[ad_1]

MudafiLatin America’s tech-enabled real estate brokerage has raised $10 million in a Series A round of funding led by San Francisco’s Founders Fund.

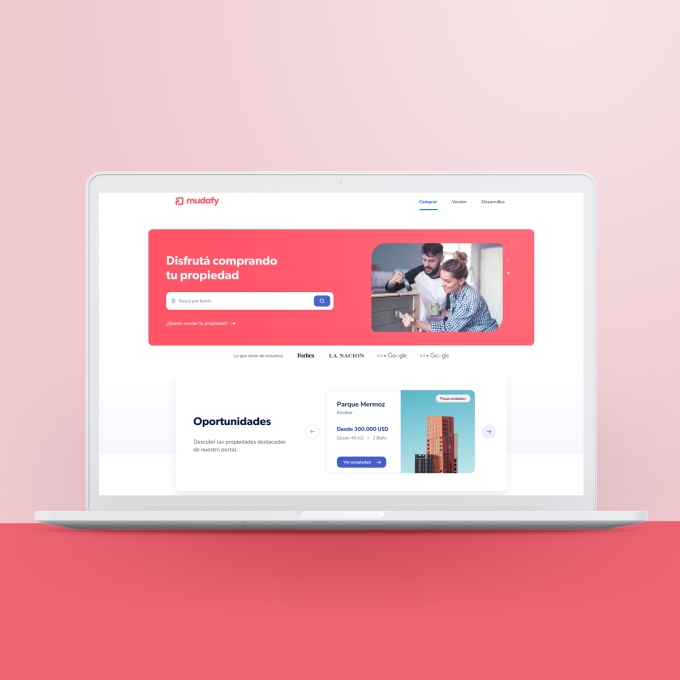

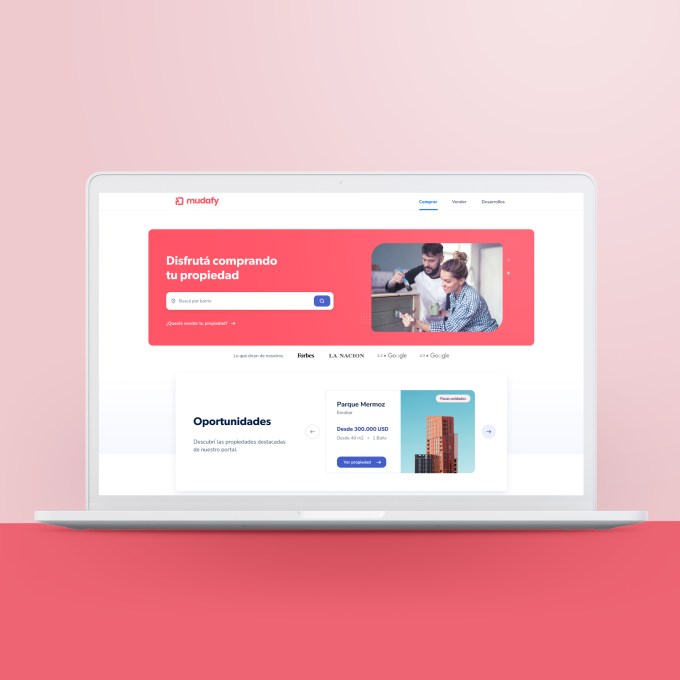

In the year Founded in mid-2019, Mudaffi operates on a traditional digital brokerage model – aiming to make it easier for people to buy and sell their homes, and act as a “one-stop shop” in the process.

The startup – also backed by Y Combinator – has a site with over 50,000 listings and over 1 million unique monthly active users in Argentina and Mexico. He says that he is doing more than 100 real estate transactions a month and is currently bringing in more than 50% loans to his clients.

“This is the start of a big push into fintech, while at the same time improving access to better assets for customers,” he said. CEO and Co-Founder Franco Forte.

Moudafi’s new capital is expected to generate, among other things, $500 million in annual sales by the end of the year. Forte says it’s over in 2021Assets sold over $100 million” And it has maintained a continuous growth of over 20% month-on-month. Overall, the company has increased its sales by 10 times by 2021 for the second year in a row.

Today, Mudaffi He says he’s running at more than 2x the pace he did in 2021.

The startup’s revenue model is based on a success fee or commission. A fee is charged when a property is sold. It also generates revenue on each mortgage loan originated.

With the new capital, Moudafi’s latest priority is to expand into markets in Mexico by 2020. Exploring the possibility of moving into other Latin American markets such as Colombia, Peru and Chile.

FOrte believes Moudafi’s product-centric approach will help him stand out in a more crowded space.

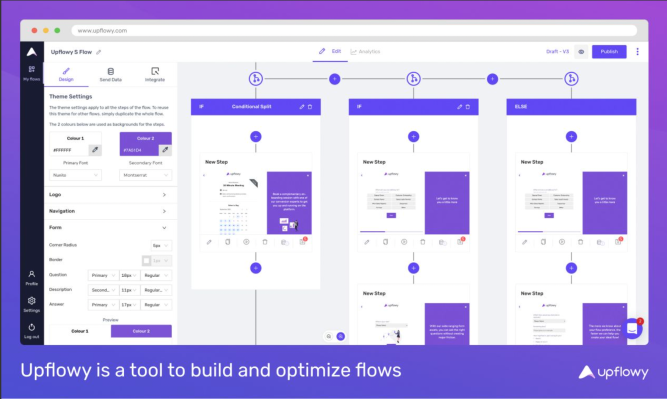

“We rebuilt the entire service stack and rebuilt the entire experience,” Moudafi’s team told TechCrunch, having previously developed products for the real estate industry for more than a decade.

The customer-facing product includes features common in the US but less so in Latin America, such as 360-degree virtual tours, online booking for showings and appraisals, and property price information. It also built an internal product that it says helps agents be 10x more efficient compared to traditional realtors.

Image Credits: Mudafi

Ultimately, Mudaffi said, the ultimate goal is to help people close on a home faster and for less money.

Certainly, in Latin America, the challenges of buying and selling a home are more time-consuming and complex than in the United States. Without an MLS, consumers lack access to official information and therefore transparency. This is where Moudafi hopes to revolutionize technology and data analytics.

Today, Moudafi has more than 400 employees — up from 204 by the end of 2021 — and plans to hire more in its new headquarters. The company has invested in its technology and products and is not yet profitable; But Fort Moudafi said it was “extremely capital efficient” and the unit’s economics were “healthy and positive.”

In total, the startup has raised $13 million. IDC Ventures participated in the latest funding round.

Amin Mirzadegan, the principal of the Founders Fund, believes The process of buying and selling homes in LatAm is “broken,” with an average sales cycle of more than six months.

“Since day one, Mudaffi has been laser-focused on providing homebuyers with a seamless shopping experience, rather than immediately diving into i-buying, rentals, etc.,” he wrote in an email. “Agents are an integral part of an ecosystem. Moudafi is building technology that not only helps buyers, but also increases agents’ efficiency and ability to serve buyers.

Interestingly, Keith Rabois is a general partner of Founders Fund and also a co-founder of it. open door, A publicly traded real estate technology company operating in the US

Not to be forgotten are other Latin American digital brokers like Loft and Quintoander. Dismissal this year. To that end, Forte said: “I believe the loft and quintessential evictions are more a reflection of the fundraising environment than the real estate market.” The market is huge, there’s room for more players, and buyers/sellers want a better experience… If the downturn affects the market, it won’t affect Protex. Instead, it will affect traditional real estate brokers.

[ad_2]

Source link