[ad_1]

NoSystem images/E+ via Getty Images

Investment thesis

Our investment thesis is:

- PIPR is a great business that has been growing its expertise and market footprint, driving revenue growth. We see the long-term vision for the business from a commercial perspective.

- Margins have scope to be good but the business looks quite exposed to changing market conditions, experiencing a noticeable margin and revenue contraction.

- Relative to its peers, the business looks expensive. Peers have not seen such a large margin contraction, with some growing more than PIPR.

Company description

Piper Sandler Companies (NYSE:PIPR) is an investment bank and institutional securities firm that provides investment banking, institutional sales, trading, and research services.

They offer advisory services such as mergers and acquisitions, equity private placements, and debt and restructuring advisory; raise capital through equity and debt financings, and underwrite municipal issuances. They also offer public finance investment banking services, equity, and fixed income advisory, and trade execution services for institutional investors and government and non-profit entities.

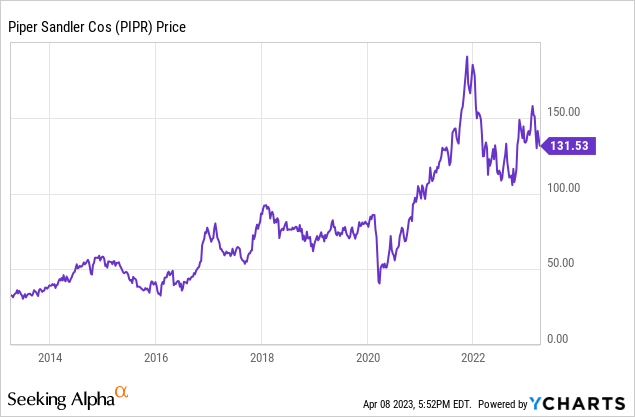

Share price

PIPR’s share price has performed extremely well in the last decade, gaining over 300%. This has been driven by sustained growth and an explosion in advisory services following the onset of the pandemic.

Financial analysis

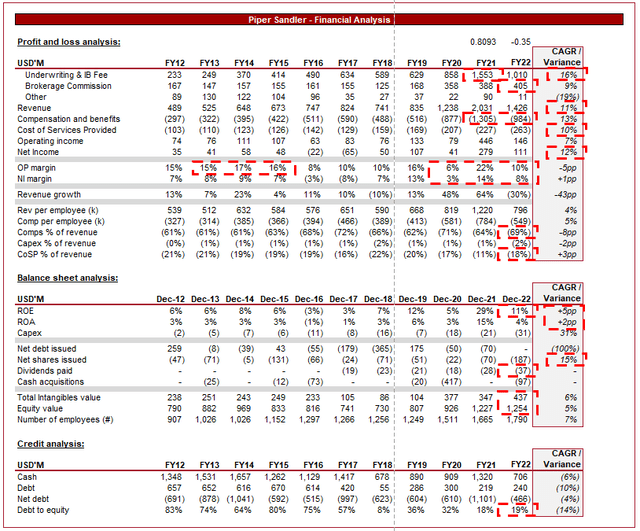

Piper Sandler’s Financials (Tikr Terminal)

Presented above is PIPR’s financial performance for the last decade. The business has done a fantastic job of growing across several service lines, improving profitability over time.

Revenue

Revenue has grown at a CAGR of 11%, driven primarily by the company’s advisory services (growing at 16%), which includes such activities as M&A support. This portion of the business makes up 55% of total revenue, representing the core operations of PIPR. This being said the company’s revenue is fairly diversified, which is a strong benefit in the IB industry due to the cyclical nature of markets. In an ideal world, PIPR would have a substantial counter-cyclical operation, such as restructuring, but as the Brokerage business has shown, growth is achievable during a bear market which supports the advisory decline.

