[ad_1]

We have a beautiful face Big climate change is a challenge, and I have long doubted whether venture capital could be part of the solution.

That is why I was so excited when Harry wrote about the Fintech’s Enduring Planet. A very clever card is being played to try to provide immediate financial support to climate entrepreneurs4 Situation – where investors, beginners, the community and the environment all win.

It has enough detail to understand what is going on without falling into the rabbit pit. Simply put, I want every floor of the ship to do this well.

Today, I am pleased to present the floor of the ship that the company used to raise funds. As you might expect, it’s a bit of a baseball game – this is a beginner floor that helps other beginners raise money from other VCs – but you understand as well as Waiting, the enduring planet knows what it is doing.

The floor of the ship is very unusual, and it’s fun to get under the skin of how the founders are thinking about the turn. The company has done exemplary work on many slides, including many beginner mistakes and even some attachment slides, which will further enhance the history and context of the fundraiser.

I have a mind to share this with you – LFG!

We’re looking for more special pitch floors to demolish, so if you want to install your own, here’s how you can do that.

Slides on this floor

The permanent Planet Slide deck has some light adjustments, but the main deck is more or less intact. The company removed revenue numbers (but saved the graph) on slide 16. Eliminates deep rotation in the bottom line and removes company names from the slide. It also deleted several attachment slides (confidential information about the text, its structures, etc.).

The main deck has 18 slides, and the company includes five attachment slides. This is the first time I’ve been able to include attachment slides as part of Peach Deck demolition. I look forward to getting in and out of the appendix slides!

- Cover slide

- Group slide

- “Some Investments to date” – Traction Slide

- “Trend” – “Why now?” Slide

- “Expanding Investment in Organizations and VCs” – Market Evolution Slide

- “Governments are challenging private sector action” – Global Market Opportunity Slide

- Skyrocket Start + SMB Expansion ”- Market Trend Slide

- Problem slide

- The slide of the solution

- Product slide

- “ML and Automation” – Product Slide Slide

- Value Proposal Slide

- Slide Key Investment Requirements

- Pipeline slide

- The road map slide of the solution

- Financial Forecast Slide (edited)

- Team and board slide

- “Fundraising Target” – Ask for a slide

- Attachments cover slide

- Attachment – Detailed problem slide

- Attachment – Sample VC Partners Slide

- Appendix – Key Investment Requirements Slide Sector List Slide

- Appendix – Key investment requirements slide equity and inclusion list slide

- Appendix – Disaster Management Slide

Love three things

There are some very serious issues on this deck, but I will bring them to the end of this article. Although there is a great story to be played here – so let’s get started there!

No fists are pulled by the ship.

