[ad_1]

There is no shortage “Direction” startups out there, but it’s rare to see one raise a $41 million round. That’s what Spanish startup StudentFinance took up a few weeks ago. Today we’re taking a closer look at the pitch deck the company used to make that happen.

We’re looking for more unique pitches to break down, so if you’d like to submit your own, here’s how to do that.

Slides on this floor

StudentFinance shared a slightly modified slide deck. Removed sensitive revenue, cost and unit economics slides. Everything else is as expected.

- Cover slide

- mission slide

- Lucky slider

- Problem slide

- The solution slider

- Value Proposition Slide Section 1

- Value Proposition Slide Section 2

- Business model slide

- Technology slide

- Parameters slide

- Road Map Slide (labeled “Expansion” Slide)

- Geographical expansion slide (called the “expansion” slide)

- Development history and direction of travel (titled “Expansion” slide)

- Group slide

- Contact slide

Three things to love

To raise a $41 million round, a company needs strong traction and a large market. I’m not surprised to see that those parts of the story are particularly well covered.

Clear, bold mission

[Slide 2] Off to a strong start. Image Credits: Student Finance (Opens in a new window)

Company-building is future-building, and having a clear vision for the future is an important part of that. Student Finance’s second pitch deck slide sets the tone for what’s to come: It’s a BHAG, as it’s called in the industry—a big, hairy, audacious goal. Student Finance has great transparency about what they’re building and who they’re building it for, and it certainly helps investors dream alongside the founders.

This slide invites investors to join the journey, which all startups should do at launch. What is the biggest goal, the biggest change you want to see in the world? Bring that to life, and you’ve made a great first impression.

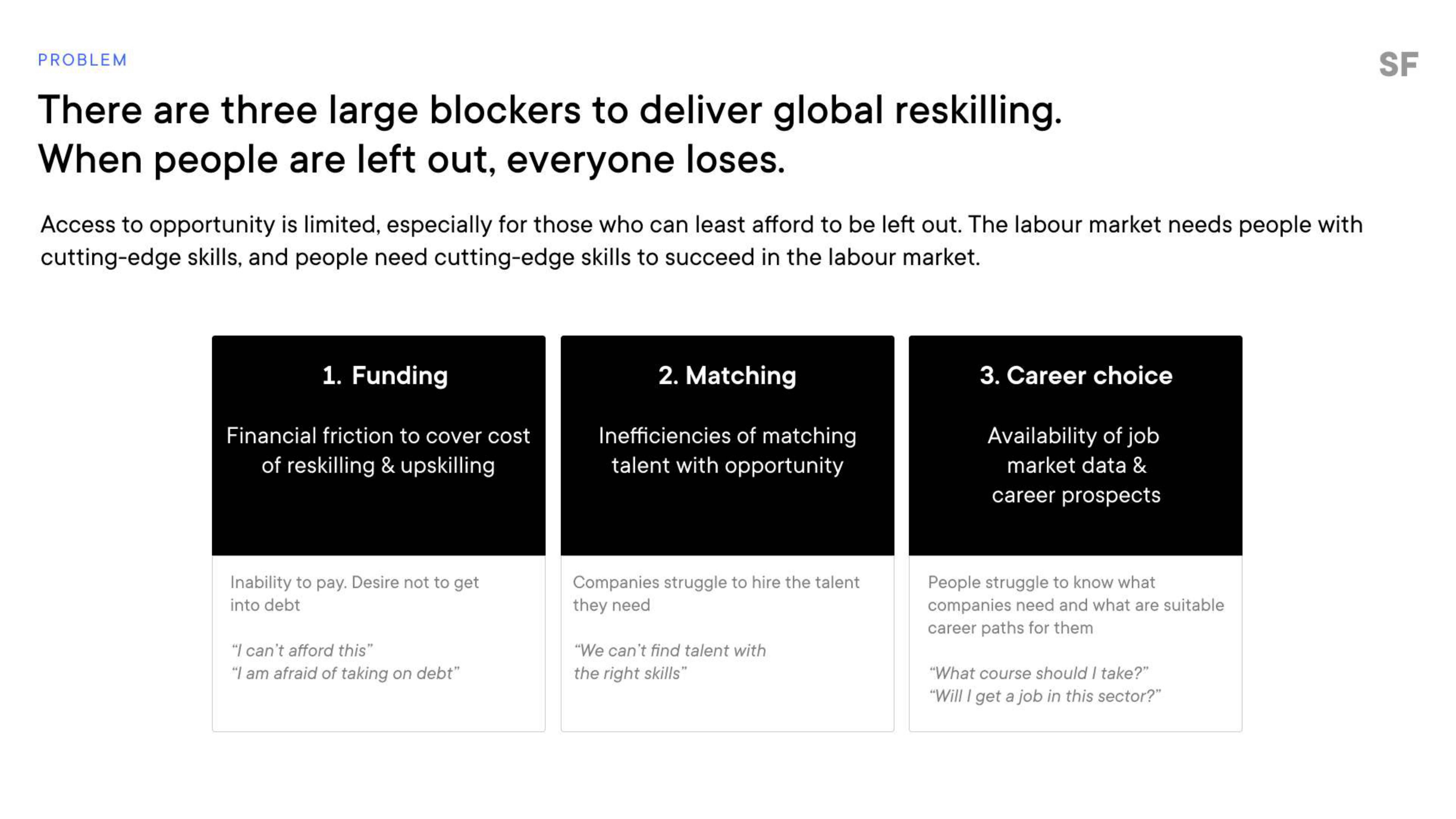

A clearly defined problem area

[Slide 4] You have to love the obvious problem. Image Credits: Student Finance

The company goes from a great mission to discussing what the opportunity looks like. He then transitions to this slide, talking about the three biggest challenges to a global, holistic approach to talent. Having a clear, well-defined problem statement goes a long way in helping an investor get a sense of how big, how serious, and how urgent the problem is. Ideally, it should give an indication of how widespread the problem is (ie, how many people are experiencing it).

