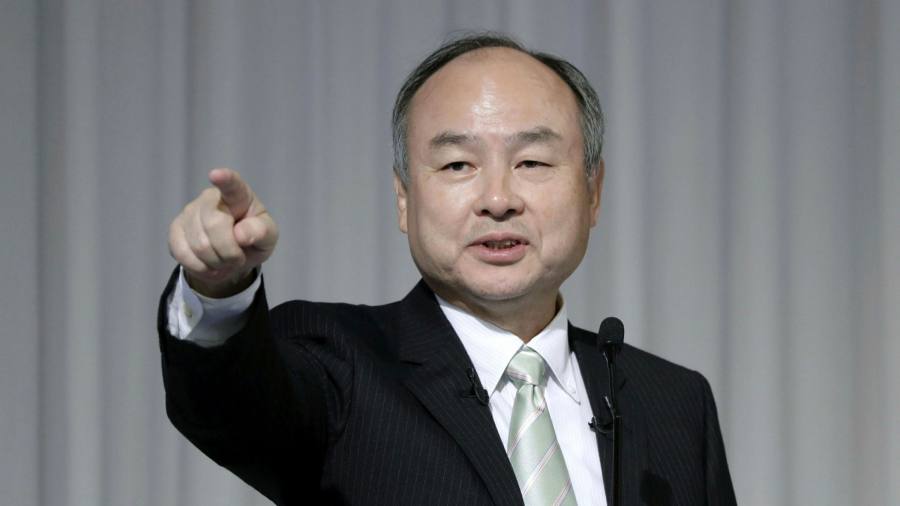

SoftBank, led by CEO Masayoshi Son, has pledged $ 30 billion in equity to the new fund after it managed to raise capital from external sponsors, such as government funds in Abu Dhabi and Saudi Arabia.

Deep Nishar, managing partner of the Vision Fund in the United States, said the second Vision Fund had begun “partnering in earlier stages of the company’s life” in an attempt to find attractive investments.

“In the current market environment, valuations are more attractive in the early stages of a company’s life cycle compared to the very late stage,” Nishar said.

The start of video communications Mmhmm said Wednesday it had raised $ 100 million in so-called Series B funding led by the second Vision Fund. The fund also led a second round of $ 140 million in funding for artificial intelligence company Vianai Systems in June.

In other emerging companies, such as the video messaging app Cameo, the second Vision Fund has taken a back seat to rival venture capitalists, investing tens of millions of dollars instead of hundreds of millions at once.

SoftBank does not expect to raise money from external investors for the second Vision Fund, although it could commit more equity, said a person familiar with the matter. The company originally said it will raise up to $ 108 billion for the fund.

Vision Fund executives have tried to dwindle We work and other high-profile setbacks from the first fund, promoting a renewed focus on emerging companies using artificial intelligence.

The new fund had invested about $ 20 billion in more than 90 emerging companies and had planned investments in at least 30 additional companies, two people reported on the figures. In comparison, the first Vision Fund has invested $ 85.7 billion in less than 100 companies.

“There is a reduction in the number of companies that are formed and that require a lot of capital to be successful,” Nishar said.

SoftBank has not always been successful in investing in smaller businesses. The Brandless and Dog Wag Dog app, which was launched, ran into problems after receiving large investments from the first Vision Fund.

The second Vision Fund has not completely shied away from the big bets. In May, the fund led a $ 775 million investment round in Perch, one of several well-funded groups that sought to consolidate Amazon’s independent merchants.

Several partners and other senior executives have recently left the team that manages the two Vision funds, including Ervin Tu, a partner who oversaw investments in ByteDance and the Uber company. Jeffrey Housenbold, who made many of the fund’s largest consumer investments in the U.S., left earlier this year.

SoftBank said it had incorporated 30 people into the investment team in the past four months. In February, the fund hired Microsoft executive Nagraj Kashyap as a managing partner to lead investments in consumer companies.

Due Diligence Newsletter

Sign up here to receive Due Diligence, leading news from the world of corporate finance, which are sent directly to your inbox every Tuesday to Friday

[ad_2]

Source link