[ad_1]

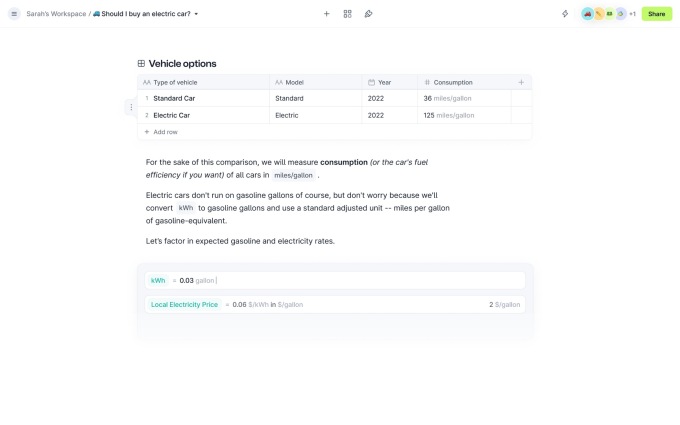

BrightRock today

Source: Submitted.

The value of this transaction is between R494m and R836m (excluding a roll-forward growth rate), payable over the next three years, subject to new business targets.

According to BrightRock CEO Schalk Malan, the acquisition supports BrightRock’s growth strategies and positions BrightRock strongly for the future.

BrightRock continues to operate as a separate business with its own brand, product offering and management team.

Since its inception ten years ago, BrightRock has grown aggressively from a zero base to R393 billion in coverage, with a total annual premium income of over R2.1 billion.

From 2017 to 2019, BrightRock delivered an average operating RoGEV (Return on Group Equity) of 21.5% to Sanlam.

“With Sanlam as our partner, BrightRock has been able to access the capital to support our growth and continue to grow with our unique brand and product technology,” says Malan. “This is an important step for BrightRock’s future growth strategies. It is also a testament to our results and our industry-changing power of unique, tailored product technology.

Providing additional coverage to customers

According to the recently released Swiss Re New Business Volumes Survey, BrightRock was the largest IFA in the personal life market in 2016. In 2021, for the second year in a row, Bright Rock ranked first in total coverage, accounting for 16.6 percent of the total coverage purchased in the market.

Interestingly, BrightRock captured only 12.6 percent of the same market, a fact that Malan says demonstrates the effectiveness of BrightRock’s needs-related product offering.

The fact that we have the highest coverage but not the highest premium shows that we are keeping our promise to our customers to provide additional coverage for the same premium rand.

On average, during the year, BrightRock customers purchased 32% more coverage for market-average premiums than they could with other insurers in the market,” he says. Likewise, BrightRock held the highest market share for funeral products sold at the IFA venue, with 21.9% of the total insured according to the same survey.

File claims for BrightRock customers

Talking about BrightRock’s performance in the market, Malan highlights its claims performance.

“Claims are the ultimate test of how we deliver to our customers, and BrightRock is proud to have paid R4.6bn in claims to date. In 2022 alone, we have paid out over R1 billion to our customers, and this puts BrightRock at over a billion rand in claims against Rock.” It was the second year it paid claims, which was more than the total claims paid in the first seven years in the market, he said.

“Claims were higher in 2022 when we started to see signs of claims returning to pre-Covid-19 levels and we paid our highest claims in November 2022, which were death claims totaling R143m.”

The future looks bright

Malan is optimistic about the future for BrightRock, particularly in the context of the Sanlam ownership agreement: “Sanlam has been a fantastic growth partner for BrightRock over the past five years and we look forward to building on the strong foundation we have created together.

“With the full backing and support of Africa’s largest insurance company and the BrightRock team, we are growing and in a stronger position than ever to meet the needs of our clients,” says Malan.

Malan said BrightRock Group’s focus is on supporting its individual risk and funeral products strong position in the independent brokerage market.

As a result of the transaction, Sanlam’s Corporate Group Risk division will take over BrightRock Group’s risk book. This transition is expected to take place next year and will support the strategies of both businesses through improved structure, marketing positioning and growth strategies, he said.

BrightRock and Sanlam will work closely in the coming months to unlock collaboration, build efficiencies and explore opportunities that benefit both parties and, most importantly, BrightRock’s customers.

Anton Gyldenhuys, CEO of Sanlam Retail Wealth, said: “Since its inception, BrightRock has established a trusted presence and provided a valuable proposition to people’s insurance needs.

Sanlam and BrightRock’s offerings combined have the largest market share of new retail risk sales in the independent broker market, according to a new NMG market share study.

“We are pleased to have contributed to BrightRock’s success since becoming a shareholder in 2018 and believe the opportunity is now right to realize its future growth prospects.”

[ad_2]

Source link