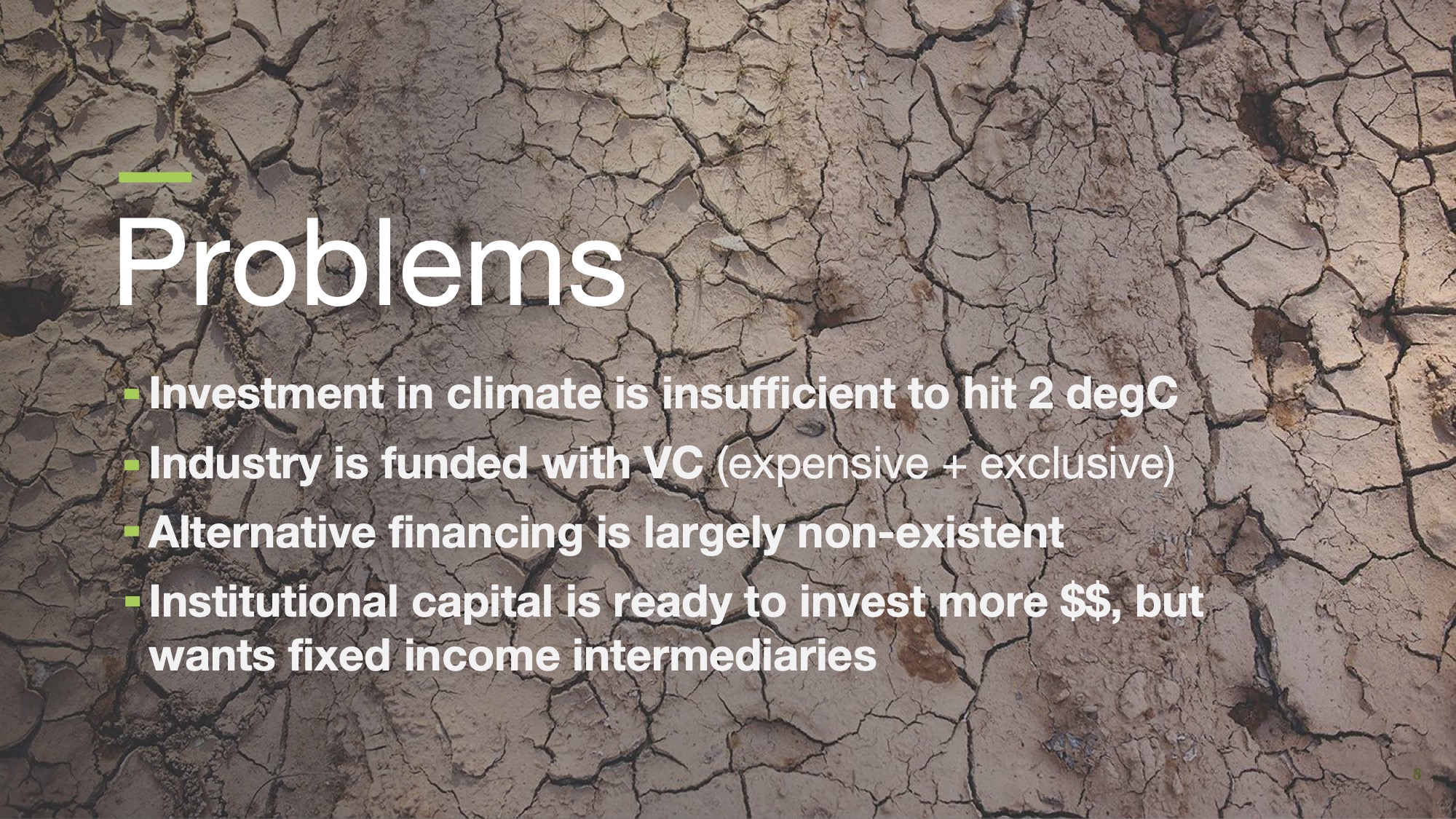

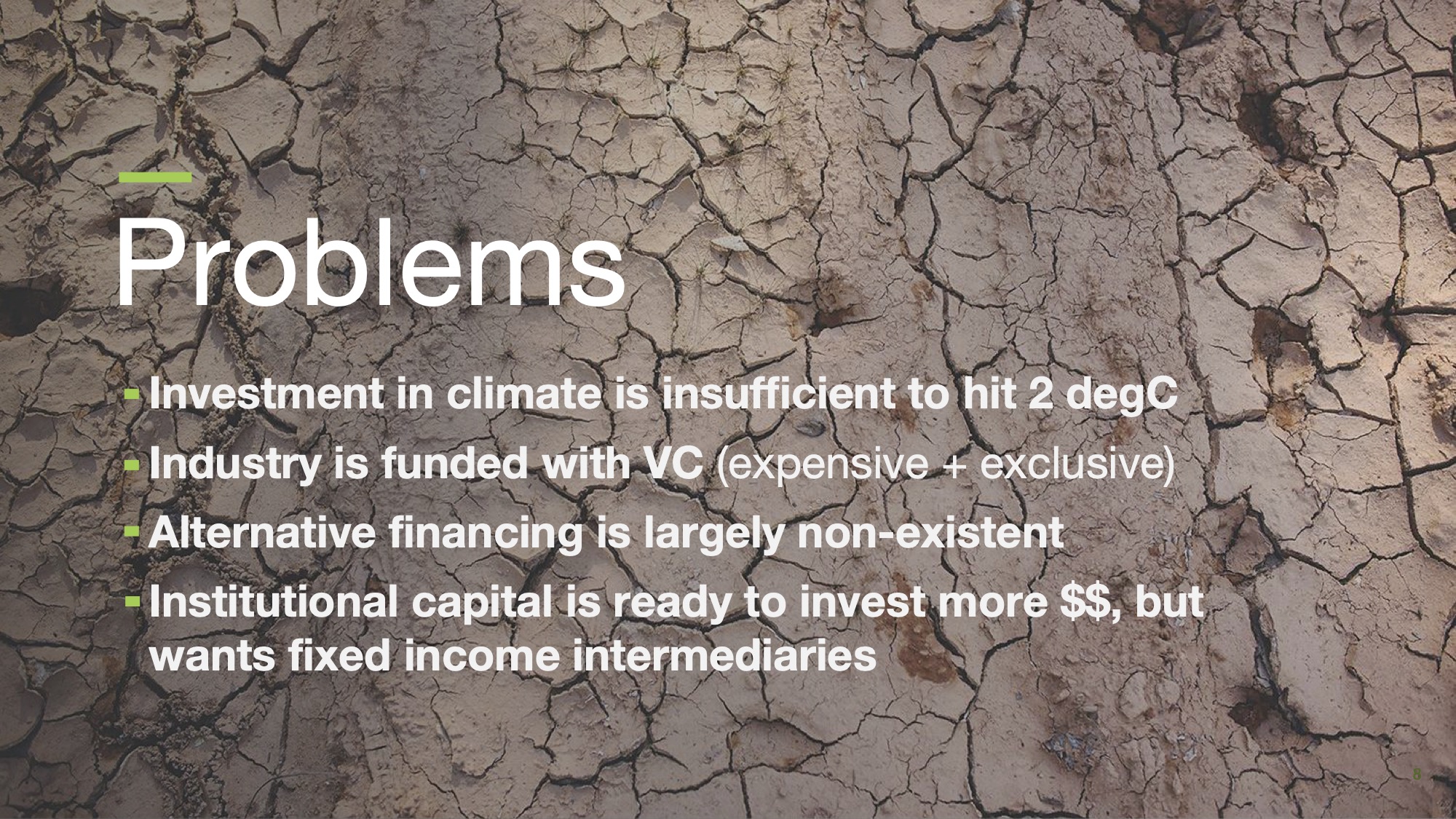

[Slide 8] The company’s problem is that the slide is bold. Image thanks Permanent planet (Opens in new window)

I had to laugh when I saw the end of the planet’s “problem” slide. He is collecting money from Venture Capital companies, but no punch is enough.

The company briefly describes the problem and hints at its own solution at the end – that institutional capital wants to invest more money but there is no effective way to do so. It’s one of the cleanest and easiest problem slides I’ve seen in a while; It lists both major problems and indicates the magnitude of the opportunity.

