[ad_1]

When involved with Our portfolio companies as well as new investment opportunities have noticed that “profit” and “efficiency” are two words separated by “growth” in every sentence.

Three months into 2023, investors continue to use buzz words like “responsible growth,” “business efficiency” and “quality marketing” when explaining how VC-backed companies should do business this year. That may be true, but there is no textbook on how a company can actively reduce its budget without slowing its growth in the near term.

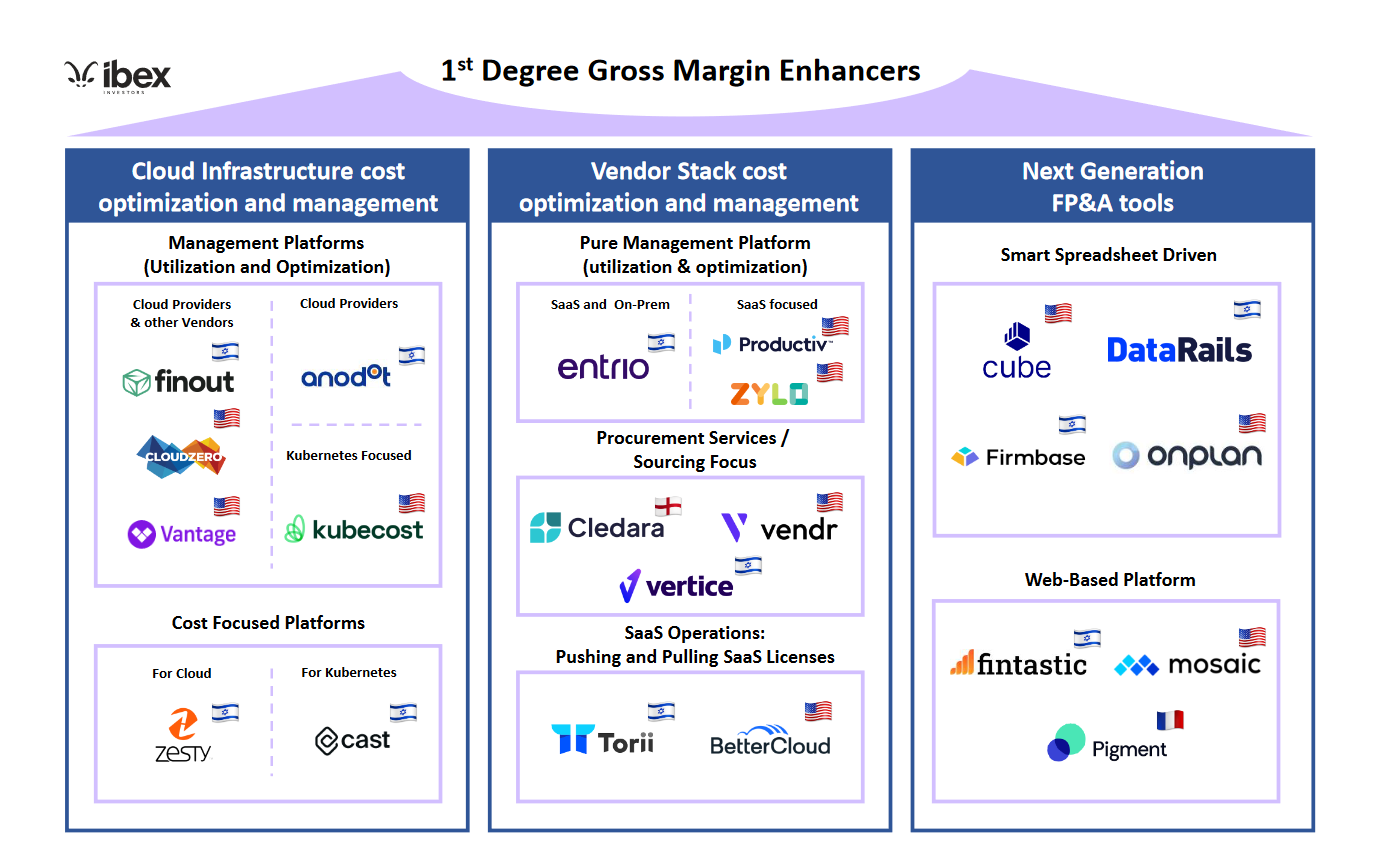

Over the past few months, we’ve researched, featured and evaluated more than 30 companies we’ve defined as “first-rate, gross margin-improving businesses.”

What does this mean? The “primary” part of that is related to the present. Investors are knocking on the door to see quarterly updates. Companies that can help you with long-term efficiencies won’t help you when you’re looking to raise money in six, 12 or 18 months.

The “gross-margin-improving” part of this definition is important because simply cutting costs in lieu of growth doesn’t work. Likewise, boosting growth with little sensitivity around spending will not work in 2023.

Image Credits: Ibex investors

In this article, we look at emerging companies that can effectively and efficiently support organizations in their efforts to achieve growth while optimizing and managing near- and long-term costs.

Given the current market, investors want to see companies follow forecasts more than ever.

The value proposition for companies in this mapping is to help businesses continue their growth journey while optimizing and reducing costs within their existing business structure. That said, there is no one-size-fits-all solution. For this reason, we have defined three key categories of gross margin improvement:

- Cloud infrastructure cost optimization and management.

- Supplier Stack Cost Optimization and Management.

- Next generation FP&A tools.

Cloud infrastructure cost optimization and management

There’s a constant struggle to balance pushback from the CFO’s office when it’s time to improve the product (ie, increasing cloud spending) and downsize.

CTOs and technical leaders know how to reduce cloud costs, but not to mention the time it takes to perform frequent requests for reductions and improvements, it can be difficult to know at what stage a given change is due. Companies want to keep growing and run faster, but they can’t afford the freedom to flip their cloud like they did in years past.

Several companies are solving these problems with different focuses: Finout, Cloud Zero, Vantage and Anodot support both enterprise and mid-market end users and provide solutions for managing the cloud and Kubernetes. Some of these players not only support key cloud providers, but also provide solutions for other cloud infrastructure providers (such as DataDog and Snowflake).

Other companies focus on specific use cases. For example, Kubecost focuses on Kubernetes management. There are also companies that aim to help you reduce costs: Zesty (for Cloud) and Cast (for Kubernetes) fall into this category.

[ad_2]

Source link