[ad_1]

For many of us, home is our greatest asset, and in the Fintech world, that leads to a reasonable extension. Today, Celina London-based Fintech offers consumers up to $ 85 million in up-to-date mortgage – up to 85% of their home value – the so-called HELOC loan -. Getting a $ 100 million loan for homeowners.

The $ 35 million Serie B equity unit is led by Lightrock, and former supporters include Pikes Capital and Global Founders Capital. (The latter two companies are partly affiliated with the Samsung brothers, who built the Rocket Internet e-commerce incubator in Berlin.) Hubert Fenwick Celina, CEO of COO Leonard Benning, who co-founded the company, is not speculating on this round, but the source said it is based on a standard B dilution of $ 140 million.

Celina plans to continue investing in the UK before considering how to solve other markets in Europe. And to launch more products around the lending business, including the credit card it will open this year, it will reduce its customer loans to make it more accessible.

“The UK is ready to take over the market and the size is huge.” We want it.

The last time we covered Selena, in July 2020, the company was launching a new location in the UK and raised $ 53 million to provide HELOC service to SMBs, not to individual consumers. Fenwick told me that consumers were always in his view, but that the company had to first verify control.

“The real opportunity was consumers,” he said. That happened at the end of 2020 and now 90% of Celina’s business is consumer credit, he said.

In both cases, there is a gap in the market. Some extra fluid. Celine and HELOC’s approach differs from these in that the loans are partially approved – the money can be obtained quickly within 24 hours – and that the money is disbursed as needed, which means that consumers only pay interest. They finally draw down.

These may be compared to mortgage lending, but the reality is the opposite, says Fenwick. Getting some fluids is often one of the ways that their customers are disturbed. Giving their customers HELOC is one way to prevent loans from affecting their home. But he said it was not an area where the banks could touch each other.

According to Fenwick, “HELOC is a protection for special lenders who combine credit card payments with mortgage securities. “You have to manage the fluid differently. The main mortgage market is huge, so banks prefer to partner with smaller companies to retain their mortgage client. [as is] Instead of entering a new market.

Fenwick Celina typically crushes a mix of its own and third parties to determine the merits of a loan and to run a different business and information science. “Our algorithms are proprietary and unique to our loans,” he said. “The stack is too long.”

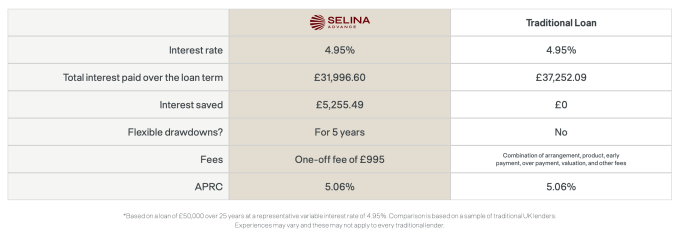

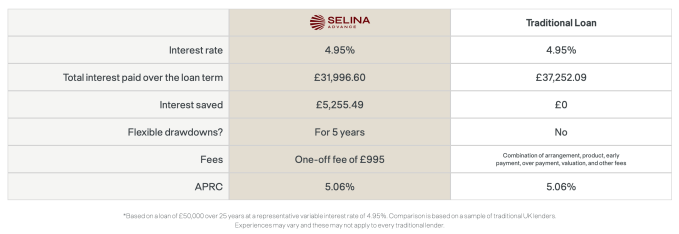

Celina recognizes that just because you have to pay interest when you withdraw money does not mean that you will not be able to repay the loan once a month. Demonstration of how a comparison chart works on a £ 50,000 loan

Image Thanks Salina

According to Fenwick, HELOCs are relatively common in the United States, with an estimated $ 150 billion market capitalization, with some of the biggest names in space being mixed (now unveiled), Noah and Homtap. The approach is relatively new in the UK, although Fenwick believes this could (and does) evolve rapidly, not only because HELOC businesses like Celina have been given a green light, but also because home ownership is everywhere; And many people are distracted by the epidemic, focusing on renovations or spending large sums of money on vacation.

“Historically, homeowners in the United Kingdom have not done much when it comes to accessing their home-grown assets,” said Ash Puri, an investor in Literature. “The team at Celina has made remarkable progress with more than $ 100 million in loans since its inception in 2019. Litrock is pleased to support such an innovative group and is eager to support Selina as it typically disrupts lenders.”

Goldman Sachs CEO Anna Montvie adds: “Celina Finance Hello is a product of innovation and bridges the gap between consumer and mortgage markets. “We look forward to supporting the Celina Finance team in the development of its business and credit portfolio.”

[ad_2]

Source link