[ad_1]

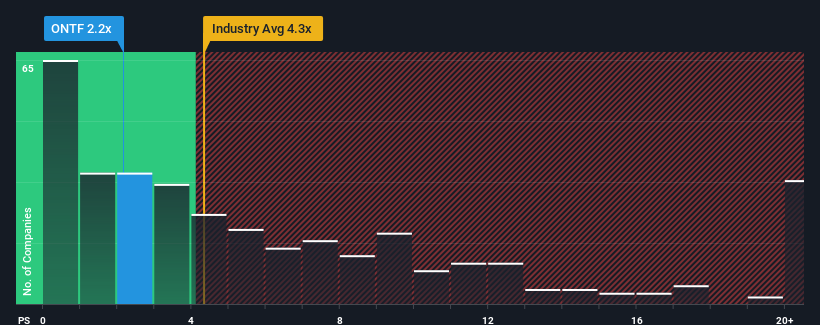

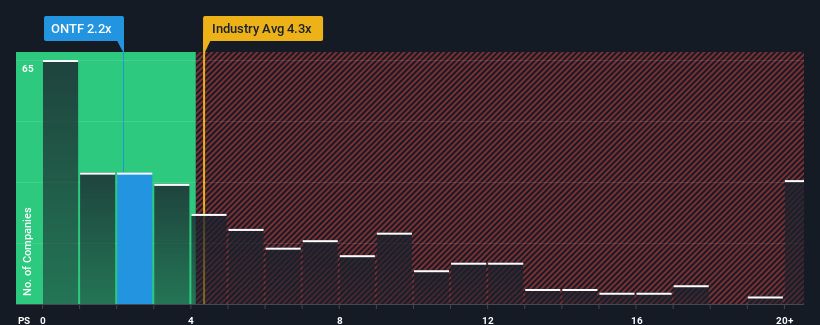

You might think of a price-to-sales (or “P/S”) ratio of 2.2x. ON24, Inc. (NYSE:ONTF) is definitely a stock worth checking out, as nearly half of all software companies in the United States have a P/S ratio of over 4.3x, and P/S ratios over 10x. However, we need to dig a little deeper to see if there is a rational basis for the much reduced P/S.

Check out our latest analysis of ON24

How is ON24 doing?

While the industry has seen recent revenue growth, ON24’s revenue has gone into reverse gear, which is not good. The P/S remains low as investors believe that prospects for strong earnings growth are not on the horizon. If you still like the company, you hope it doesn’t so you can pick up some stock while it’s not worth it.

If you want to see what analysts are predicting in the future, check out our free Report on ON24.

Do earnings forecasts match the lowest P/S ratio?

In order to justify the P/S ratio, ON24 will have to create an anemic growth that will closely follow the industry.

Looking back, last year saw a 6.3 percent decline in the company’s top line. However, a few very strong years before that meant it still managed to grow earnings by a total of 114 percent over the last three years. So we can start by confirming that the company as a whole has done a very good job in terms of revenue growth over that period, even if it has had some bumps in the road.

Looking ahead, revenue growth estimates from the seven analysts covering the company are heading into negative territory, with a 13% decline next year. With the industry predicting 12 percent growth, that’s a disappointing result.

With this in mind, we find it surprising that ON24’s P/S closely matches its industry peers. However, there is no guarantee that the P/S will reach the floor yet and the income will go in the opposite direction. Even sustaining these prices may be difficult as the weak outlook weighs on stocks.

Bottom line on ON24’s P/S

The power of the price-to-sales ratio is not primarily used as a valuation tool, but rather as a measure of current investor sentiment and future prospects.

It is clear that ON24 is expected to maintain the low P/S due to the weakness of the earnings slippage forecast. Currently, shareholders are accepting the low P/S because future earnings will probably not provide any pleasant surprises. Until these conditions improve, they will continue to pose a barrier to share prices around these levels.

You should always remember the risks, for example: ON24 has 1 warning signal. We think you should know.

If strong companies that turn a profit pique your interest, you’ll want to check this out free An interesting list of companies that trade at low P/Es (but have proven earnings growth).

Have a comment on this article? Concerned about the content? Connect directly with us. Alternatively, email editor-team (at) simplywallst.com.

This Simply Wall St article is general in nature. We only provide opinions based on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to be financial advice. It does not provide advice to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide you with long-term analysis driven by fundamental data. Note that our analysis may not include recent price-sensitive company ads or quality content. Simply put, Wall St has no position in any of the listed stocks.

Join a paid user research session

They receive a. $30 Amazon gift card 1 hour of your time helping us build great investment tools for individual investors like yourself. Register here

[ad_2]

Source link