[ad_1]

Back in February, Northspyre announced that it has raised $25 million to help control costs for major construction projects. (TechCrunch’s Mary Ann Azevedo mentioned the fundraiser in her FinTech newsletter.)

It’s a huge industry with powerful potential – so how does one tell the story of building a company like this? We’re lucky enough to be able to share Northspire’s pitch deck with you today. Find the crow; Let’s break this thing down to see what’s inside.

We’re looking for more unique pitches to break down, so if you’d like to submit your own, here’s how to do that.

Slides on this floor

He told me that the company had removed some of the most financially sensitive slides from the deck before sharing them with us. What’s left behind is a surprisingly well-designed, clean and clear deck.

- Cover slide

- Problem Slide 1

- Problem Slide 2

- Product slide

- Market size slide

- The solution slider

- Value proposition slide

- KPI slide (labeled “financial” slide)

- “The question” slide

- Group slide

- User credentials slide

- Financial history slide

- Thank you and see the slide

Three things to love

Northspyre has a mature and well-designed deck that’s a sight for sore eyes compared to many we’ve seen in this series. Here are a few highlights.

You have to love this market slide mic drop

For some markets, you need to go deeper to explain why this market is worth pursuing. This is especially true for technology companies operating in emerging industries. Construction is not one of them, and therefore they get away with anything. Including:

[Slide 5] Market size? Huge. Next question. Image Credits: Northspyre

A quick Google search will show US real estate development numbers anywhere from $2 trillion to many times that. I don’t think anyone can argue that this is a huge potential market and you can probably get away with taking a piece of that market and calling it a day.

As a beginner, it is a good idea to read the assignment before filling in the answers. If you named your slide “product,” you’d have to touch on at least some of the things investors want in a product slide.

However… one thing to be careful about here: when you talk about market sizes, you’re usually not talking about the total cost of goods sold. If you’re eBay, your market size isn’t the list price of sports shoes, video games, and cars listed on the site; The buyer’s fees and sales commissions are the same. In other words, the eBay market size for a single PlayStation 5 is probably around $30, or not $500.

Northspyre is getting dangerously close to making a mistake here: even if the company is perfectly run, it can’t be a $2 trillion company. To be honest, they don’t necessarily say it here – and maybe it’s irrelevant, since the market is so big – but to get the perfect result here, the beginner could have known what the correct TAM/SAM/SOM numbers are. Have an intelligent discussion about this.

Be very careful what you’re betting on depending on your market size. By all means, report the top line numbers for the entire market, but you have to dig down to get the full picture.

He answers “why” beautifully

[Slide 7] What value are you offering to your customers? Image Credits: Northspyre

It is always a strong idea to explain why and how a customer will benefit from using your product. This slide (combined with the market size slide above) tells a powerful story right there. The company suggests that teams can save 2% to 6% of their construction costs. Multiply that by a $2 trillion market size and a picture begins to emerge: Northspyre promises up to $120 billion in cost savings in an industry hungry to cut costs. It’s a great story made even stronger by including a link back to the investment calculator.

A few good startups ask, “But why should I worry as an investor?” They couldn’t tell. story, and it’s a relief to see Northspyre avoid that pitfall. This is a strong value and a good idea to highlight to your investors.

