[ad_1]

As if the logistics and transportation technology market isn’t slowing down (recession be damned), HyperTrack, a startup that provides APIs for freight order planning, placement and tracking, closed a $25 million Series A round of funding today. The round, led by Westbridge Capital with participation from Nexus Venture Partners, will be used to expand HyperTrack’s engineering team and “double down” on broader growth, CEO Kashyap Deorah told TechCrunch in an interview this month.

As supply chain challenges persist, VCs see logistics startups — including HyperTrack — as safe bets in choppy market waters. While the investment in early 2022 has slowed compared to 2021, startups developing transportation and logistics technologies still raised $14 billion in Q1 alone, according to Pitchbook.

The pandemic has dramatically accelerated the growth of on-demand delivery, the gig economy, and software automation. All three factors have served as tailwinds for HyperTrac’s growth,” Deora told TechCrunch in an email. “Two of the most pressing challenges for technology leaders are hiring talent and optimizing cloud accounts. As development roadmaps continue to lag, business needs speed to market. APIs help technology teams build their applications on their own at a predictable time and cost.”

Prior to launching HyperTrack, Deora owned blogging platform RightHalf.com and restaurant payment app Chalo (among other startups) acquired by Stratify and OpenTable. After spending more than a year at OpenTable following the Chalo acquisition, Deora said he was motivated to acquire HyperTrac because of growing demand for locations in the “on-demand” economy (such as food and delivery services). and mapping technology.