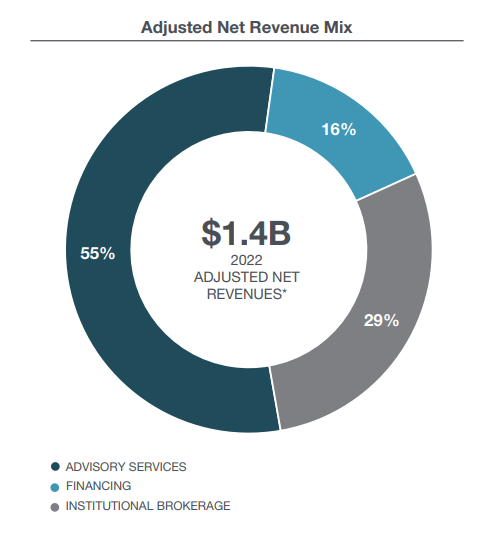

Revenue split (Piper Sandler)

What immediately jumps out from the revenue data is the 81% increase in IB activity during FY21. What we saw was unprecedented activity in the market following the initial year of the pandemic. A decade of low interest rates and loose monetary policy culminated in a deals spree. From an advisory perspective, the Bulge Bracket (BB) banks could not keep up, resulting in high ticket transactions going to the tier two / elite boutique banks, with PIPR being one of them. The company did a fantastic job of both increasing and driving greater volume and mobilizing appropriately to deliver.

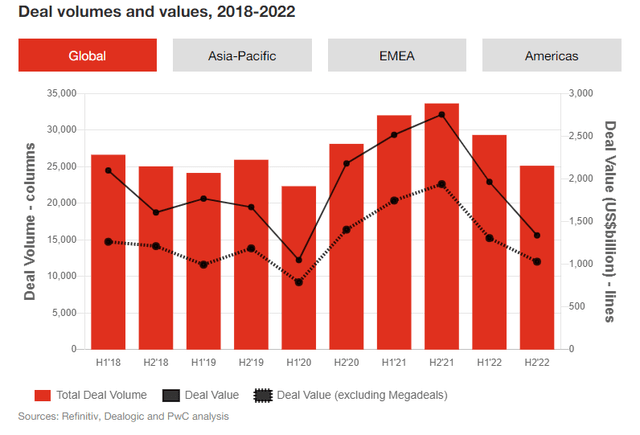

With Advisory being the key segment for the business, it is vital to understand where the industry stands today. Global M&A volumes and values declined in 2022 by 17% and 37%, respectively, from record-breaking 2021 levels, although importantly remained above pre-pandemic levels. This decline in deals has continued into 2023, with uncertainty and recessionary fears.

Deal vol / val – PwC (PricewaterhouseCoopers)

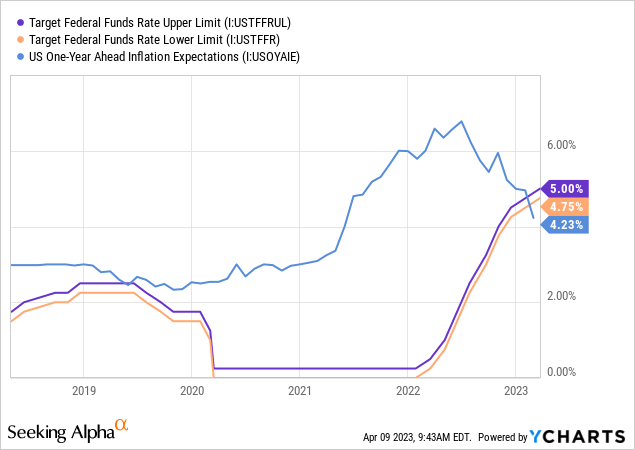

Our view is that investors are hesitant to finance deals at the same valuations that were seen before the interest rate hikes, resulting in an insurmountable delta between the bid and ask in private markets. Having spoken to many PE clients over the last few months, the impression I have received is that they are willing to bide their time, focusing on value creation, rather than being drawn into a “bad” deal with unfavorable financing terms. PwC’s view aligns with this, as they state “We believe this (End of interest rate hikes) will act as a catalyst for greater stability and certainty leading to an upswing in M&A, notably among private equity.”

The question then becomes, when will rates begin to trend down? Our view is that one or two hikes are still possible, given that inflation remains stubborn in its decline. For this reason, it could be another 6 months or so before market signals suggest rate declines, and another 12-18 months before debt markets become favorable again.

