[ad_1]

juststock/iStock via Getty Images

Paycom (NYSE:PAYC) is a highly profitable technology stock with a dividend yield and HCM offering. PAYC stock has bounced back from 2021 highs. The stock is now trading. Although it looks like continued top-line growth and strong profit margins in 2020 levels. PAYC has a strong balance sheet with $400 million in net cash. While PAYC operates in a crowded field, I expect its steady revenue growth rates and high profit margins to pave the way for higher share prices. I am starting PAYC coverage with “Buy”.

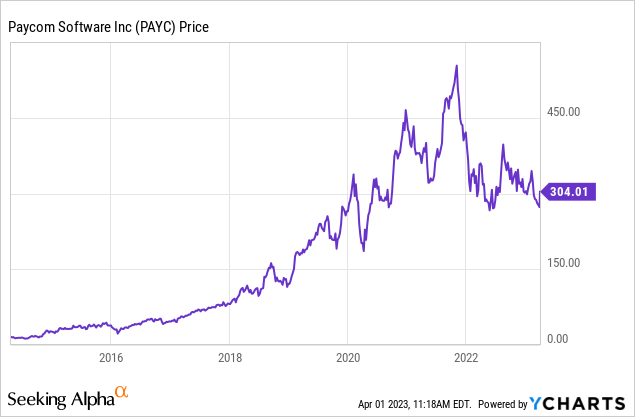

PAYC share price

PAYC went public in 2014 but was founded in 1998 in the midst of the dot-com bubble. Despite recent volatility, PAYC remains a household investment for those who have stuck with it. long term.

PAYC is 44% lower than its 2021 highs, but the stock may be trapped in a tech bubble.

PAYC stock key parameters

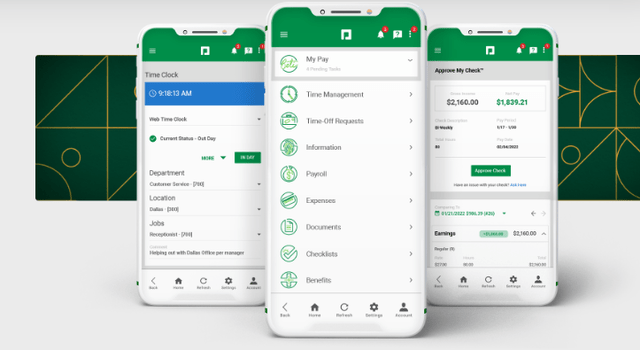

PAYC is a payroll and HCM solution that helps clients manage their employees’ work life cycle, from payroll to leave requests. PAYC can be considered as an enabler of digital transformation of human capital management. You can see how the Paycom app looks like below:

Paycom

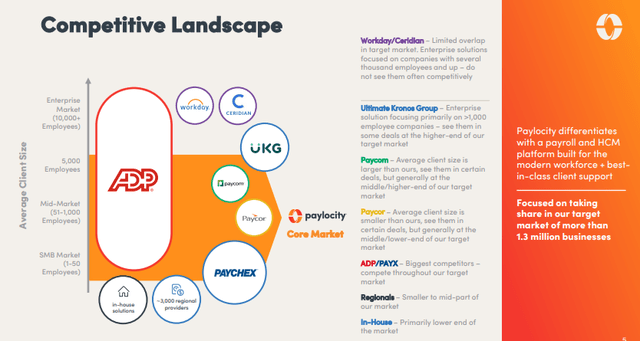

This is a highly competitive field as seen in the competitive landscape diagram below (taken from the Paylocity (PCTY) approach).

Paylocity investor presentation

PAYC seems to have found a niche for mid-level companies. PAYC itself points to the simplicity of the all-in-one offering, which is a common selling point for their target market (and has some positive effects on their financial profile, as discussed below). For an in-depth look at the PAYC business model, I can recommend this article by Robert Chan.

In the most recent quarter, PAYC posted 30% YOY revenue growth to $370.6 million, with recurring revenues accounting for $364 million. Unlike the typical tech company, PAYC is highly profitable, with adjusted EBITDA of $163.9 million and GAAP net income of $80 million. These figures represent margins of 44.2% and 21.6% respectively.

How profitable is PAYC? The secret seems to lie in the extremely lean R&D and S&M spending buckets, both growing at strong rates YOY while representing a much lower percentage of revenue than seen by other tech companies.