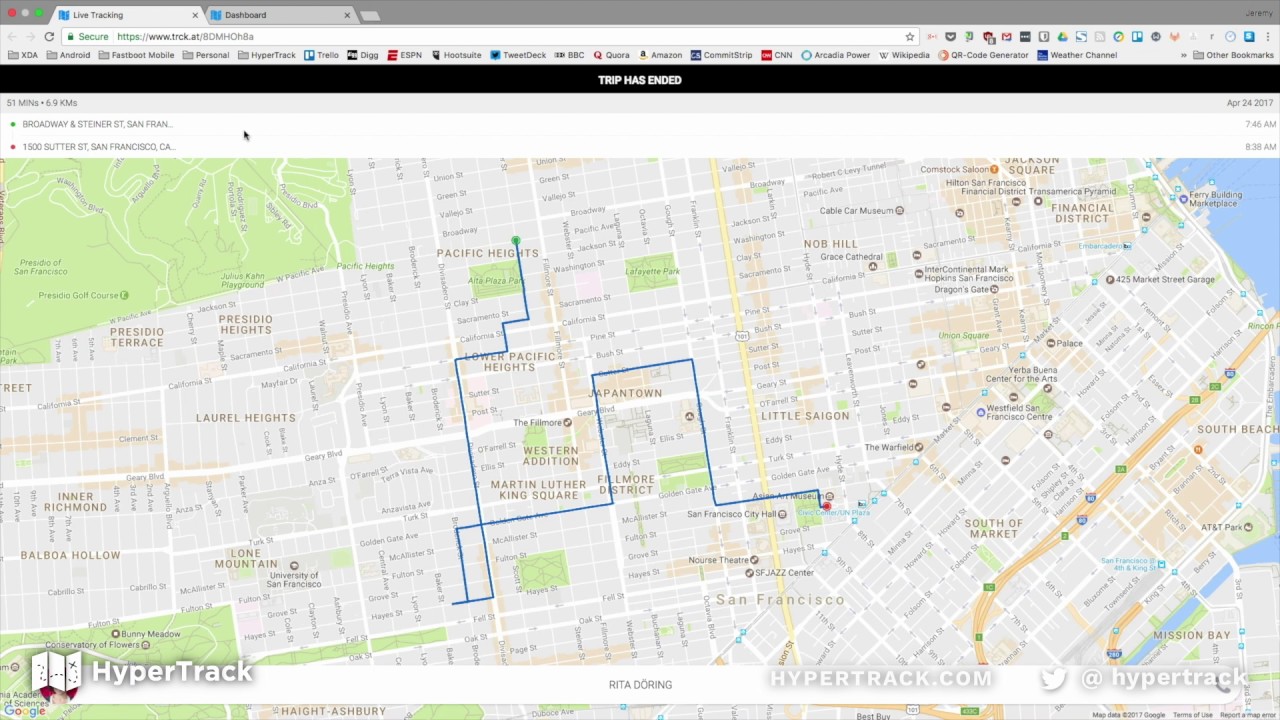

Image Credits: Hypertrack

“In the early days of Doordash, Instacart and Postmates, then the so-called ‘Uber-for-X,’ I saw the on-demand economy as the nexus of physical and digital commerce across multiple industries and regions,” Deora said. “HyperTrack has seen more and more enterprises build their own logistics technology solutions, specifically to meet the demands of gig workers. Our APIs offer better solutions, support and cost forecasting than HyperScalers.”

As Deora explains, traditionally, on-demand delivery companies have taken a “linear approach” to geocoding customer addresses. (“Geocoding” refers to the conversion of location descriptions, such as addresses or place names, into geographic coordinates.) But the addresses are not always accurate. According to a recent study, the coordinates vary widely among vendors, with one vendor only having 30% of the addresses correctly.

HyperTrack, on the other hand, uses “ground truth” delivery data – data from orders fulfilled and routes taken to destinations – to calculate address accuracy in addition to metrics such as service times, route deviations and live driver locations. The platform feeds this data back into AI systems to “continuously” improve delivery order planning and placement, says Deora — preventing late orders, underpayments to drivers and incorrect ETAs.

