[ad_1]

The natural world has produced many of our most important medicines, but instead of looking under a leaf or a rock for the next big cancer drug, Pragma Bio is actually looking inside the human body—the swarms of microbes that live inside it. With the new approach and a new $10 million in funding, the startup hopes to begin the first phase of a 10-year plan.

The company is taking on a new identity – if the technology looks familiar, it has raised $4.5 million in seed funding in 2020 as VastBiome.

In case you didn’t know, the human body is a whole zoo. Countless bacteria and other microfauna proliferate, covering everything inside and out. Most of them are, well, a handful of villains, but many of them are useful in ways we don’t fully understand. For whatever reason, certain microbes in the body may be associated with better outcomes in many diseases, including cancer.

“It’s a great source for exciting molecules,” said Kareem Barghouti, CEO and co-founder of Pragma Bio. “Like soil and plants, like where other products come from, we’re only looking at the body. And toxicity? Maybe not, it’s already in there.”

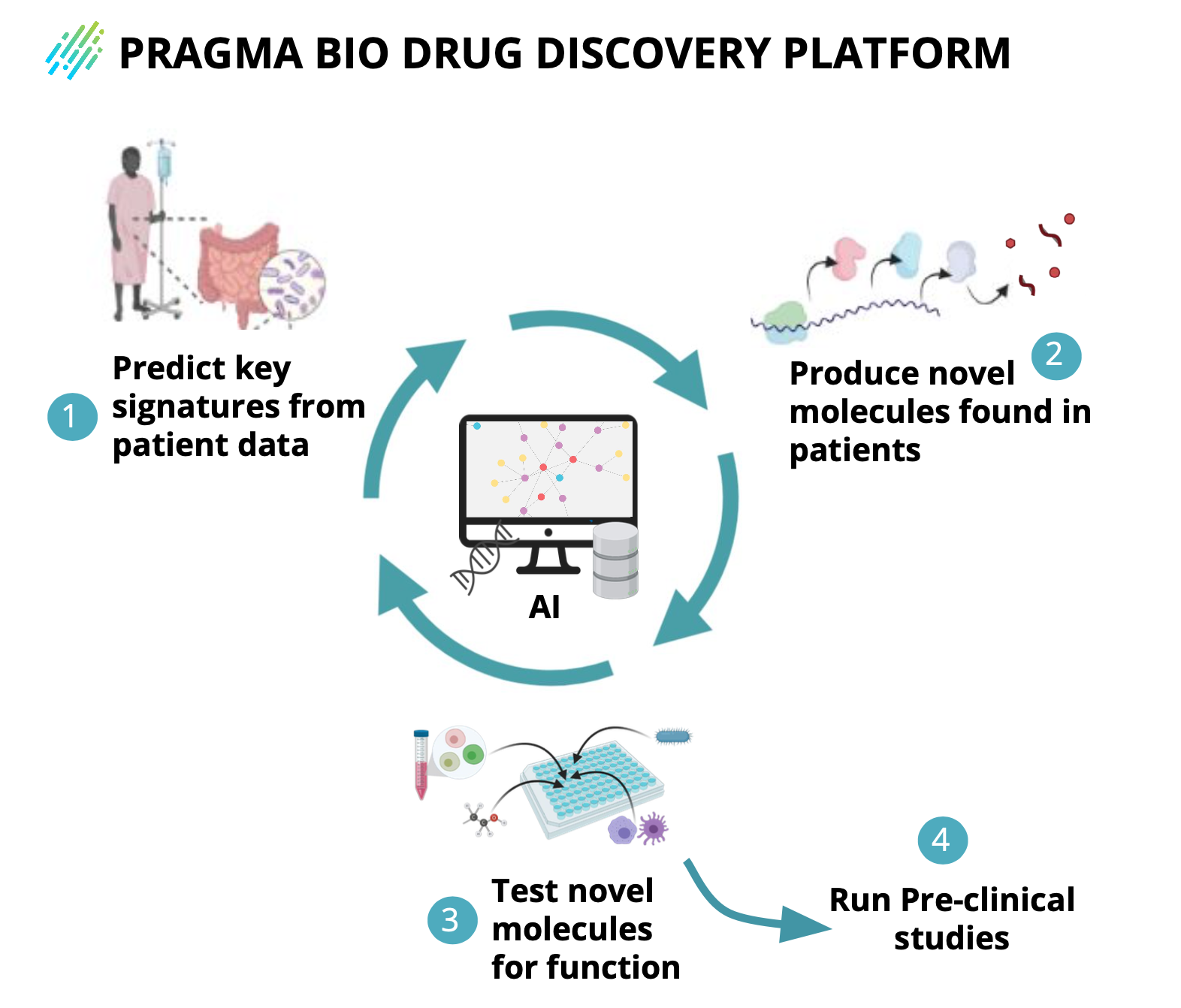

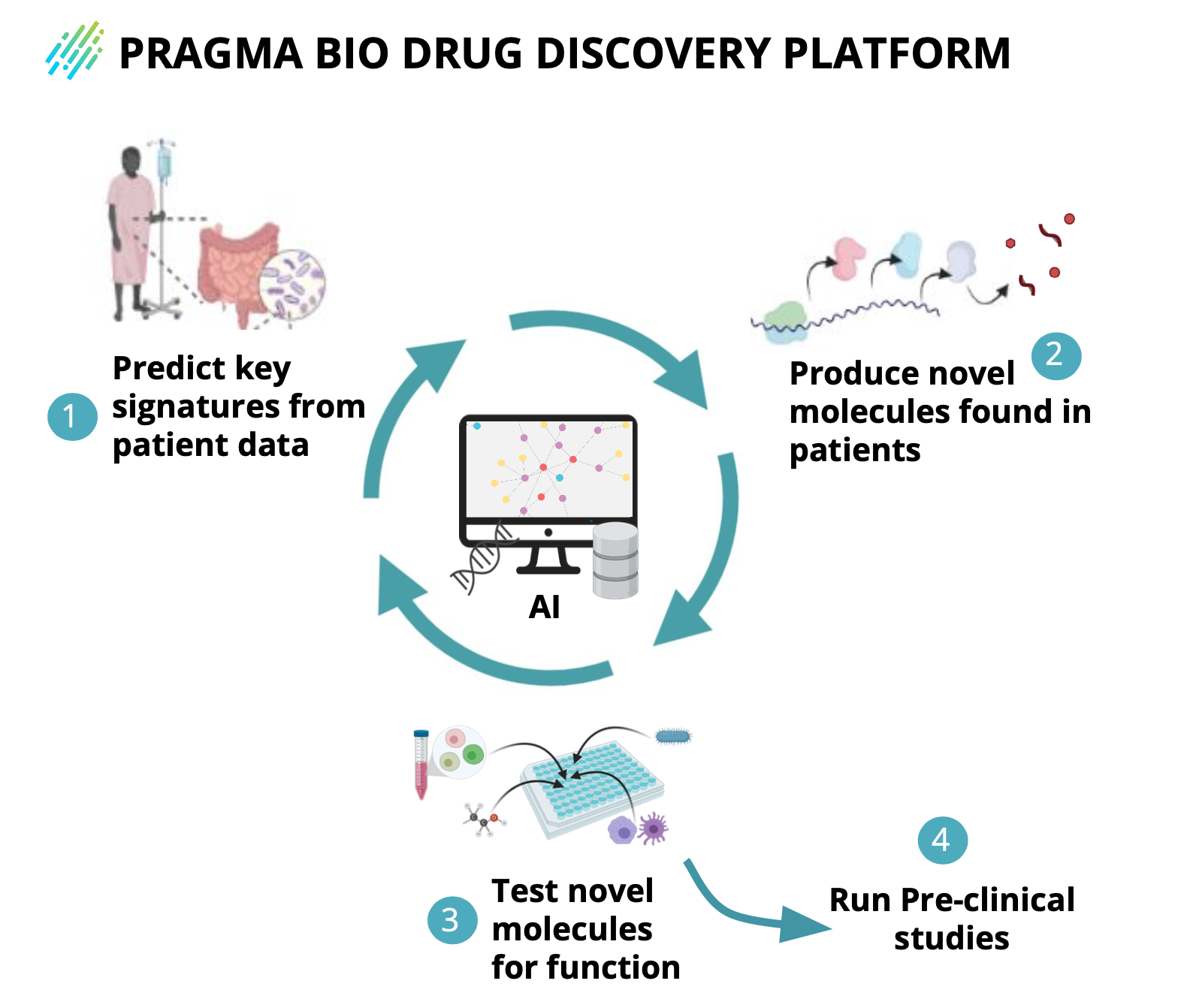

There are two main components to Pragma’s approach to “mineralizing” this gut biome. First, it’s a giant map of what microbes, their genes, proteins, enzymes, and other molecules produce, and how all of these things relate to disease pathology.

For example, in people suffering from a certain cancer, you find that people who respond well to treatment A always have the same microbiome profile: the more molecule C you know produces, the more microbiome B you know. It might be a good idea. Why not identify molecule C and see if it can be used to help others use therapy A?

It’s not that simple, but Pragma is building a massive statistical model (with machine learning of course) out of all of these things to identify candidates for screening. The first domain to see an increase is immunotherapy in oncology, which appears to be particularly closely related to the microbiome.

