[ad_1]

It was life. The last couple of years have been brutal in hospitality, but that hasn’t stopped Mint House from stepping up to the plate with a series of tech-forward apartments.

Under the slogan “home comfort”. Hotel luxury. Tech-enabled and customized for you,» the company is trying to make leaving home a little less difficult. Targeting high-end business and leisure travelers, Mint House recently raised a $35 million Series B round from Moharry Hospitality with participation from Revolution Ventures, Legion Ventures and Ingleside Investors. In this teardown, we take a closer look at the floor where the company has landed the Series B.

We’re looking for more unique pitches to break down, so if you’d like to submit your own, here’s how to do that.

Slides on this floor

- Cover slide

- Summary slide

- Business model slide

- Consumer product slide

- Competitor comparison slide

- Key parameters slider

- Value proposition for real estate slide

- Results slide

- Corporate partnerships slide

- Group slide

- Appendices cover slide

- Case study attachment slide

Three things to love

I’m intrigued by how you’ve developed this round, especially since the deck has a red flag the size of Texas.

Collecting $35 million in hotel space at the tail end of the pandemic? Good heavens, I’m curious how you pulled that off. This is doubly true as the deck has a Texas-sized red flag that is one of the most universally accepted deck slides of any deck (more on that in the “Things That Could Be Better” section below).

But hey! That’s what we’re here to investigate! Let’s start with the big wins:

Excellent 1-page summary slide

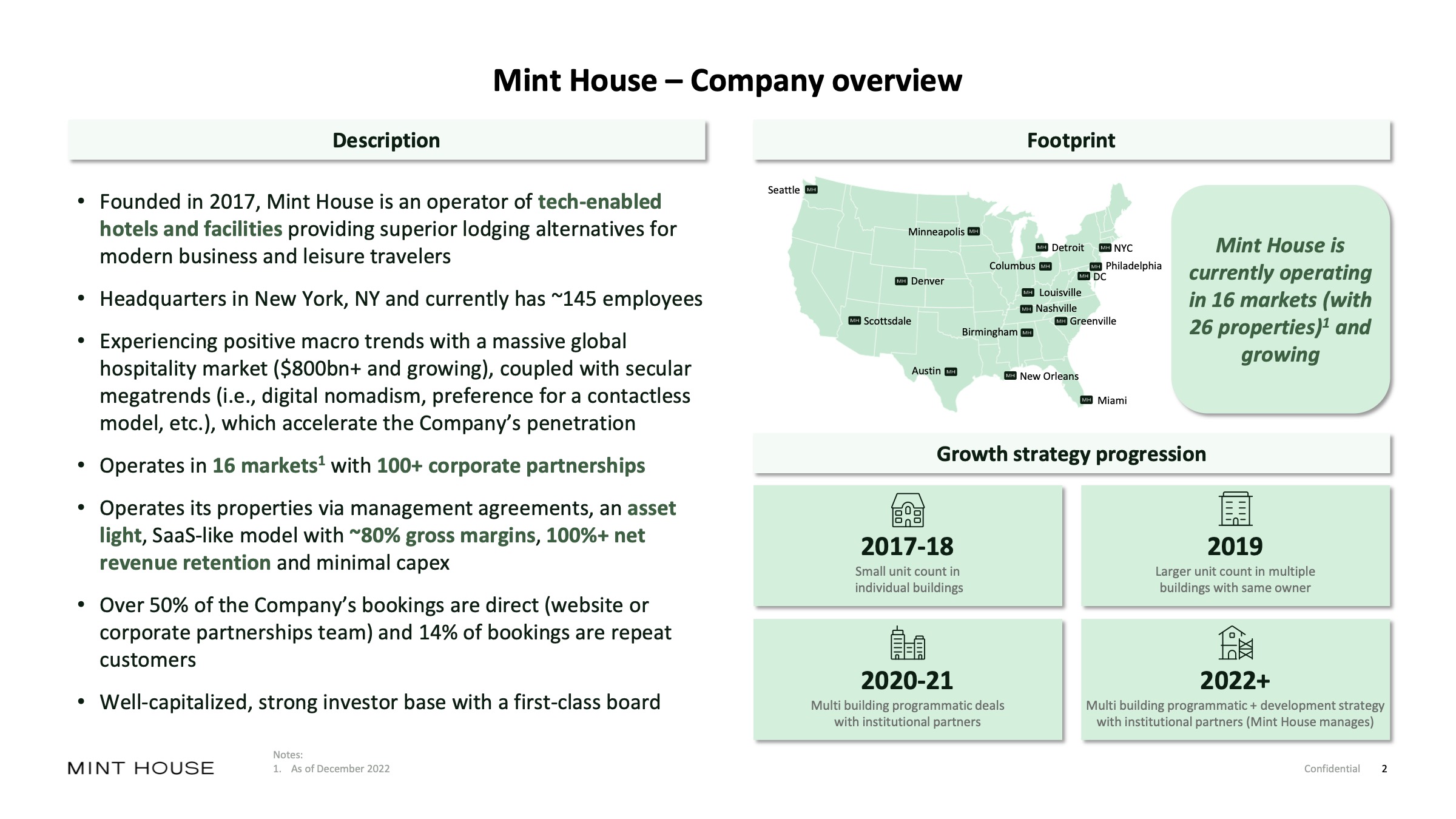

[Slide 2] Oh, I love a good summary slide. Image Credits: Mint House

(Opens in a new window)

It’s no secret that I love a good summary slide—it can set the tone and pace of a presentation. This cover slide is not good for use in a pitch layout; For presentations, I would probably recommend making it more simple. But to forward the deck, this brings investors up to speed and explains the macroeconomics of what the company is doing and the activity and growth it’s showing, and gives a brief summary of what the company is doing and who they’re doing it for. .

I wish he mentioned how much money he was raising here or on the cover slide – but other than that, this slide is the epitome of perfection.

As a startup founder, what you can learn from this slide is how to fill an investor in on the context of the company and focus your volume on the important things at hyper speed in the round. Are you growing, what are your plans and where is the market going. This is especially important for the later rounds – thinking about the past is important just to make sure you know what you’re doing. After all, investors are investing in what will happen next.