PAYC ended the quarter with $400.7 million in cash and $29 million in debt. The net cash balance and positive cash flow generation allowed PAYC to repurchase $100 million of its stock for the full year. PAYC has $1.1 billion left in its share repurchase program and I expect the company to take advantage of this program given its strong profit margins.

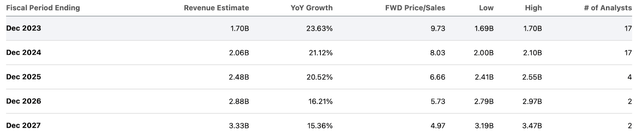

Looking ahead, management guided for 25.7% YOY revenue growth in the first quarter and 23.7% YOY full-year revenue growth. Adjusted EBITDA margin is expected to remain strong at 41.2% for the full year.

At a time when it seems like every technology management team is talking about artificial intelligence, PAYC management took a different tack, saying on the conference call that they believe “AI is not for AI’s sake. It’s important to the customer.” While I suspect PAYC may not be a household name for tech investors, it may soon become one of the few tech companies that can sustain such strong revenue growth rates alongside solid profit margins.

Is PAYC buying, selling or holding stocks?

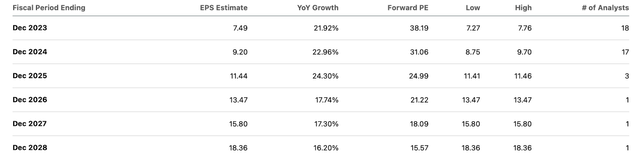

While PAYC is less than 40% of its all-time high, the estimate is not yet depressed. Wall Street is likely to be bullish on the stock’s prospects due to the aforementioned combination of top-line growth and GAAP profitability. PAYC recently traded hands at around 10x sales – a reasonable valuation but certainly at the top of the growth spectrum. For reference, Okta (OKTA) trades at 6.4x sales despite a similar growth outlook.

Seeking Alpha

But the PAYC assessment looks more reasonable when weighed against earnings. PAYC recently traded around 38x earnings — a reasonable valuation considering its low-twenties earnings growth rate.

Seeking Alpha

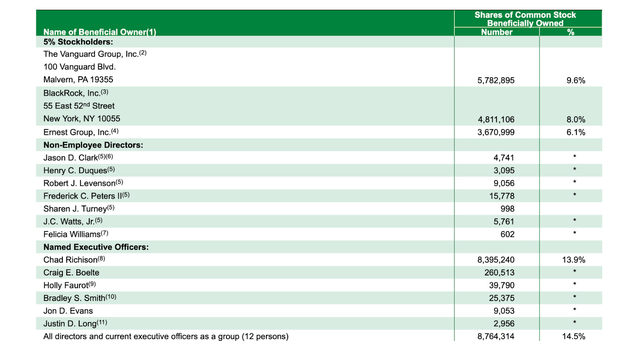

It’s worth noting that founder and CEO Chad Richison still owns 13.9 percent of the outstanding shares.

2023 DEF14A

At recent prices, I find PAYC still a bargain. I doubt that profit margins will expand meaningfully from this, but that may not be the case. Based on 30% long-term net margins and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see PAYC trading in the vicinity of 10x sales – meaning the stock could deliver annualized returns similar to its earnings growth rate.

What are the main risks? Ironically, the reason why investors like this stock may be the source of the risk. PAYC’s high margin profile could be a long-term red flag, as it could indicate that the company isn’t investing much in innovation. There seems to be some evidence of that in the company’s 3.6-star Glassdoor rating, which is arguably low for new tech companies. While such a strategy may yield high profits in the near term (as we will see now), it may also cause the company to suffer severe disruption in the medium to long term. Given the fact that the company hasn’t been around much in recent years, I wouldn’t be surprised to see the company show appetite going forward. PAYC may want to expand its product portfolio to reduce the likelihood of disruption, with the same playbook as Salesforce ( CRM ). But such a strategy may not benefit shareholders, as any resulting M&A could be costly. PAYC has a strong balance sheet and cash flow profile, but management could use that as a reason to justify a large acquisition that would require the company to take on significant debt. If this happens, I expect the stock price to experience a material multiple squeeze for the increased financial risk. On the other hand, if the company can demonstrate operational viability and commitment to its share buyback program, I could see the stock experiencing strong earnings in the medium term. I rate PAYC stock a buy but note that the valuation is high compared to technology peers and the risk of management performance issues is not trivial.

[ad_2]

Source link