[ad_1]

I have been released from more startups than anyone I know. Yes, it’s weird to be proud.

Nearly 100,000 tech workers lost their jobs last month, and it felt like a major disruption in the workforce. These are real people struggling with real uncertainty: should they move? How long will their savings last? Should they risk another startup or start their own?

As public companies and unicorns cut headcounts, many early-stage startups are still actively recruiting. Mary Ann Azevedo answers several fintechs that are hunting for new talent.

Full TechCrunch+ articles are available to members only.

Use discount code TCP PLUS ROUNDUP Save 20% on a one- or two-year subscription.

Ron Miller interviewed analysts, CIOs and hiring managers, who confirmed that there is a wide demand for IT workers. The twist?

“People who leave Big Tech may not go to other tech companies,” reports Ron, adding that employers like the IRS, Citi and Liberty Mutual have posted thousands of new openings.

“The perception is, hey, there are too many discounts,” says Nicholas Marshall, director of sales enablement at Manpower Group.

But what we’re seeing is that in the last couple of years, those tech companies have been over-hired, and it’s more of a correction and improvement, but there’s still strong demand and job prospects. “

If you’ve been laid off, make taking care of yourself a priority. Ask for support from your friends and family and above all Don’t take it personally. You’re being swept up in macroeconomic trends that have nothing to do with your skills, abilities, or worth.

Thank you very much for reading

Walter Thompson

Editorial Manager, TechCrunch+

@your main actor

So the founder you’re supporting turns out to be problematic. what now

Image Credits: Retrorocket (Opens in a new window) / Getty Images

Even when things go offline, early-stage investors don’t closely manage the entrepreneurs who wash them with cash. And in some cases, they can’t exercise much power.

When a VC is supposed to invest in a safe note, “if that stake doesn’t turn into equity, they don’t have much say if things start to go wrong,” reports Rebecca Szkutak.

To learn more about how investors handle troubled CEOs, she spoke to:

- Cameron Newton, Founder and General Partner, Related Ventures

- Eric Bahn, Co-Founder and General Partner, Hustle Fund

- Angela Lee, Venture Partner, Professor, Columbia Business School

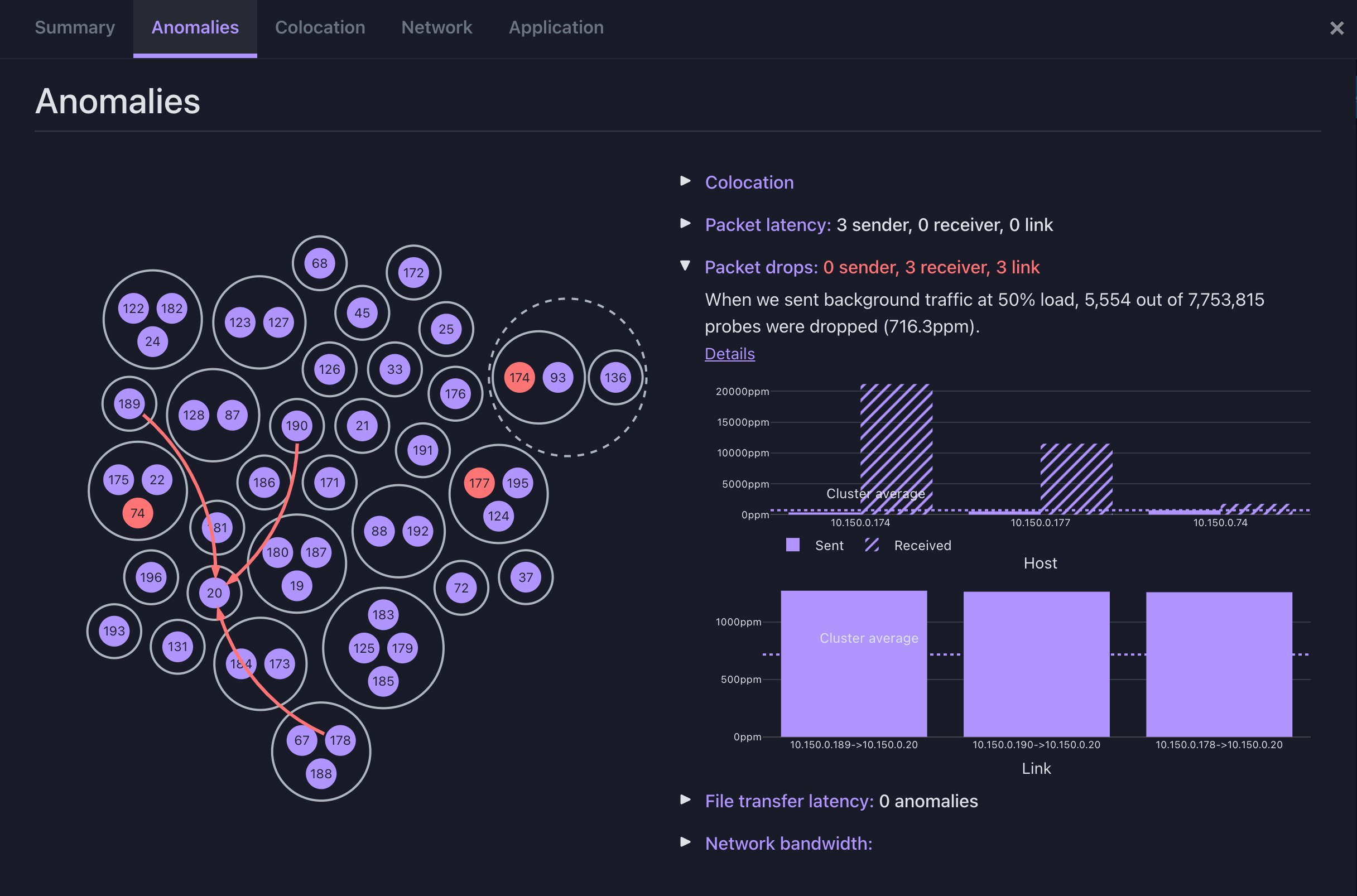

Pitch Deck Teardown: Game monetization company Insimo AI’s $850K seed deck

Image Credits: Enzymo (Opens in a new window)

Advertising in free-to-play mobile games is a billion-dollar industry, which is why Ensimo.ai aims to help advertisers maximize ROAS and LTV with its proprietary AI products.

Enzymo’s founders raised $850,000 in seed funding and shared all 12 slides with HJ Jan Kamps.

- Cover slide

- Problem slide

- The solution slider

- Drag slide

- Customer slide

- Business model slide

- Market size slide

- Market direction slide

- Goals / targets slide

- Group slide

- “The question” slide

- Road map slide

Dear Sophie: Am I eligible for an E-1 business visa?

Image Credits: Bryce Durbin / TechCrunch

Dear Sophie,

Am I Eligible for an E-1 Trader Visa? I’m from New Zealand and I have a B2B SaaS company with many clients in the US

We have a Delaware C Corporation that has raised funds and I am working at a subsidiary in Oakland where all our employees are located. We currently do not have a US office, but we file our taxes there.

– Kin Kiwi

5 buyer red flags to look for in the M&A process

Image Credits: Dibenitostock (Opens in a new window) / Getty Images

It’s tempting to think of M&A as a way for founders to make money, but acquisitions generally require teams to stay on board while the new owner integrates the business with their operations.

This can be a difficult time, according to serial entrepreneur Marina Martyanova, founders often clash with new owners in relation to growth, product priorities and communication.

“Buyers who can’t give you a clear picture of your company’s future after the acquisition don’t have your best interests in mind,” she writes.

[ad_2]

Source link