This will act as a drag on PIPR’s core operations, resulting in greater competition in the M&A market to secure mandates. A 35% decline in FY22 is a substantial amount regardless of the softening conditions, suggesting PIPR is sensitive to market changes.

The counter-argument to this is that the deals market will remain robust in the coming months, before increasing substantially going forward, once rates decline. The reason for this is the level of dry powder private equity firms have, which currently amounts to an estimated $2TN, or 28.2% of AUM. Asset managers must spend this money or face underperformance, encouraging deal-making.

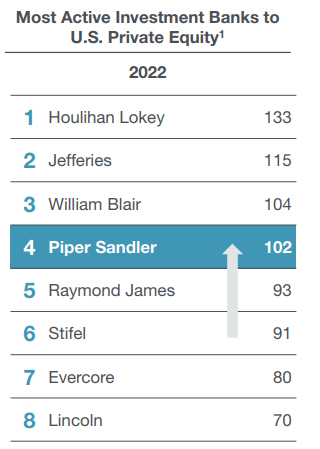

Our view is that PIPR is positioned perfectly to benefit from this dry powder spend, with the company currently the 4th most active IB for PE clients. Due to the wide range of deal sizes, PE firms are increasingly looking for IBs with the experience to deal make across a wide range of sectors, while having the flexibility to deliver. All of this at a cost-effective level, with Fund costs increasingly scrutinized by LPs. This has allowed the elite boutiques to fight back against the BB and gain market share, especially in the higher mid-market, lower large-cap space.

PE activity IB (Piper Sandler)

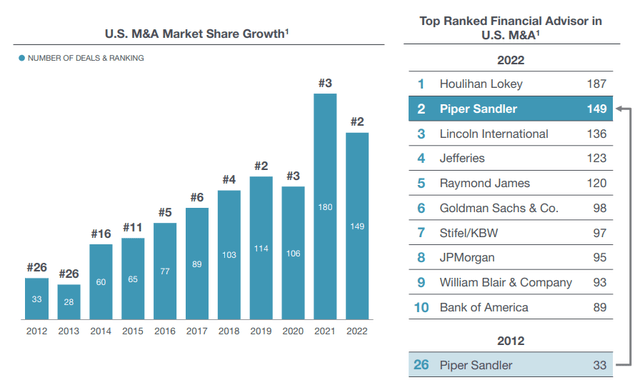

Further, there could be a suggestion that PIPR has only increased to this level due to the pandemic boost, and that it may experience an equal decline. This does not look to be a valid critique, as the company has been gaining consistent market share over the last decade for total deal-making, reaching No.2 in 2022.

Total deal-making (Piper Sandler)

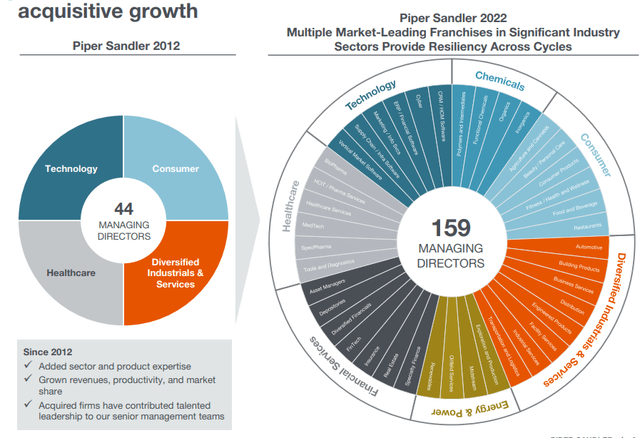

This has been achieved through sustainable means in our view, with the company hiring high-profile MDs across the spectrum of industries, resulting in quality creds to pitch for work, as well as the ability to deliver a high-quality service.

