[ad_1]

For more than a year, we’ve been tracking and sharing indicators of how travelers view and review trips in quarterly reports based on Expedia Group’s first-party data and custom research to inform our partners’ marketing strategies. In our Q1 2022 report, we highlighted how search windows are lengthening to meet the growing demand for sustainable travel options and opportunities for our partners to rebuild and rethink travel.

Now, as we look to Q2 2022, as the travel industry faces additional challenges—including recessionary threats and chaotic airports—travelers are desperate and looking even further afield. Along with sustainability, people want to see inclusive and accessible travel options, and a genuine commitment to welcoming all types of travelers and supporting local cultures and communities. Read on for key takeaways from our Q2 2022 Traveler Insights report.

Travel searches remain.

In the second quarter of the year, as global travel restrictions continued to be lifted, demand for getaway travelers remained strong.

Global travel search volumes will remain flat in Q2 following a 25% quarter-on-quarter increase between Q4 last year and Q1 2022. Regionally, we even saw double-digit growth between Q1 and Q2 – particularly in APAC, where the region saw a 30% increase.

After the announcement on June 10 that the US was lifting its testing requirements for international air travelers, international searches were up 10 percent globally on June 13, with double-digit increases in searches from APAC and EMEA destinations. This is a strong signal that makes travel consumers excited about making plans.

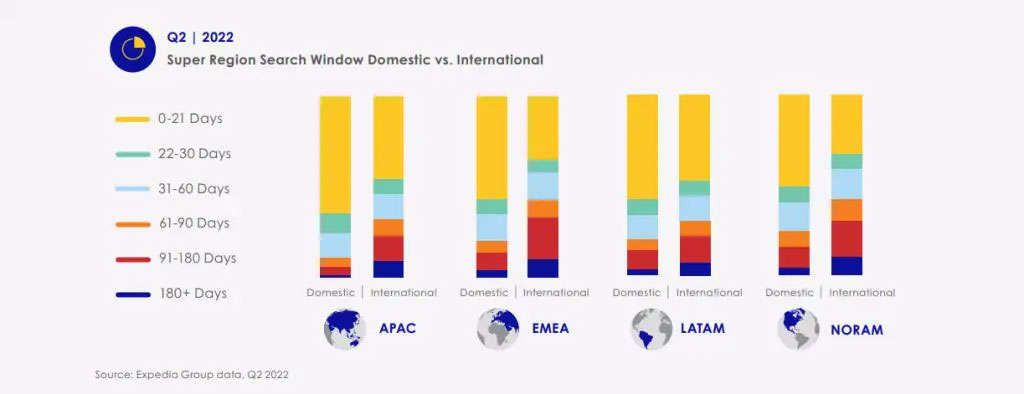

Travel demand will drive growth in a 2-3-month search window

Compared to Q1, we saw shortening search windows globally in Q2, with searches in the 91- to 180-day window down 20% over the quarter. On the other hand, searches within the 0- to 90-day search window increased by more than 5% over the quarter. The 61 to 90 day window had the highest growth of 15 percent.

This may be because Q1 was when most travel shoppers were planning their mid-year vacations, and the decline in stock levels in Q2 was relatively stable. Also, travel shoppers may be spending their time hoping that fuel costs – and flight prices – will drop. However, this April 2022 Expedia Group survey finds that most consumers who plan to travel within 12 months feel comfortable booking the actual trip within 3 months of their trip.