“We are building a biological map of immune cells that interact with bacteria in the body. But pharmaceutical companies don’t want microbes, they want molecules — they don’t know how to commercialize bacteria,” Barghouti said. “Biology says to us, ‘Hey, go there.’

Image Credits: Pragma Bio

That’s where Pragma brings in another major element, a very quick sequence and method of testing the organisms and elements in question. Typically, you can identify the microbes you like and then fire up a bioreactor, breed a couple of billion of them, and then identify the molecules they produce. This works, but it’s a time-consuming process that can break easily.

Pragma Bio’s “self-reading” system jumps the part of billions of microbes, from DNA sequencing to expression and miniaturization of the desired molecule in a matter of days. This helps when the pool of molecules to choose from is very large—and the efficiency makes them a good partner for drug companies willing to pay for leads.

The next step is where things start to get expensive, so these partnerships need to be on the pragma side as well. Synthesizing a more or less novel molecule unknown to science and testing its effects in vivo is neither cheap nor easy. Fortunately, pharmaceutical companies do it every day and are happy to sell this resource to a potentially useful (and profitable) candidate.

“We have the capital to scale up production, but not for many molecules at once,” Barghouti explained. They don’t think it’s wise to pour all their operating money into their first lead, as it might lead nowhere else – it’s always a gamble in drug development and all you can do is stack the deck as best you can, he said. can

All the same, the new funding will be used for this and other scaling efforts; $10 million isn’t the end of this fundraiser, but it’s a nice round number that the company felt was good enough to get out there with its new name. That change, by the way, came with the company’s shift to using previously useful molecules (it’s a functional approach). The old name suggested more gut health, so they renamed it.

The investment so far has been led by Venture Collective, joined by Viking Global Investors, Merck Global Health Innovation Fund and CJ Investments in Korea.

[ad_2]

Source link