[ad_1]

More and more organizations are adopting microservices that comprise an application. In the year According to a 2020 O’Reilly survey, 77% of organizations have adopted microservices, and 29% report migrating or deploying most of their systems using microservices.

The widespread adoption of microservices has brought new challenges to application development. According to the same O’Reilly survey, company culture and integration with proprietary systems have become the main challenges in the field of microservices.

Startups are rushing to fill the solution. There’s Helios, a microservices management platform that helps developers understand how their code interacts with the rest of their applications. Vendors such as OpsLevel and Temporal compete with Helios for business, offering platforms that organize microservices through a central portal. A new entrant in the space is Nucleus, which aims to enable devices to run on microservices architectures using a variety of infrastructure, security and monitoring tools. Backed by Y Combinator, Nucleus has raised $2.1 million in VC funding to date.

Nucleus was co-founded in 2021 by Avis Dranova and Nick Zeley, after the duo spent seven years building infrastructure platforms at large enterprise companies (eg IBM, Garmin) and startups (Skyflow, Newfront). The Nucleus initiative came after Dranova and Zeley realized that they often needed to rebuild a similar platform to help developers create, test and deploy their microservices.

“We have noticed that more and more companies are trying to relocate [microservices] And they split the monoliths apart but struggled to do this well,” Dranova said in an email. “Some companies that have tried to move to microservices have burned their fingers because they don’t have the right tools, and more importantly, the right people…but service-based architectures without having to be experts in security, infrastructure, and observability.”

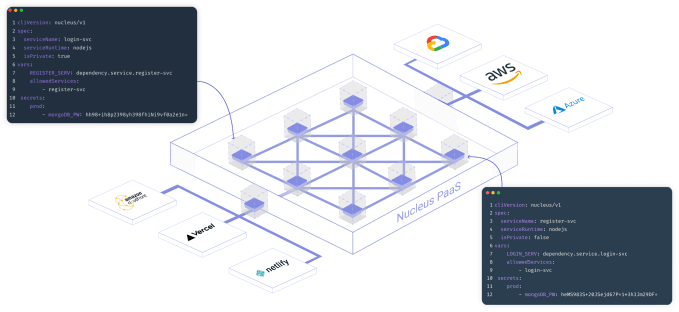

With Nucleus, developers define microservices and deploy them on the Nucleus platform, which automatically configures their security, observability, and more. Nucleus is delivered through a command-line interface designed to fit into existing developer workflows and comes with pre-built integrations, including tools from Hashicorp, Cloudflare, and Okta.

Image Credits: Nucleus

“Nucleus is an infrastructure platform that allows complete freedom over your code,” Drenova said. “As a developer, you can write your code in whatever language you want, and we support it out of the box. We don’t interfere with your business logic—one way to think about it is that we’re building a home where you can put your code, and this home is integrated with your infrastructure and third-party tools and is very secure.”

Drenova acknowledges the many competitors in the microservices orchestration space. But he sees the “do-it-yourself” crowd as the primary competition for the nucleus, .

Before we wrote any code, we interviewed 55 technology executives and 90% said they had built something like this before, and it took an average of 8-12 months, costing over $1 million and three full-time senior engineers. ” Dranova said. We believe we can offer a better product at 10% of the time and 10% of the cost when it comes to DIY. That is very compelling.”

Those are lofty expectations. But to Dranova’s credit, Nucleus — whose platform is still in beta — already has “a handful” of early customers and eight design partners. Investors also won, with Soma Capital, Y Combinator, Lombard Street Ventures and “dozens” of angels throwing capital in Nucleus’ direction.

“Nucleus is critical software. We manage all your services,” Dranova added. “It’s bigger than any developer, which means CTOs are always our buyers… Our target market is companies with 20-plus developers who are moving to a service-oriented architecture. But any service A company that uses it can use us.

Nucleus is currently focused on organic growth, with a small team of four employees including the co-founders. Drenova is looking to hire 1-2 engineers next year, but is backing it conservatively, waiting for signs of product market fit.

“In the recession, the playing field is more level for early-stage companies, and while the big competitors are focused on reducing financial burn and staying alive, we will put the pedal to the metal and follow the opportunity,” Dranova said. “We have a lot of money in the bank and a runway for the next few years.

[ad_2]

Source link