KPIs

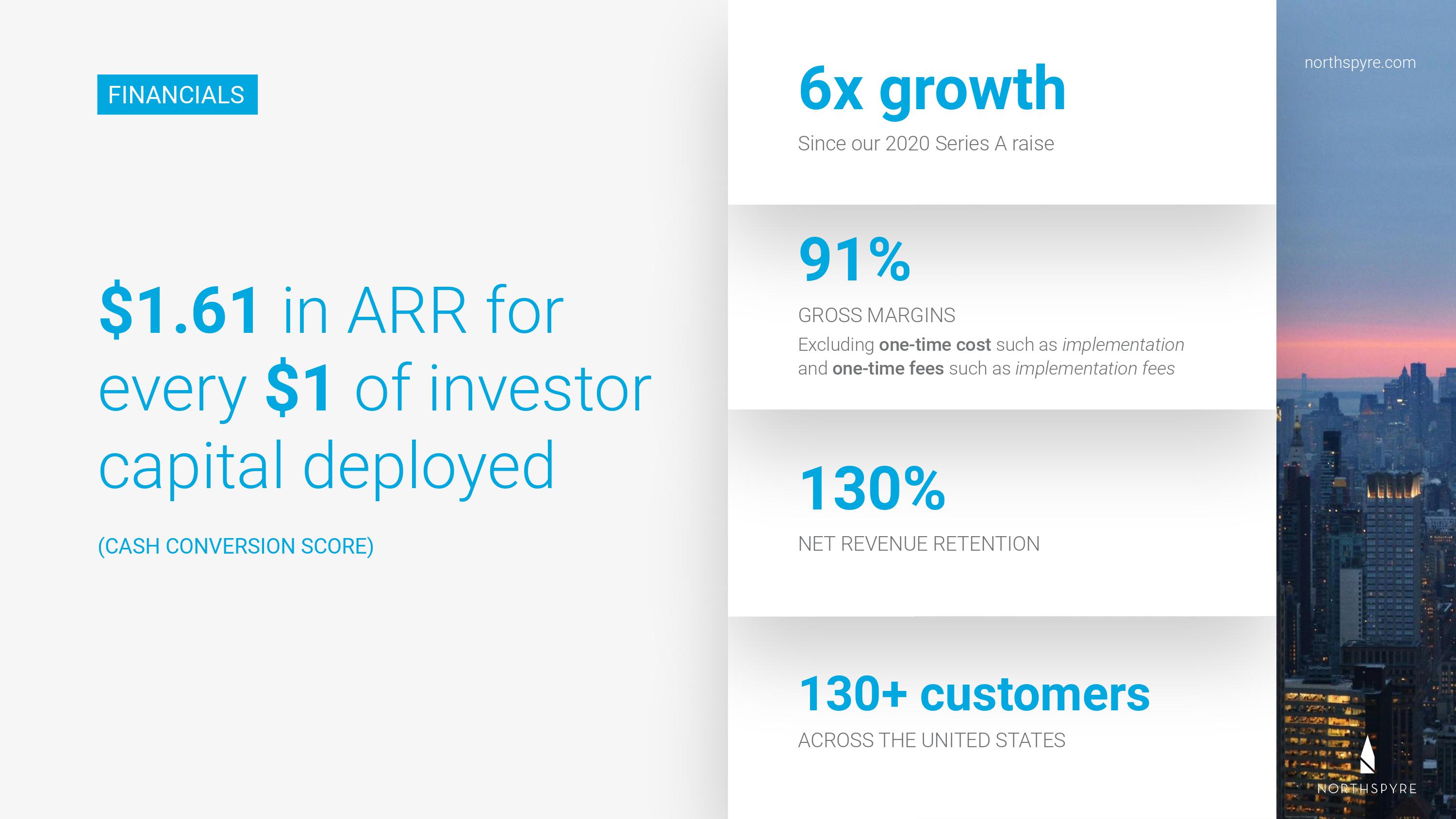

The company listed this slide as a “financial” slide. is not; Financials are usually presented in the form of an operating plan or more in-depth spreadsheets of “real” financials or an overview of what the company will look like over the next three to five years. This slide is mislabeled, but that doesn’t mean it doesn’t tell an important part of the story:

[Slide 8] They are not financial matters, but they are helpful. Image Credits: Northspyre

I might call this slide “Traction,” or “Key Performance Indicators,” or perhaps “Our Story in Numbers.” Regardless of the exact label, these numbers are not kidding: six hundred percent growth from 2020 awesome (Although it would be good to know how to measure the growth – number of customers? revenue? number of projects?).

91% gross margins are SaaS level returns, and 130% net income retention is more than impressive. This means that, on average, customers will increase their spending on Northspire rather than jump. The number of 130 customers isn’t too surprising – maybe some of them aren’t the most important customers – but it does show that the company has a pipeline to at least get customers to a certain point. All these are positive.

Another great thing is that Northspyre knows what the important KPIs are: gross margin, NRR, growth and number of customers are all worth tracking.

The ARR of $1.61 for every $1 invested is a bit blurry, and I’m not sure why that particular number is on this slide. If this is a historic number, I’d be interested to understand how confident the company is that it can continue in this direction. How certain is it that if it raises $20 million, an additional $32.2 million will be added to the ARR figure at the end of the 12-month period? If this confidence is low (or comes with prices), it means the company is selling small numbers on the vanity of things.

Now, I’m not going to give Northspyre a hard time here. It has additional slides removed from this deck, so there may be other useful data elsewhere.

But as a startup, what you can learn from this example is to make sure you signal to your investors that you know what the most important metrics are in your business. Combine that with a “go to market” or “growth” slide to draw forward historical lines, and you’ve gone a long way to highlight why the investment is worth it.

In the rest of this teardown, we’ll look at three things Northspire could have improved or done with — including a production slide that wasn’t, in fact, a production slide — with a full pitch deck.

[ad_2]

Source link