[ad_1]

There are a few key trends to look for if we want to spot the next multi-bag. Ideally, a business shows two trends; First growing give back In terms of capital employed (ROCE) and secondly, it is increasing Size Employed capital. Ultimately, this shows that it is a business that reinvests profits on rising revenue rates. Although, when we look at it Magni-Tech Industries Inc (KLSE:MAGNI), doesn’t seem to have all these boxes ticked.

What is Return on Capital Employed (ROCE)?

Just to clarify if you’re not sure, ROCE is a measure of how much a company earns before tax (as a percentage). Here is the formula for calculating this metric for Magni-Tech Industries Berhad:

Return on Capital Employed = Earnings Before Interest and Taxes (EBIT) ÷ (Total Assets – Current Liabilities)

0.14 = RM114m ÷ (RM875m – RM68m) (Based on twelve months to January 2023).

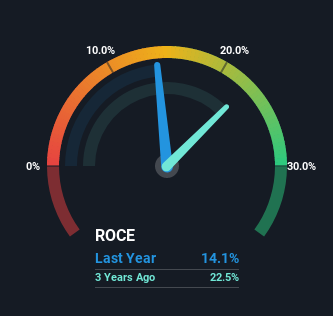

in order to, Magni Tech Industries has a combined ROCE of 14%. In absolute terms, that’s a very typical return, and closer to the luxury industry average of 13 percent.

Check out our latest analysis of Magni-Tech Industries Berhad

Above you can see how the current ROCE for Magni-Tech Industries Berhad compares to its previous return on capital, but there’s only so much you can tell from the past. If you want, you can see the analysts covering Magni Tech Industry Berhad here free.

How are the returns looking?

Given Magni-Tech Industries’ historical ROCE activities, the trend is not spectacular. Five years ago, capital gains were 26 percent, but since then they have fallen to 14 percent. However, both capital employed and income have increased, but the business seems to be showing growth at present, due to short-term returns. If these investments are successful, this could bode well for the stock’s long-term performance.

Our take on the ROCE of Magni Tech Industries

While Magni Tech Industries’ returns have fallen slightly in the recent past, we are encouraged to see that sales are growing and the business is reinvesting. Against this backdrop, the stock has gained just 31 percent over the past five years. So this stock can still be an attractive investment opportunity, provided other fundamentals prove to be sound.

One more thing to note, we have identified 1 warning sign With Magni-Tech Industries Berhad and understanding this should be part of your investment process.

For those who want to invest strong companies, Look at this free List of companies with strong balance sheets and high return on equity.

Have a comment on this article? Concerned about the content? Connect directly with us. Alternatively, email editor-team (at) simplywallst.com.

This Simply Wall St article is general in nature. We only provide opinions based on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to be financial advice. It does not provide advice to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide you with long-term analysis driven by fundamental data. Note that our analysis may not include recent price-sensitive company ads or quality content. Simply put, Wall St has no position in any of the listed stocks.

Join a paid user research session

They receive a. $30 Amazon gift card 1 hour of your time helping us build great investment tools for individual investors like yourself. Register here

[ad_2]

Source link