MD growth (Piper Sandler) MDs and industry (Piper Sandler)

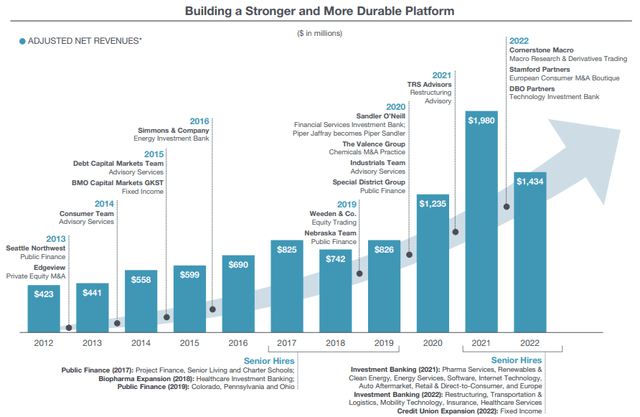

A key factor supporting both revenue growth and expertise growth is the company’s M&A activity. PIPR has been extremely smart in growing the business inorganically, acquiring a countless number of boutique investment banks, usually specializing in a sector. This gives the company value across the board. It receives additional revenue, greater expertise in a sector, greater cross-selling opportunities, additional creds, and a larger client book. It is also important to note that these acquisitions are in several services, allowing the business to slowly expand and support its offerings.

M&A activity (Piper Sandler)

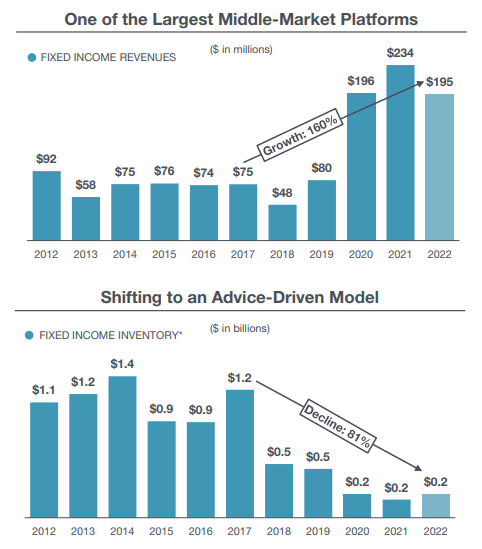

Although we have focused on M&A advisory primarily, PIPR is highly regarded across the board. The business has a large brokerage operation, a highly regarded equity research team, and it has deep fixed-income expertise.

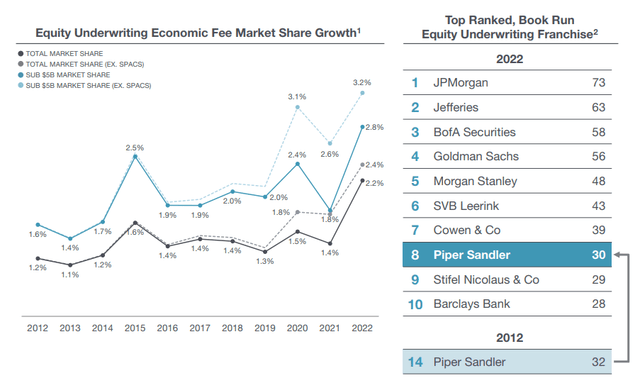

Its equity underwriting services have seen market share gradually climb in the last decade, with the company now 8th. Equity markets are another segment that will likely be soft during the current market conditions but again has scope to grow once rates trend down.

Equity underwriting (Piper Sandler)

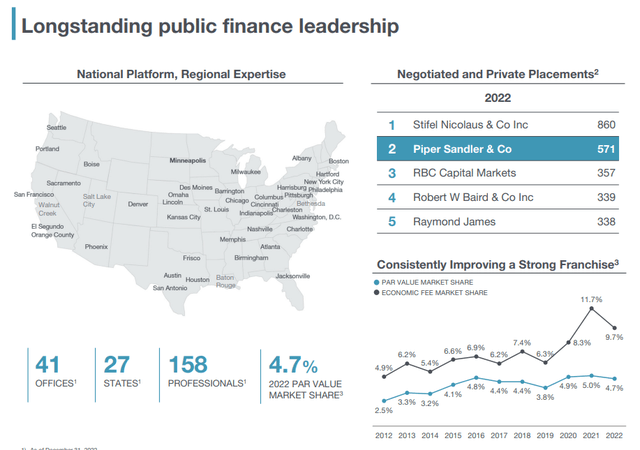

Further, the business does extremely well in private placements, a segment in which PIPR faces far less competition from the bulge bracket, allowing its relative position against boutiques to drive volume. Market share has once again consistently trended up in the last decade.