Solution and product slider work together

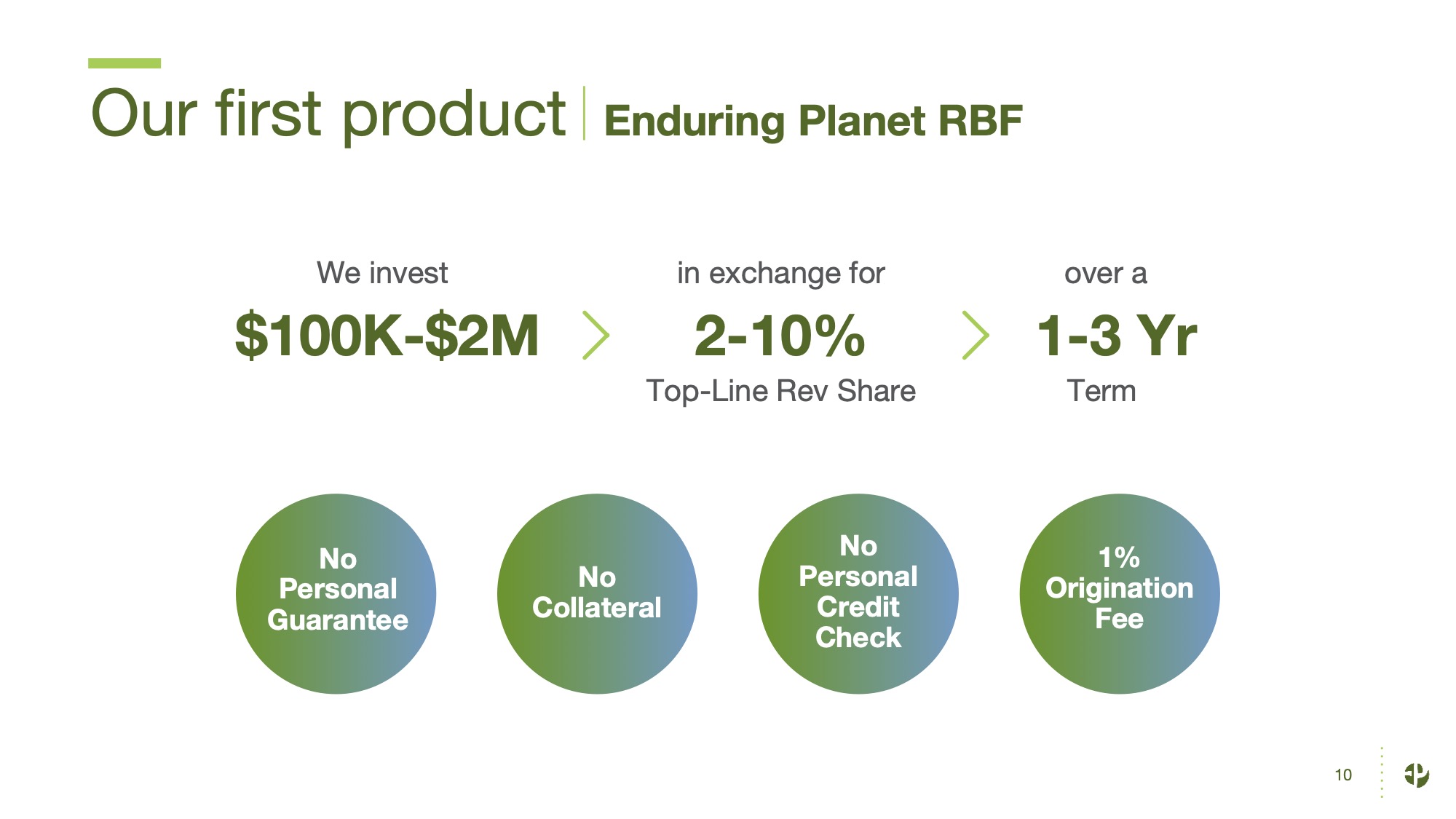

[Slide 10] Product slide. Image thanks Permanent planet (Opens in new window)

For a long time, I had a weakness for companies that could clearly describe the solutions and their products as two different stories. There is good reason to do so.

Especially in the first place, you think that your product is a good solution to the problem, but you are not sure. You are preparing yourself for success by divorcing the solution that your company believes in. You can always copy correctly. why You provide a solution – you are showing a deep understanding of your market. In addition, they are preparing a story with more than one product to solve a whole set of problems in the industry. That’s what the Enduring Planet is doing here.

On the solution slide (slide 9), the company said the solution “is a climate-specific loan platform that provides the most suitable capital for entrepreneurs using the latest automation technology.” It sounds like a mission, but pay close attention.

From Slide 9, he moves on to the product, and he clearly states that this is his first Product. There is no whispering here.

If you are in the process of raising funds, see slides 8 through 10 on this slide floor. The Sustainable Planet does a good job of presenting the problem / solution / product in an integrated history, without having to go into the rabbit pit in detail to understand what is going on here. Simply put, I want every floor of the ship to do this well.

