[ad_1]

Editor’s Note: Seeking Alpha is proud to welcome Cameron Fenn as a new contributor. It’s easy to become a Finder Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click Find out more here »

Young Balinese

Introduction

insurance (NYSE: PAGS) is a Point of Sale (‘POS’) provider in Brazil. This means that PAGS provides hardware and software to handle purchase transactions from retail customers. Similar to the US market is a company like SQ. PAGS is down 58% since its IPO in January 2018. This is likely due to major IPO valuations and macroeconomic factors – both in Brazil and in the USA where it is listed. Growth investors are reluctant to invest in foreign people and businesses without a track record of profitability in this area. As a result, they have shunned stocks like PAGS. However, however Considered a growth stock, a closer look suggests a disruptive, fast-growing, and cheap overall business.

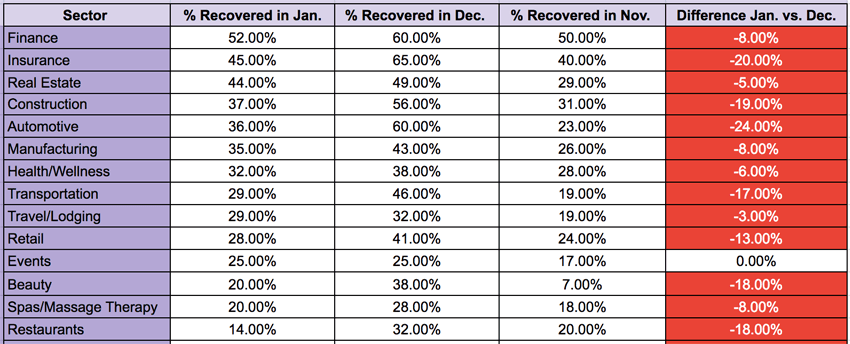

Overview of the Brazilian payment sector

Before explaining my thesis, I would like to give an overview of the dynamics and business outlook in Brazilian payments. I think understanding business dynamics is more important than looking at company metrics like current growth rate and P/E ratio. However, I will cover that as well. Existing payment platforms Cielo ( OTCPK:CIOXY ), Rede and Getnet charge high fees — a percentage of the transaction that goes to the payment provider. For example, Steven Baria from S&P Global listed Cielo’s credit card rate at 4.99 percent in 2019. During that time, PAGS and payments distributor Stonco ( STNE ) both took around 2.5 percent.

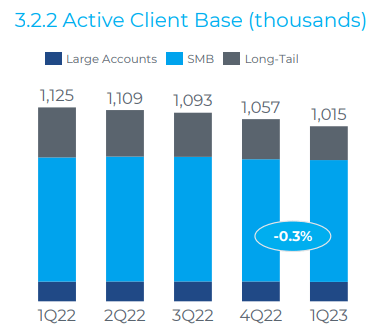

Incumbents did not want to cut prices as this would reduce profitability. But this dynamic allowed PAGS (and STNE) to grow from 7.2% in Q42019 to 10.9% in Q32022, while Cielo’s share fell from 40% to 26.8%. The PAGS strategy involves targeting micro merchants, defined as retail businesses, with a total transaction value (TPV) of BRL 15,000 ($3,000) per month. Due to Cielo’s high cost, most of these businesses did not have any payment processors before PAGS, and PAGS was the only significant player in this segment. In Cielo’s Q1 2023 fact sheet, small business owners have a small presence in the ‘long tail’, the so-called low-priority demographic.

Q1 2023 Cielo Customer Composition (Q1 2023 Fact Sheet Cielo)

Current and future development

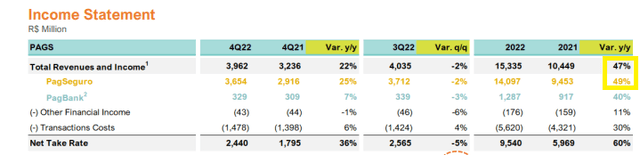

The momentum gained from this strategy is responsible for historical growth. PAGS has grown at a CAGR of 45% over the past four years and its growth is not slowing down – growing at 47% YoY by 2022. Although incumbent payment processors are reducing their acceptance rates, reputation and ancillary businesses seem to be driving PAGS growth.