Press the long pole in front of the tent

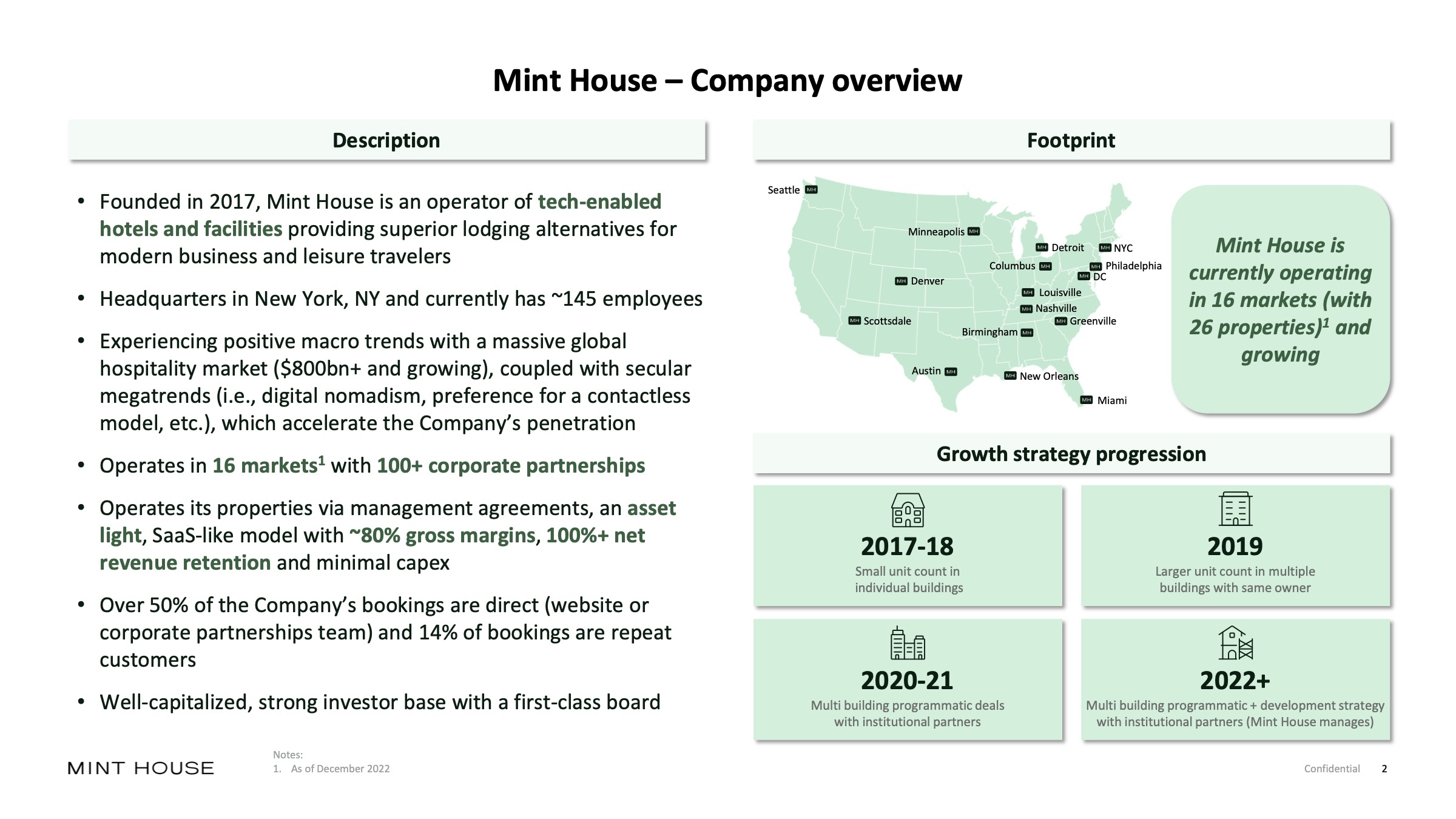

As a startup founder, you can probably predict what the biggest challenges will be for the company you’re about to launch. In the case of Mint House, the third slide says something about the company’s push for investment. Hotels can be a profitable business, but the business model is well-trodden ground. The company promises to innovate on that model, and for investors, this is both the biggest risk and the biggest opportunity.

[Slide 3] Dig into the business model. Image Credits: Mint House

In the hospitality world, it’s hard to stand out, and non-specialist investors often don’t even look at the vertical. Finding a way to tell the story well and clearly distinguishing yourself from the situation is an important part of telling the story. Mint House does that beautifully here by touching on every part of its business model on one slide. Is the slide itself good? Not really — the text is so small it’s practically unreadable. But it does a good job of summarizing the key differences.

As a start, you can learn here how to separate yourself from the binding walls. If you can’t, well, you basically have no business.

Show me the numbers!

