[ad_1]

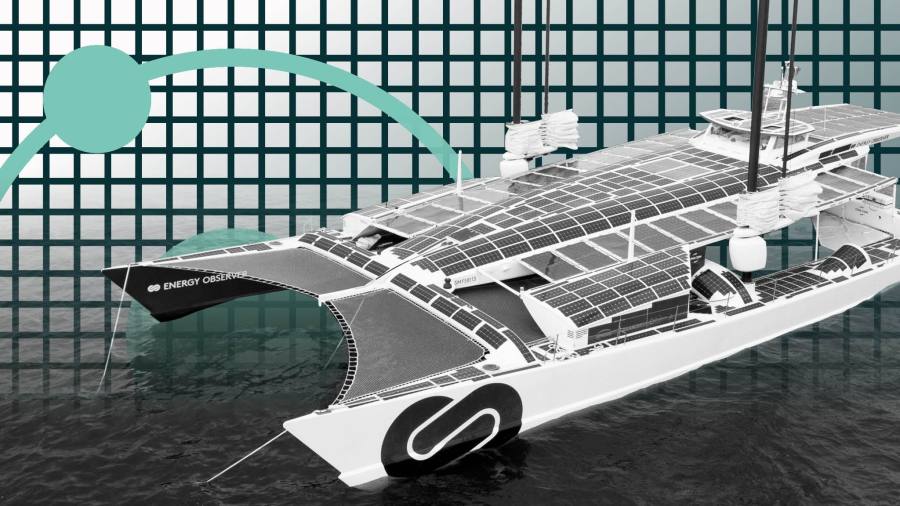

The Compagnie Belge Maritime du Congo launched its first steamship, the SS Leopold, on its first voyage from Antwerp to the Congo in 1895. Today CMB, the successor to the colonial-era group, carries passengers between the city. Belgian and the nearby Kruibeke on a hydrogen-powered ferry.

“This is the fourth energy revolution in shipping – from rowing our boats to sails, to the steam engine and diesel engine, and we need to change it once again,” said Alex Saverys, executive director. of the WBC and descendant of one of the oldest shipping families in Belgium.

Maritime transport produces about 3% of global greenhouse gas emissions, and without action, its contribution is likely to increase for decades as world trade grows. The International Maritime Organization, the United Nations agency that regulates global industry, wants to reduce its impact by at least 2050.

Many industry figures rely on blue or green hydrogen, produced from natural gas with carbon sequestration or renewable electricity, and the only byproduct that burns water, to help get away from polluting bunker fuel.

“There is no doubt about whether hydrogen will be the energy carrier of maritime transport in 2050,” said Lasse Kristoffersen, executive director of Norway’s Torvald Klaveness. “The question is, how do you produce it and what form do you use as a carrier?”

But other executives who operate the huge boxes that traverse the planet transporting from raw materials to consumer goods are skeptical hydrogen may play more than a little in the fuel transition.

Although pilot projects such as the CMB show that fuel is viable on a small scale on fixed routes with fuel supply infrastructure installed, 85% of the sector’s emissions come from bulk carriers, oil tankers and container vessels, according to analysis by Royal Dutch Shell. Nothing can feed them as efficiently and economically as fossil fuels.

“It won’t be an easy sector to decarbonise,” said Bud Darr, executive vice president of Mediterranean Shipping Company, the world’s second-largest container shipping group. “The need for autonomy in maritime transport forces us to transport a large amount of fuel. We need a range of alternative fuels on a large scale and we need them urgently. We keep an open mind and explore all possible solutions. “

Hydrogen has a low energy density compared to heavy fuel. Storing it in liquid form below -253C requires heavy cryogenic tanks that occupy precious space, making it unfeasible for large cargo ships.

“With the current state of technology, we can’t use hydrogen to power our ships,” said Morten Bo Christiansen, head of decarbonization at AP Moller-Maersk, MSC’s biggest rival.

However, the industry has been increasingly optimistic about the use of ammonia, a compound of hydrogen and nitrogen, to feed the workhorses of world trade without producing greenhouse gases.