PagSeguro Top Line Growth and Takeover (PagSeguro 2022 Annual Report)

As you can see, 2022 revenue grew 47% YoY, while 4Q2022 grew 22% YoY. Pagbank increased its loan portfolio by a significant amount, but its cash flow grew by only 7%. This is a temporary post that doesn’t affect future earnings, but I’ll talk about its implications later.

Sum of parts – Pagbank details

Both PAGS and STNE have invested heavily in ancillary services which often result in losses. But like SQ, given the size of PAGS and STNE’s payment business, both contribute to ecosystem resilience and grow into profitability. This means that valuing PAGS on P/E alone is lacking. PAGS created the lending/banking platform PagBank. Although PagBank is not profitable, there is reason to expect it to contribute significantly to the bottom line. PagBank echoes SQ’s efforts with Square Capital/Square Loans. Because the payment processor has the merchant’s payment process data, they are in a better position than even the bank to write a loan for this customer, and do so with machine learning, eliminating the time and expense of traditional underwriting. STNE tried to enter banking but ran into problems with loan defaults, which put STNE behind PAGS. PagBank, acquired by Transaction Data, has become the second largest neobank in Brazil (behind Nubank). In the last 2 years, PagBank has grown active customers at a 43% CAGR and has BRL 20 billion in deposits.

Although PagBank has underwriting advantages compared to NuBank (NU), NU’s development cycle may shed some light on PagBank’s maturity. Unfortunately, I cannot find better metrics like PagBank’s tangible equity in PAGS’s financial reporting, so I have to use deposits as a proxy for bank size. NU had BRL 75 billion in deposits in 4Q 2022 and BRL 50 billion in deposits in 4Q 2021. With BRL 75 billion in deposits, they achieved BRL 750 million quarterly profit and 40% annual return on equity (ROE). This data indicates that the profitability inflection point is between BRL 50 and BRL 75 billion in deposits for PagBank. Using the current growth rate of 40%, it will take NU less than 3 years to reach the BRL 50 billion deposit volume required for Pagbank to become profitable. While this is optional, I rate PagBank at $0.

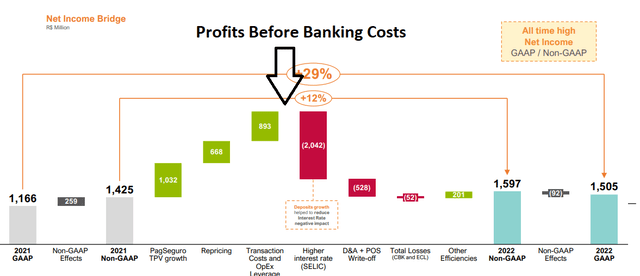

Sum of parts – fees

Currently, PagBank is a drag on the bottom line. According to the 4Q 2022 annual net income waterfall, if the bank does not incur losses due to inflation, the payments business will have revenues of at least 4 billion BRL ($800 million). There may be some bank losses baked into 2021’s non-GAAP earnings, so the number could be higher. This equates to a 6x P/E ratio, depending on how you model taxes on additional income. The market value is undervaluing the payments business itself, even though it is not worth anything to Pagbank. At a relative P/E of 12x, PAGS’s market value would be 100% higher. This number is conservative and takes into account the large losses due to Pagbank, but does not provide any premium for growth in payments business revenue.

Profitability diagram showing profit before bank losses (PagSeguro 2022 Annual Report)