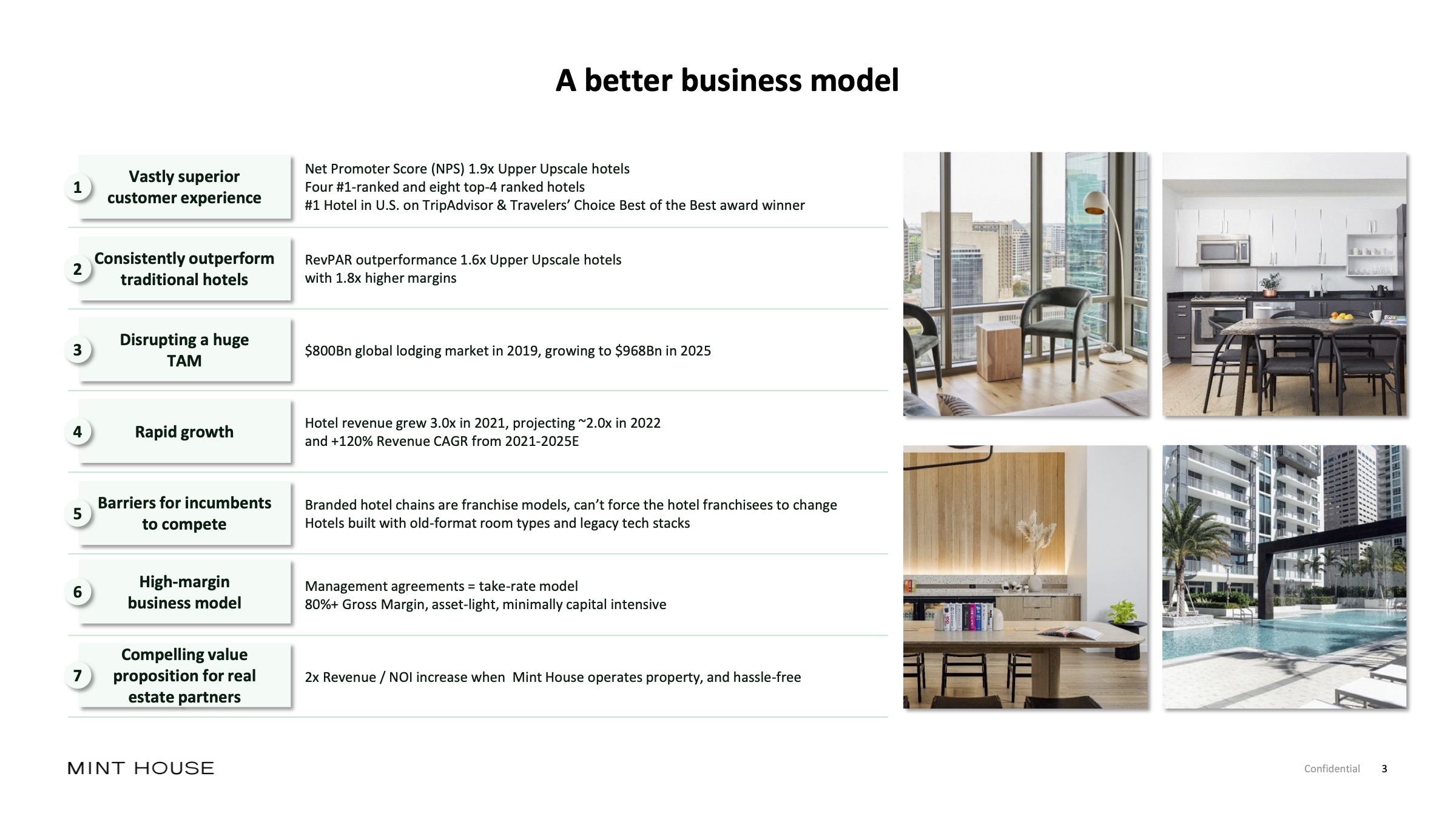

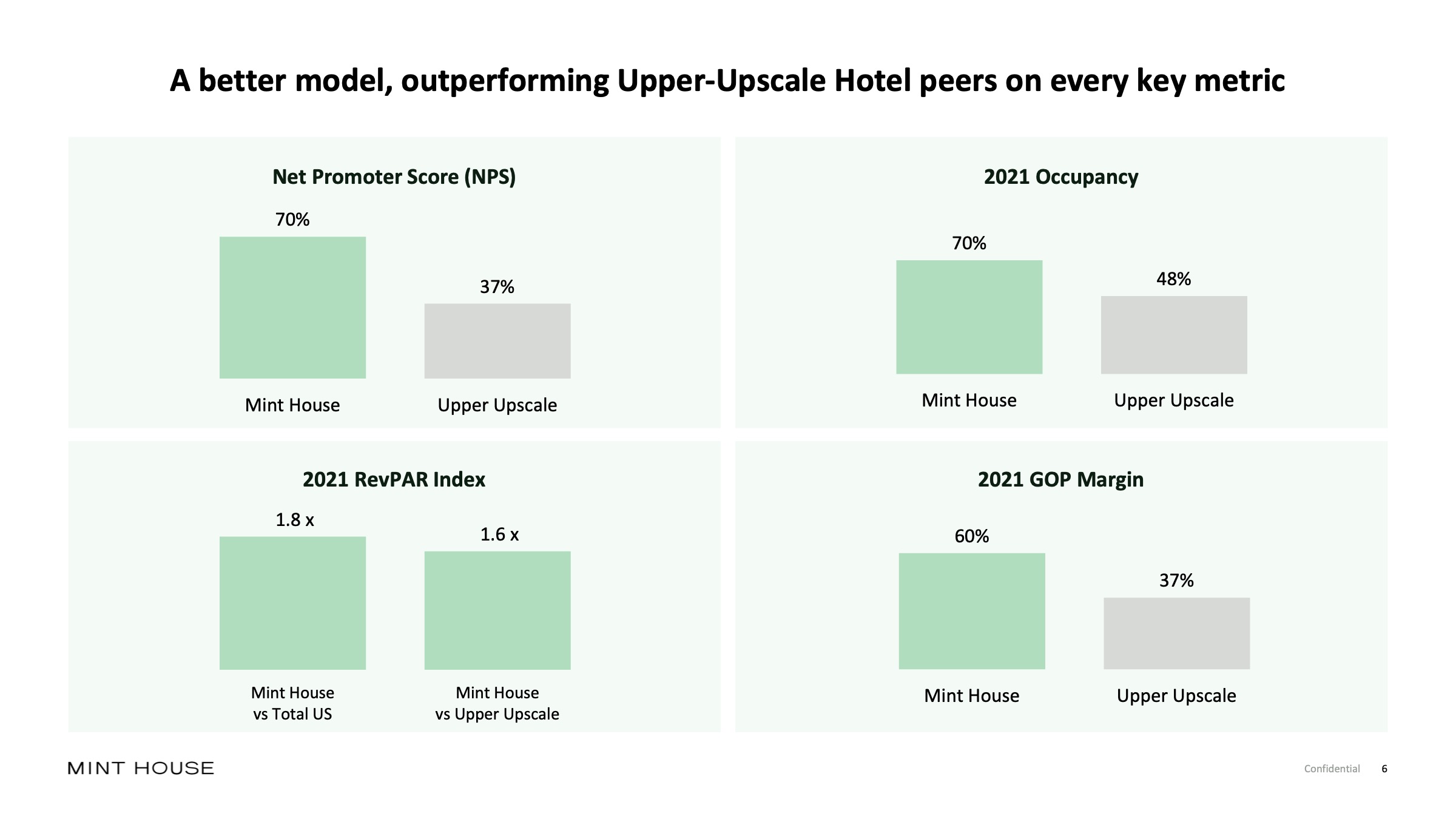

[Slide 6] Measurements for days. Image Credits: Mint House

Businesses in operating and growing mode have parameters. Not showing them in your pitch deck would be silly and the numbers themselves are just as important as the numbers you choose to represent your business to potential investors.

It’s great and encouraging that this slide is here – but investors are going to be watching very closely. Operating profit margin, revenue per unit and occupancy numbers are critical to the business side. In other words: if you’re going to be responsible for growing and developing Mint House for the next three months, those metrics are critically important.

However, those aren’t necessarily the metrics investors care about. I would have expected to see graphs including revenue, over time and maybe customer acquisition costs and other graphs that show what’s going on under the hood. Operating efficiency and cash flow may be another set of metrics to watch closely.

The metrics that an investor cares about are directly related to the revenue stream. Are you raising $35 million? great. Show in an action plan what you will do with the money and what your major milestones are for the next six to 18 months.

There’s a deep orange, maybe not red, flag here, though: net incentive points are represented as a percentage, which is incorrect. NPS is an absolute number from -100 to 100, calculated using a formula you can find on every growth-hacking blog. The fact that the founders (and everyone who looked at this deck) didn’t pick up on that – along with the incredibly inaccurate metric choice above – makes me wonder about the quality of the team as a whole.

My guess here is that the team is made up of tech startup founders or hotel operators. There’s nothing wrong with being the latter, but Airbnb can run with better profit margins than someone who operates dozens of brick-and-mortar buildings. I’m not saying this wouldn’t be a good investment, but I question whether it makes sense as a VC investment.

For the rest of this teardown, we’ll look at three things Mint could improve or do differently, along with a full pitch deck — and the big red flag I mentioned earlier.

Three things that can be improved

As good as Mint House’s pitch deck is, there are a few things that left me scratching my head – some of the errors were so severe that I was curious how the company managed to develop it, to be honest. Let’s see.

[ad_2]

Source link