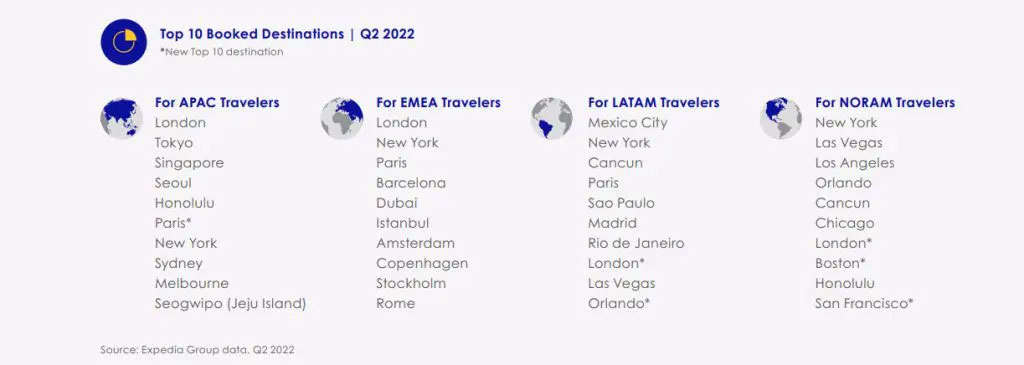

Long distance destinations are coming back

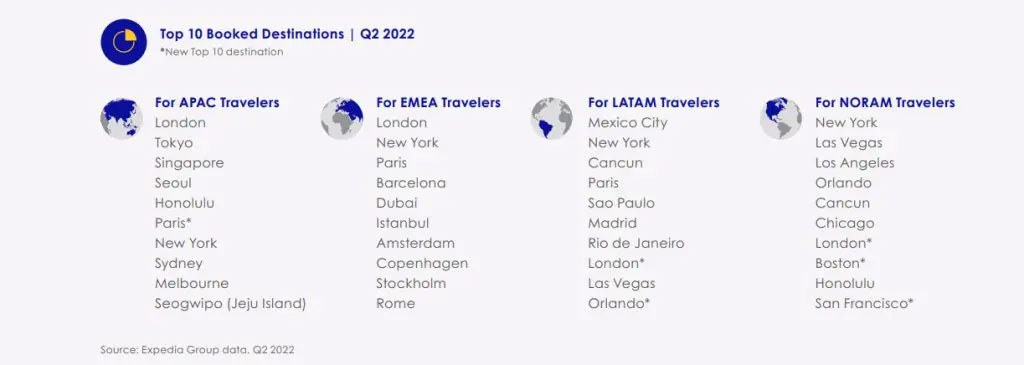

As we’ve seen in previous quarters, big cities and beaches remain popular around the world, but London and Paris are both popular with travelers from all regions. In fact, London was the top-ranked city for travelers in APAC and EMEA and entered the top 10 for LATAM and NORAM. In our last quarter’s trending report, Paris came in at number 7 in the global top 10 and was in every top 10 regional list except North America.

We also see demand for long-haul flights (flights of 4 hours or more) to remote destinations coming back. In fact, we saw an even stronger performance with more than 50% increase in long-haul flight demand from global travelers and more than 100% year-over-year growth for flights from the US to Europe.

Strong demand despite higher costs

In addition to demand for long-haul flights, we have seen continued growth in the accommodation sector. Following a strong Q1, where residential demand grew at double-digits for more than quarter-on-quarter, we saw more modest growth in Q2, with APAC showing the strongest growth.

This is despite strong travel demand and rising spending. Compared to Q2 2019, international average airfares were in double digits, led by EMEA and APAC. This may be due to self-demand, rising fuel costs and booking of long-haul flights.

Opportunities for inclusive travel

The enthusiasm for travel means there is an opportunity for travel marketers to inspire and engage, despite cost and industry uncertainty. As shared in our Inclusive Travel Insights report, travelers are willing to pay more if travel options align with their values, especially around inclusion and diversity.

In a recent survey of 11,000 consumers in 11 countries, we learned that 7 in 10 would prefer a destination, accommodation or transportation option that includes all types of travelers, even if it’s too expensive, and 78% have taken the trip. Selection based on promotions or advertisements.

This means travel brands need to find ways to ensure that both their offerings – and their marketing – are inclusive and accommodating.

These takeaways are just a sampling of the insights the full report provides, based on more than 70 Expedia team travelers’ needs and wants data. To learn more, download the Q2 2022 Traveler Insights Report.

Download the report.

About Expedia Group Media Solutions

Expedia Group Media Solutions is a global travel advertising platform that connects marketers to hundreds of millions of travelers across Expedia Group brands. With more than 70 petabytes of Expedia team’s travel search and booking experience, we provide advertisers with actionable insights, sophisticated targeting and comprehensive analytics reporting. Our suite of solutions includes display, sponsored listings, audience extension, collaborative campaigns and custom creative campaigns – all designed to meet the objectives of our advertising partners and add value to travel consumers on our globally branded sites. With a consultative approach and over 20 years of travel and media experience, we help our advertising partners inspire, engage and convert travelers for meaningful results. For more information, visit www.advertising.expedia.com.

© 2022 Expedia, Inc., an Expedia group company. all rights reserved. Trademarks and logos are property of their respective owners. CST: 2029030-50

See the source

[ad_2]

Source link