Victory / Winner Value Proposal

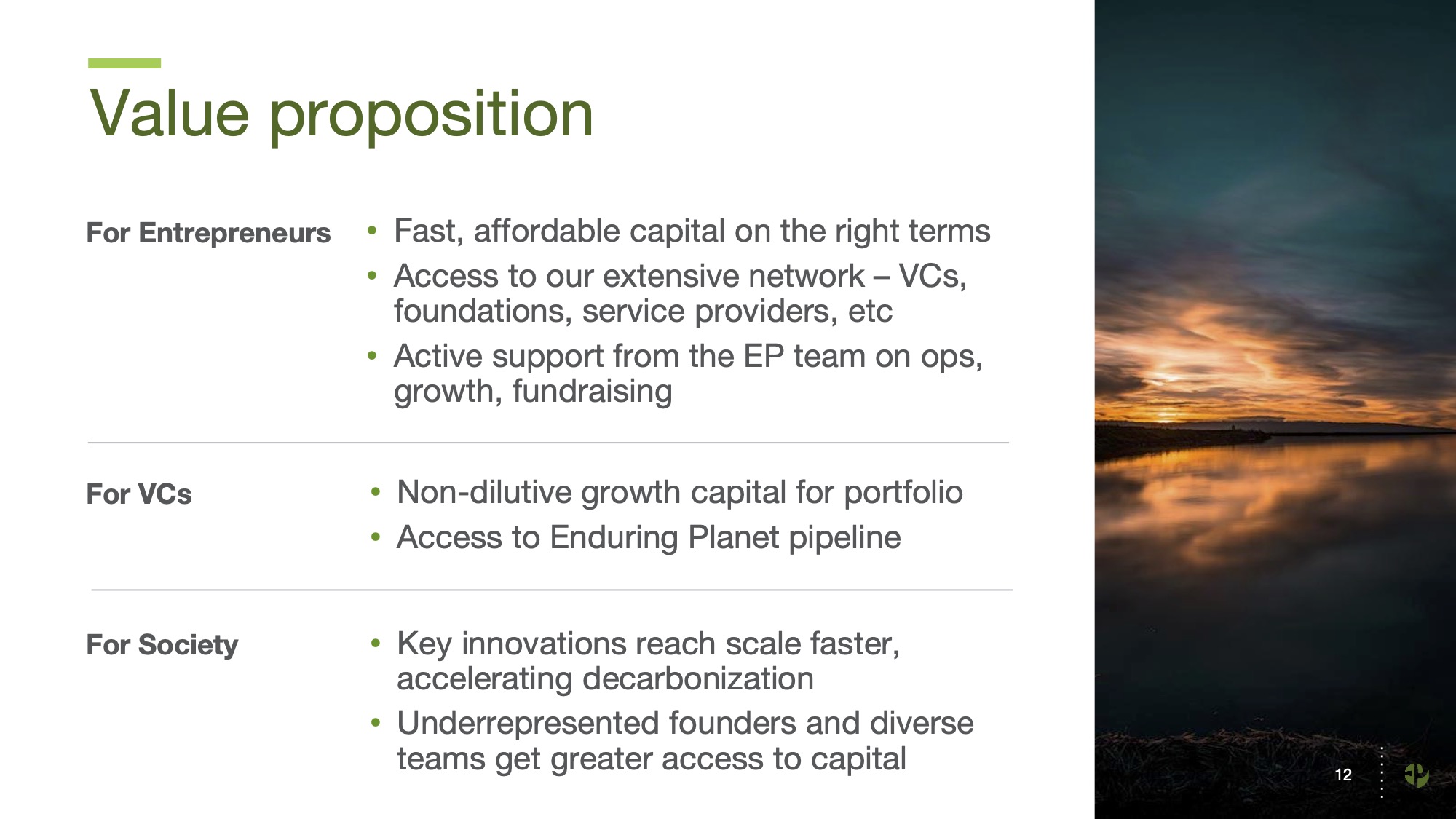

As I pointed out in the introduction, the permanent planet does a particularly good job of drawing a world where everyone can win.

[Slide 12] Value proposal slide. Image thanks Permanent planet (Opens in new window)

I often see value proposition slides in Peach boats; Often, they show benefits to customers. It is encouraging to see how a sustainable planet looks at the world. In the appendix, it expands on how to visualize a society where everyone is dragged in one direction.

Pay more attention to this “VCs” section – I want to be an investor. With two short bullet points, Enduring Planet can create two different points. “Unchanging Growth Capital for Portfolio Companies” is a powerful statement; This means that the sustainable planet is promising VCs that the companies can move forward without further injustice. Given that VCs are typically adapted to take care of their proprietary (and, in turn, they are allergic to unwanted dyes), that is a strong promise.

The second point is related, but it is very different. That is a gold mine for VCs who want to invest in this area. As a company prepares to promote equity financing, some of the roadblocks after acquiring financing from the Enduring Planet are in a state of shock. .

Bonus: Extras

Image thanks Permanent planet (Opens in new window)

I wanted to quickly see more of the objects that the enduring planet used in the Peach stage. It is useful to take a closer look at them on the entire deck below, but I like Slide 20, which expands the company’s claim that it is “neither capital of climate entrepreneurs nor costly or accessible.” It provides a complete matrix of how equity, aid, business debt, venture debt and income-based finance are weak ways to start a business in this area. It makes the most beautiful and sustainable planet a great financial option. “These challenges are huge for founders who are not in the climate-technology ecosystem,” the company said.

This is a good example of why you are considering grabbing the application in the first place.

Placing such a slide on the main floor will be distracting; Details There are 20 cells, and if you care about such a thing, you can easily take advantage of each of the financial support options for several hours individually and for different startups. The enduring sides of the planet that beautifully; If the VC wants to discuss the matter in more detail, they can quickly swipe to the relevant slide and show that they have done mental work to answer the question. And it’s great if it doesn’t come out as part of the field. The information is that the investor has to enter the meeting after or after the call, and they do not waste any time in the limited volume of time. This is a good example of why you are considering grabbing the application in the first place.

In the rest of this tear, we see three things that could have been improved or worked out in a permanent way with a full peach floor.

[ad_2]

Source link