Risks of the company – ecological competition

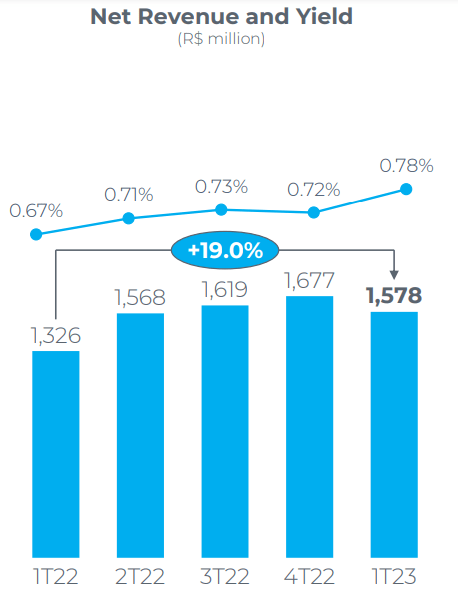

I would like to present some risks and additional colors regarding the thesis. One downside to PAGS is developing a point-of-sale (POS) payments ecosystem. As it matures, Square has implemented supporting software and Application Programming Interfaces (APIs) to access an ecosystem of apps to do whatever a merchant needs. This led to stickiness for their POS system. STNE has done a great job of building a suite of software, which is important because they focus on small and medium businesses – more than just PAGS micro traders. But, to increase their mortality, PAGS should follow STNE. Building a credit operation and building PagBank is an important first step, however, merchants will benefit from software such as ERM, CRM, fraud detection, etc. In addition, at this time, Cielo and other incumbents seem to have reduced the amount taken by the STNE. and PAGS. At least the TPV revenue rate is very low for Cielo at around 0.78% compared to 2-3% for STNE and PAGS. The drop in Cielo’s take rate indicates that at least one incumbent has realized that it cannot charge 4.99% on financial transactions and compete in quality with STNE and PAGS.

Cielo Take Rate and Revenue (Cielo Q1 2023 Presentation)

However, PAGS can no longer rely on deterministic pricing to take more shares from Celo, Rede and Gatenet. SNPE and PAGS are now a premium product, and therefore need to defend that reputation. With their acquisition of Lynx, STNE is creating a premium retail POS ecosystem. Lynx is the largest retail management software company in Brazil with a market share of around 50%, opening up channels for sales and cross-selling. PAGS also needs to develop an ecosystem to compete with Celo, Rede, Gatenet, and eventually STNE for SMB and enterprise customers. Given the hidden revenue power of PAGS, it has the ability to compete with STNE by building an ecosystem through M&A. However, the focus on PagBank seems to have prevented it from expanding its POS ecosystem beyond deposits and loans. PagBank is important, but PAGS management must be able to walk and chew gum at the same time. At current rates and growth rates, this may be seen as a good, but not necessary, option consideration, but not an unreasonable managerial desire. PAGS should generate good IRRs for its investors, but if STNE is the market leader in the next 10 years, it will generate better returns despite its high valuation.

Risks of the company – other

Given the low P/E and high growth rates, it’s fair to ask what other risks the market is pricing in. First, there is a national threat in Brazil. With inflation high and corruption a major issue, the country has tamed inflation and started to grow its economy in single digits and around 3+ percent since covid. Inflation is now around 4%, down from 12% a year ago. Discussing politics, perhaps the new president Lula is considered a less business-friendly option for president, but the defeated Bolsonaro had a reputation for flirting with civility. In a bad hand, picking Lula might be the best option. Also check out the result’s thrifty Lula and his socialist impulses.

A final disaster not only for PAGS but STNE as well. Both companies offer small business financing through accounts. Merchants can choose to pay a fee and PAGS/STNE will credit them with a confirmed amount in their accounts. Through this program, PAGS accumulated BRL 34 billion ($6.8 billion) in balances on their balance sheets. According to this article, in 2018 PAGS charges an interest rate of 2.99% per month for this loan, so it is a profitable business, but it is open to write-offs if the economy goes into recession. These risks are legitimate, but these problems are the problems of the process considering the company’s low valuation and growth.

If PAGS starts trading at 30-40x P/E to earnings, I don’t see this as a buy. If growth rates drop to Brazil’s inflation rate, I would consider selling, especially if rates rise. Also, if Brazil is not very friendly to foreign investors and PAS starts losing a lot of money, even if it trades at a good P/S multiple, I will sell.

Conclusion

In conclusion, PAGS’ interest rate losses on loans are hiding the profitability of their payments business. The company is trading at 6x P/E on earnings and its overall business is growing at about 50% per year. Growth is strong and well above Brazil’s inflation rate. Usually companies trading at 6x PE often face existential risk, but with PAGS, for a well-run company – currency risk, execution risk, etc. The company is not an unknown or a microcap company, but due to the market downturn, investors viewed this as a growth stock with short-term profitability and threw the baby out with the bathwater. A closer examination points to the current disruptive, fast-growing, and low-cost part-of-the-room business.

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link