[ad_1]

Real estate technology company Redfin Corporation (RDFN -2.29%) It is trying to change how people buy and sell their homes. Buying a home is a complex and often stressful process, but that hasn’t changed much over time.

The idea of easily buying and selling your home is attractive, but Wall Street isn’t buying into Redfin’s business model; The stock is down 90% from its high.

Redfin could be a home run if things work out long-term, but there are some red flags investors should be aware of before risking their money.

Why is the brokerage business not growing?

Redfin is one of the most exciting companies in the real estate space. From its brokerage, which pays agents a salary and charges much lower commissions than traditional agents, Redfin Now’s division is a mixed bag of ideas for buying and reselling your home outright (known as ibuying).

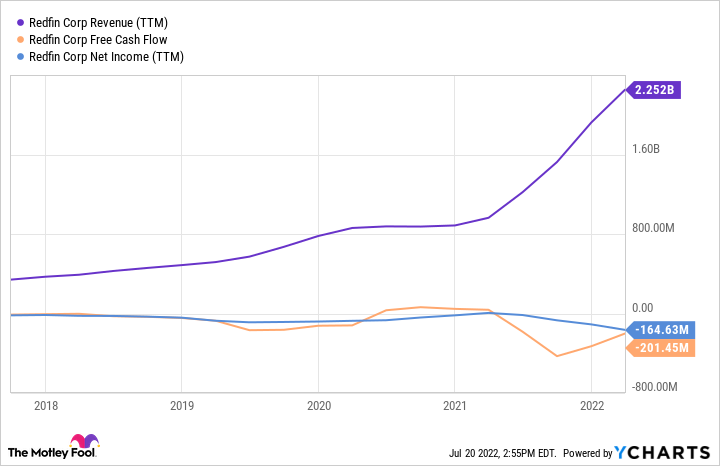

The business has seen significant growth over the past several years, but the company’s free cash flow and bottom line have gone in the opposite direction.

RDFN Revenue (TTM) data by YCharts.

Digging into some numbers is where you start asking the hard questions. For example, look at Redfin’s brokerage business, which generates trading commissions.

Redfin increased from 1,399 to 2,750 as of June 30, 2020. It has increased to 2,750 on March 31, 2022. Jump up.

In fact, much of the growth in real estate services came from home price appreciation, and the company’s average revenue per transaction increased 36 percent, from $7,576 to $10,346.

When you bring in more people, you want to move more homes, and Redfin’s inability to meaningfully increase volume with more people is a concern. That doesn’t mean it won’t change, but it’s something to watch.

Is iBuying going to work?

Redfin is now a new part of the company, where it buys and resells homes for cash, a process known as iBuying. The total transaction price is treated as income, meaning that a $600,000 house that Redfin bought counts all $600,000 as income.

The iBuying industry is still a bit of a mystery on Wall Street; Zillow They tried and gave up, many are still skeptical Open doorThe most pure-play iBuyer in the industry.

Redfin’s continued growth has primarily driven the company’s top-line growth over the past 24 months. The company sold 617 homes for $376 million in the first quarter of 2022, compared to just $90 million for 171 homes last year.

But Redfin’s current gross profit margins were just 5.5% for the quarter, leaving little room for error. The housing market has become more volatile since then, and investors will be watching how Redfin fares in the coming quarters in a challenging market.

Caught between a rock and a hard place

Ultimately, Redfin is currently operating as a low-margin company. Gross profit margin in Q1 2022 was over 12 percent. A low margin is not a bad thing; Walmart He sells tons and tons of items, making a sliver on each item.

But Walmart can make money because it sells so much that all those little quotes add up. If Redfin doesn’t fundamentally change its business in a way that boosts its margins, it will need to increase volume dramatically to become profitable.

That’s why the market is so fragmented as Redfin struggles to grow its business, especially in the brokerage segment. Redfin should be growing market share, but has struggled to get above 1% so far. It is cutting about 6% of its workforce due to market conditions, which could further hurt its growth efforts.

Redfin has long-term potential; Any company that can add value to a multi-trillion dollar industry is valuable. The stock decline has reduced Redfin’s market value to $1 billion. But here too there are many risks and Redfin is not sure to work in the long run. Investors should approach with caution and always use diversification to reduce portfolio risk.

Justin Pope has positions at Opendoor Technologies Inc. The Motley Fool has positions in and recommends Opendoor Technologies Inc., Redfin, Walmart Inc., Zillow Group (A shares) and Zillow Group (C shares). The Motley Fool recommends the following options: Short August 2022 $13 calls to Redfin. The Motley Fool has a disclosure policy.

[ad_2]

Source link