[ad_1]

“We’re making sure the models we’ve built for the home and casualty insurance use case are broadly applicable to the $12 trillion U.S. mortgage servicing market,” ZTII founder and CEO Attila Toth said in an interview.

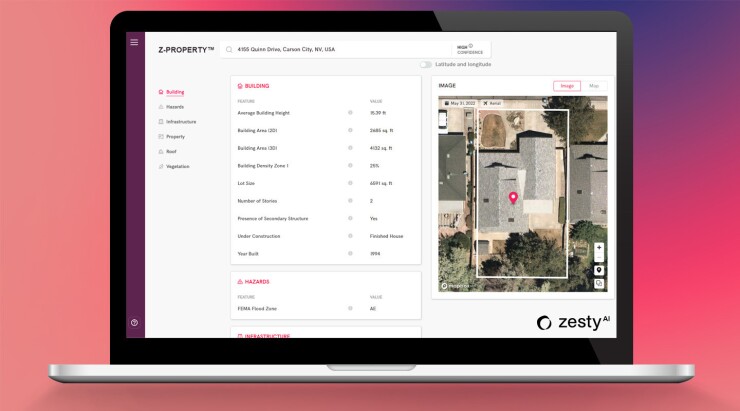

The purpose of the technology is to enable servicers to optimize the size of mortgage loans in their portfolios by using a variety of data sources, including images collected remotely about properties.

“If they have aerial imagery or building permits, they can’t use that as input. It’s an unstructured data source. So we’re using machine learning to mock structured data,” Toth said.

Eventually, Zesty.AI plans to provide mortgage companies with analytics that will allow insurers to increase the amount of risk exposure to properties such as natural disasters. Hurricane Ian Or Wild fire.

The analysis calculates, for example, the annual probability that a property will be surrounded by a wildfire based on location. If so, it can assess the likelihood of a fire, based on the characteristics of the structure, including the pitch of the roof, the materials it’s made of, and overhanging plants.

“The first step is to present [mortgage companies] We’re taking it to the next level with asset valuation and asset characterization and then offering climate risk metrics,” Toth said.

[ad_2]

Source link