It is especially beautiful to break the problem into three easily understood parts like this. Funding is an obvious thing, people worry about money – but looking for a job and getting career guidance are less obvious in the face of this challenge. Bringing it to life using the short example questions below will help humanize the problem. All very well done.

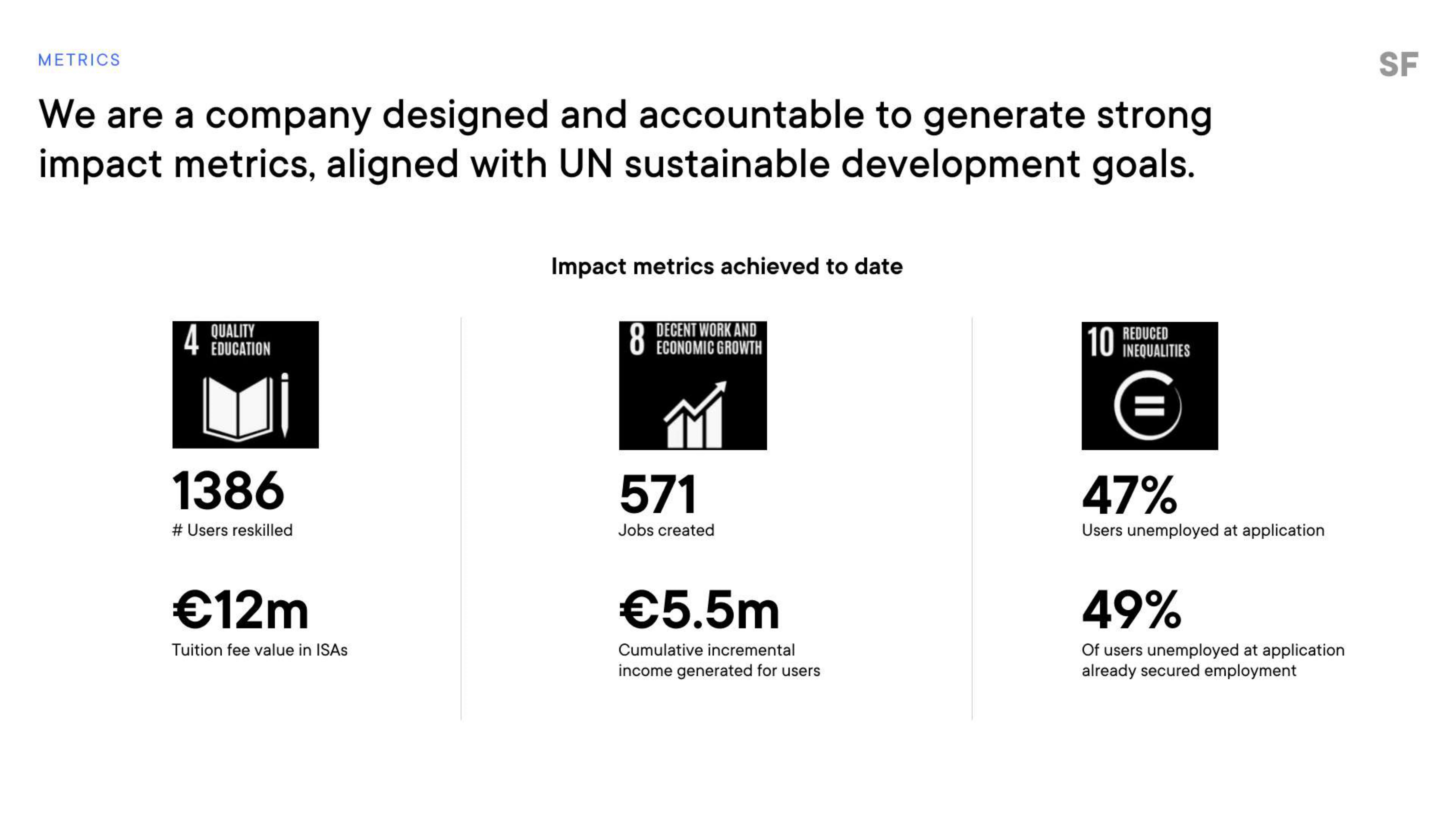

Promising early measurements

For a company raising over $40 million, I would have expected pretty bullish metrics. Of course, I have nothing against it, so I don’t know if these parameters are good or not, but the investors must have seen something. The win here, however, is identifying and reporting metrics that seem key to the company.

[Slide 10] Measurements, measurements, measurements. Image Credits: Student Finance

Some important numbers are missing here, and in any other case, I would give the founders a hard time.

You can learn a lot from a company’s metrics – both the KPIs themselves, of course, but also the figures that a company believes are key to its growth. Student finance overlaps these metrics with the United Nations’ Sustainable Development Goals, which is a great way to indicate how the world is becoming a force for good. Again, elegantly done.

The number of people skilled and the cost of tuition are both important numbers (although I can’t figure out what ISA means, maybe there’s an opportunity to fix it there). Job creation, wage generation, and land employment for nearly half of the people who go through the program are all meaningful key indicators.

Some important numbers are missing here, and in any other case, I would give the founders a hard time, but the team has already informed me that the “sensitive income, expense and unit economics slides” have been removed – and those are exactly these. Parameters I would like to see here.

In the rest of this teardown, we look at three things student finance could have improved or done differently, with a full pitch deck!

[ad_2]

Source link