Private placements (Piper Sandler)

Margin

The key cost base for an IB is its employees, who are essentially the value drivers of the business.

Over the historical period, margins have been quite volatile, reflecting what are periods of unsustainable trading. What we mean by that is periods of margin outperformance have been followed by a decline, usually driven by a bump in compensation. A portion of this is likely acquisitions, but also a reward for employees, with retention key.

Across the historical period, we have seen compensation per employee increase at a rate of 5%, only marginally exceeding revenue per employee of 4%. Although this is disappointing, the data point makes it deceiving, as we are coming off a sharp decline in revenue. Employee costs will always be more sticky, due to the fixed portion of compensation.

The cost of services provided, essentially all other operating cash costs to the business, have increased at a rate of 10%, which looks slightly high, despite being inferior to revenue growth. There are few additional costs that come with running an IB outside of employees, so this leakage is disappointing.

PIPR should target a comp/rev ratio of mid-60s, and a CoSP/rev ratio of 15-17%.

Overall, our view is that PIPR’s profitability profile can be quite attractive but the recent margin contraction is an issue. Growth should return at a healthy level in the coming 12-24 months, but the key is for the business to be resilient until then.

Q4 download

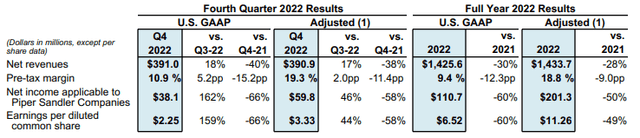

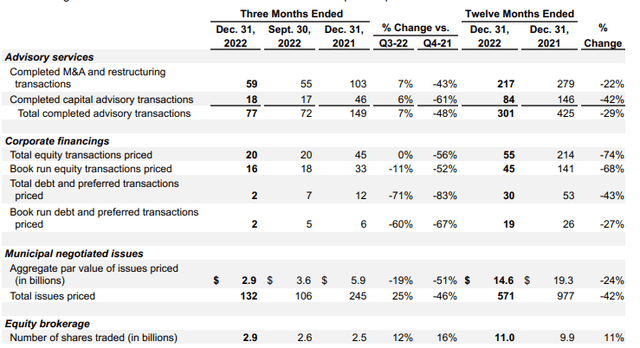

Q4 results ( Piper Sandler)

PIPR experienced a soft Q4, with net revenues down 40% against Q4-21 and EPS down 66%. This is a reflection of the rapidly slowing market conditions. Interestingly, performance is up on Q3-22, which could be an early sign that things are beginning to improve. It is far too early to conclude on this, however.

Performance by segment (Piper Sandler)

Almost every segment has experienced a noticeable decline, with M&A and equity being the key needle-movers. Transactions have also halved since last Q4 last year, with equity transactions down over 50%. The decline looks to have ceased in the last decade, with the revenue increase likely being driven by value.

Balance sheet

As an IB, PIPR’s balance sheet has less going relative to its P/L.

We have seen its efficiency metrics trend up in the last decade, although face quite a large degree of variability. This is a reflection of its improving profitability as scale continues.

Further, Management has made an effort to reduce its balance sheet exposure to assets, de-risking and reducing its capital needs. This is part of a targeted effort to run an “advice-driven model”.

Advice-driven model (Piper Sandler)

In the last few years, Management has managed to achieve sustained dividend payments and share buybacks, allowing for improved profitability to be returned to shareholders. It looks reasonable to assume these will continue.

Outlook

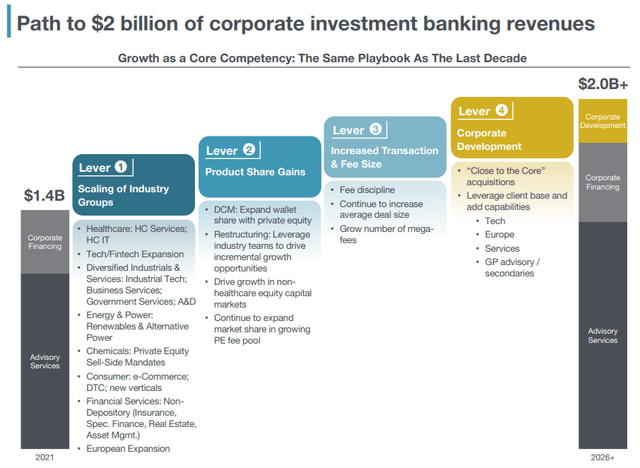

Management outlook (Piper Sandler)

