[ad_1]

Revenue season is winding down.With the largest US technology companies reporting second quarter results. But often the most interesting results come not from your Amazons or Apples, but from small concerns – and even from non-traditional technology companies. For example, SoftBank.

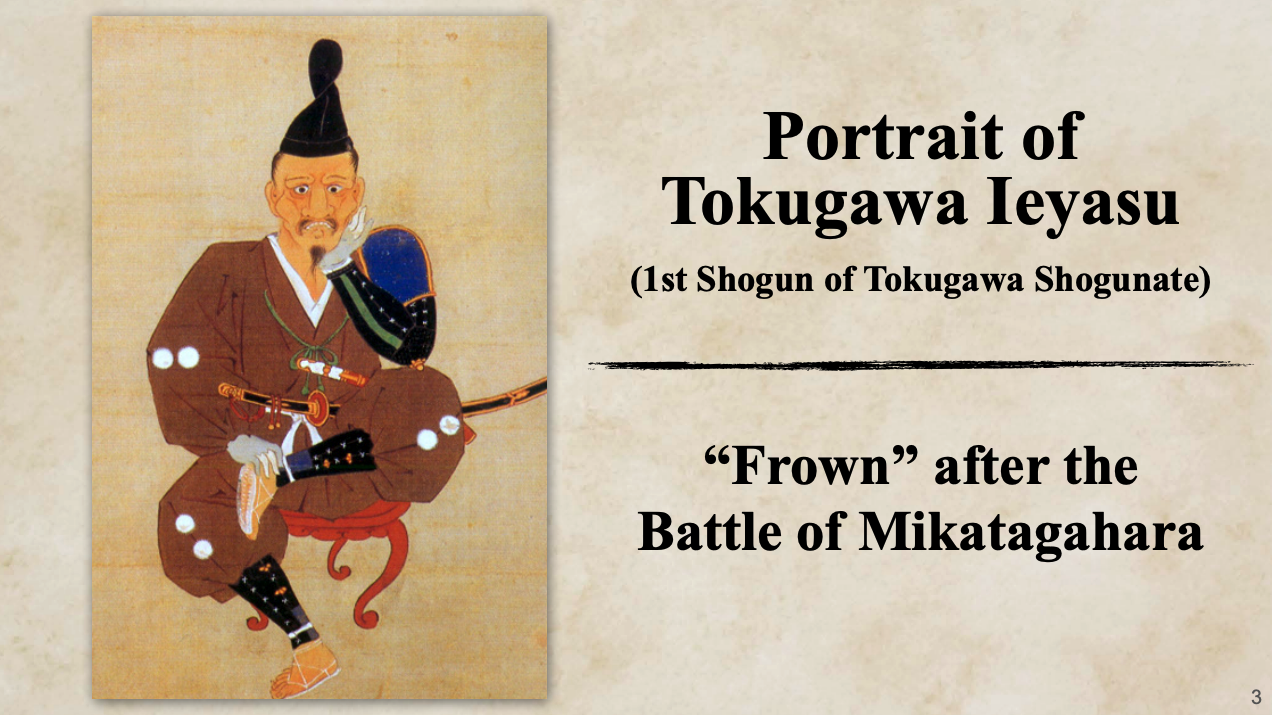

Today, Japan’s conglomerate and startup investing powerhouse reported that it was more than a little gloomy. SoftBank’s quarterly loss, estimated at 3.2 trillion yen ($24.5 billion), was its biggest ever, prompting the company to post the following image in its investor presentation.

Image Credits: SoftBank’s investor approach

They say a picture is worth a thousand words. So what went wrong? How did SoftBank lose so much money? Vision Fund, a two-part effort to invest more than $100 billion in private companies. Let’s see what caused the damage.

The exchange examines startups, markets and money.

Read it every morning on TechCrunch+ or get the Exchange newsletter every Saturday.

Before we do, however, it should be noted that the Vision Fund has gone through a transition period. After the WeWork IPO fiasco, it’s been a bit tougher on companies whose profits have become the world’s watch. But that doesn’t mean SoftBank has stopped putting capital to work — or immune to changing market conditions. Let’s see.

[ad_2]

Source link