Although toxic and odorless, ammonia is easy to liquefy, is already transported worldwide, and has almost twice the energy density of liquid hydrogen.

“The cleanest and most realistic transportation fuels of the future are hydrogen-based fuels, including green ammonia,” said Rasmus Bach Nielsen, global head of fuel decarbonization at commodity trader Trafigura.

Engine manufacturers believe the technology is within reach. Finland’s Wärtsilä said it would be ready to scale ammonia-ready engines by the end of next year, while Germany’s Man Energy Solutions plans to deliver an ammonia-powered oil tanker in 2024. They both said that until there would be supply infrastructure, there would be new engines would also have to be compatible with bunker fuel.

Almost all of the 176 million tonnes of ammonia produced each year, mainly for fertilizers, currently use “gray” hydrogen extracted from natural gas in an energy-intensive process that emits CO2.

Producing carbon-free ammonia on a large scale is a difficult task. According to the document, about 150 million tonnes would be needed to meet 30% of maritime transport fuel demand by 2050 a report by catalysis company Haldor Topsoe. This would require 1,500 terawatts of renewable energy, roughly equivalent to all of last year’s global wind energy production.

Companies in the shipping industry are now calling for a global carbon tax to accelerate the production and uptake of next-generation fuels.

“The technology is there and ready,” Bach Nielsen said. “We need regulation now.”

However, with the 174 IMO member states, including oil producers and commodity exporters, it is not easy to reach an agreement on the price of carbon. The EU will make proposals in June to include maritime transport in its emissions trading plan, but maritime transport executives believe a global carbon tax should be several times higher than current EU record prices for over € 47 a tonne to make hydrogen-based fuels competitive. .

Any transition to hydrogen or hydrogen-based fuels is likely to be a lengthy process given the industry’s caution in switching to a less polluting fossil fuel. Even now, only 11% of the new ships in charge will run primarily on liquefied natural gas, according to consulting firm Drewry.

The medium-term decarbonisation efforts of larger shipping companies focus mainly on synthetic fuels and low-carbon biofuels.

Maersk, which plans to launch its first carbon-neutral ship in 2023, supports methanol, either waste-derived biomethanol such as wood or e-methanol produced from captured CO2 and green hydrogen. CMA CGM, from France, invests in biomethane. Both are compatible with existing engines.

Critics say the biomass resources needed for biomethanol are limited and that production can lead to environmental problems such as deforestation and water degradation. They also point to the fact that while synthetic fuels absorb CO2 when they are produced, they emit it again when burned.

“Why the hell should we release CO2 into fuels when we first capture it?” asked Kristoffersen of Torvald Klaveness.

For many minds, this leaves hydrogen in some form at the core of any long-term vision to decarbonize shipping. Few, however, can confidently predict how quickly it can happen.

“We would expect the technical challenges to be resolved in the coming years,” said Jan Dieleman, head of ocean transportation for U.S. grain trader Cargill. “The main challenge is the regulatory framework, as even large-scale production of these fuels will always be more expensive than fossil fuels. If we want to decarbonise shipping, we will need regulations to drive change. “

The colors of the hydrogen rainbow

© Christopher Furlong / Getty Images

Hydrogen green It is done through the use of clean electricity from renewable energy technologies to electrolyze water (H2O), separating the hydrogen atom from its molecular twin oxygen. It is currently very expensive.

Hydrogen blue It is produced with natural gas but with carbon emissions captured, stored or reused. Insignificant production quantities due to lack of capture projects.

Hydrogen gray This is the most common form of hydrogen production. It comes from natural gas by reforming methane steam but without capturing emissions.

Brown hydrogen The most economical way to produce hydrogen but also the most harmful to the environment due to the use of thermal coal in the production process.

Hydrogen turquoise It uses a process called pyrolysis of methane to produce hydrogen and solid carbon. Not demonstrated on a large scale. Concerns about methane leakage.

[ad_2]

Source link