Management’s outlook for the business involves growing its core operations through trading up to larger deal sizes and fees, as well as increasing its product offering. We concur with this view as the risk PIPR faces is becoming dependent on M&A work, which is cyclical in nature. Further, as the business continues to develop its expertise, it becomes far easier to cross-sell services to clients, which should now be the focus.

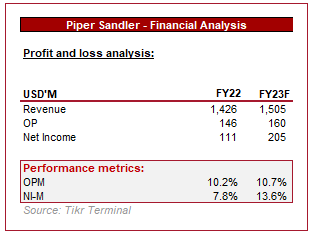

Piper Sandler outlook (Tikr Terminal)

Analyst estimates are far less useful for businesses of this nature but do provide some value as they reflect discussions with Management and peers. Expectations are for FY23 to be improved, with growth returning. Profitability is also expected to increase, suggesting bigger ticket projects, which looks reasonable as these are the types of projects which have been deferred due to uncertainty.

Peer comparison

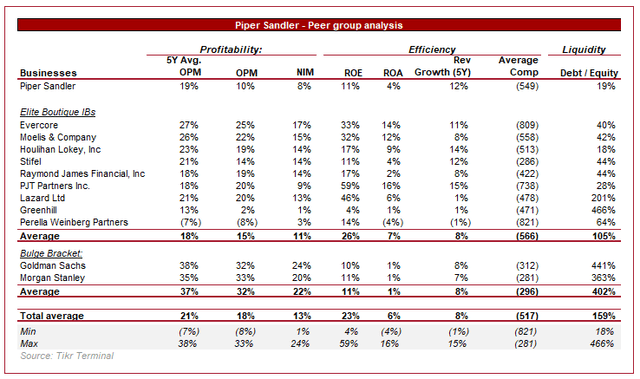

Peer group analysis (Tikr Terminal)

Presented above is a comparison of PIPR’s financials to a cohort of listed investment banks.

PIPR performs relatively poorly in the present period. The business is less profitable on an operating and net income level, owing to its exposure to current economic conditions. When considering the 5Y OPM margin, PIPR suddenly looks far better, arguably superior when factoring in leverage.

The key outperformance metric is growth, with this being an area of focus for PIPR in the coming years. Margins could be improved by moving its comp in line with revenue generation but this would go against the current growth strategy.

Valuation

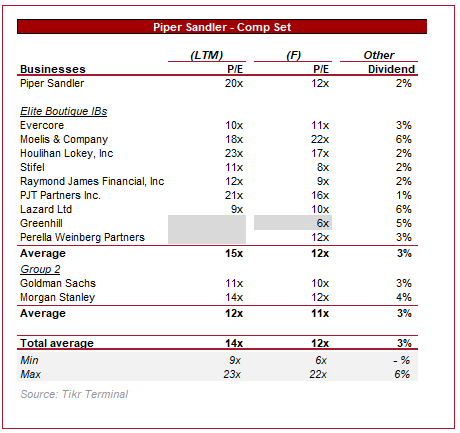

Valuation (Tikr Terminal)

From a valuation perspective, PIPR is trading in line with the market on a NTM basis, with its LTM valuation blown out, likely due to the substantial decline in advisory revenue.

Our view is that PIPR has the potential to be a premium player, owing to superior growth and what could be market average margins. The issue is that the business is not there today and so suggesting a market parity valuation implies upside is incorrect.

Final thoughts

PIPR has done a great job of growing its business over the last decade, with a commercially sound business in a position to continue its current trajectory going forward. Our key concern is how exposed the business is to market conditions, with advisory work down 35% and margins contracting noticeably. The business is focused on growth and this is where value will be for investors.

PIPR is currently valued in line with its peers, yet has seen the deepest margin contraction and is not leading the pack in growth.

[ad_2]

Source link