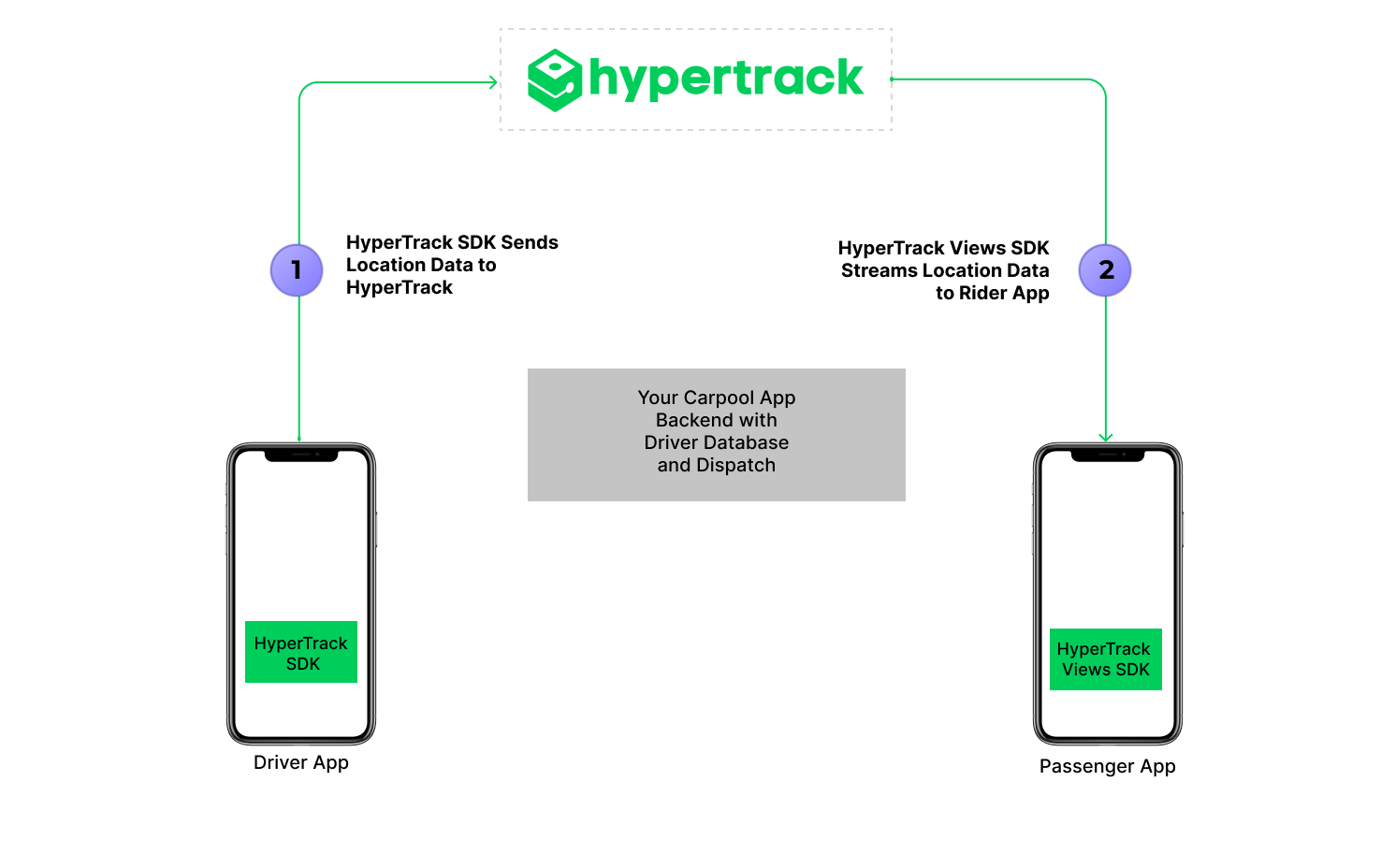

For customers, HyperTrack provides software development tools and APIs specifically for last-mile logistics or the last leg of an order’s journey. The toolkit allows companies to build workflows that help predict things like capacity utilization and order costs, and capabilities like proximity search, geotags, geofences and “flexible routes” in consumer and delivery driver applications.

HyperTrack solves the logistics bottleneck that other vendors, including Google and Amazon, have tried to solve with their own solutions. For example, AWS’ Amazon Location Service lets developers add features like maps, routing, and tracking to their apps, while Google’s Last Mile Fleet Solution ships with APIs, SDKs, and backend services for mapping and routing functionality.

But Deora says HyperTrack is one of the few offerings on the market that combines mobile, cloud and maps at a commanding price. He takes aim at startups like Onfleet, Bringg (which became a unicorn last June) and Locus, which he says only offer proprietary packaged apps, as opposed to unpackaged APIs and development tools.

Cost is a major challenge for logistics providers in last mile delivery. According to Statista, more than half of them cite an increase in shipping costs Main Challenge, then meet the reliable order and lack of staff. Eighty-two percent of brands feel they need to improve their customers’ last-mile experience, a separate study found — in part by increasing delivery options and increasing sustainability.

The stakes can be high. In the year A Florida trucking contractor’s reliance on the US Postal Service’s flexible routing software has cost it $110 million in 2021, forcing it to cut hundreds of jobs and file for a lawsuit. Amazon’s cost-effective routing algorithm is reportedly driving traffic.

Image Credits: Hypertrack

“Logistics technology developers can often be overwhelmed by the variety of route finders, mapping platforms, cloud technologies and smartphone APIs they need to build simple use cases – not to mention static fleet management apps that confuse developers with their APIs,” he says.[Using HyperTrack,] Logistics technology developers no longer need to spend months developing with a team of engineers to build consumer and driver applications for mobile, live location tracking, operations dashboards and cloud infrastructure.

Against the fierce competition, HyperTrack appears to be doing well, with 3,000 apps using the platform, including technician company JobBox and home services company Spiritzo. Deora – which declined to disclose revenue numbers – said the platform is now coordinating 10 million orders per month among 150,000 drivers.

In 2022 alone, Hypertrack has grown from 15 to 30 employees and we plan to grow to 40 in the next few months. Deora said. “[HyperTrack] It was a complex product to build, but here we are with a large product and many users of the product, and now it’s time to increase the development.

The Series A tranche brings HyperTrack’s total raised capital to $32 million.

[ad_2]

Source link