[ad_1]

Everybody expected that Intel was going to turn in a pretty bad final quarter in 2022, and even before it posted its numbers yesterday after the market closed, there were plenty of signals that it was going to be worse. And it was. And the worst is still yet to come here in 2023, we think.

The PC business, which exploded during the coronavirus pandemic in tandem with a rise in datacenter compute for the hyperscalers and cloud builders as well as for enterprises and governments, imploded last year and many think Intel is being overly optimistic about the prospects for a PC rebound. Intel is also facing competitive threats from AMD in its core X86 server business in the datacenter, and is also seeing the rise of Arm in both the PC and the server. And it still doesn’t have its foundry at anything close to parity with that of Taiwan Semiconductor Manufacturing Co, and won’t for at least two years. And thus, it can make some design wins on architecture with its chips, but most of the time it is going to be making supply wins where the price per unit of compute is being set more by its rival AMD and its supply and the Arm upstarts.

We now have eight quarters of financial results as we look back on Intel’s reorganization under chief executive officer Pat Gelsinger, who took the helm of the chipmaker two years ago and who diced and sliced the company groups and the executives in charge of them in June 2021.

Many things are obvious in hindsight. The first is that the creation of the Data Center and AI group, which correctly absorbed the Programmable Systems Group FPGA business that came to Intel from the $16.7 billion acquisition of Altera in June 2015, was designed to boost profits as much as possible and to get some money-losing adjacencies, such as its network switching business, out of the DCAI profit and loss ledgers.

The second thing is that the AXG spinout of discrete graphics for visualization and compute was just a way to keep the losses that Intel’s GPU efforts would incur out of its DCAI group and as well as its Client Computing group. The reorganization of the DCAI and NEX units was also designed to make both look stronger, and NEX had pretty good revenues thanks to the Xeon and Xeon D sales in datacenter and out at the edge (particularly in cell towers). But really, NEX is mostly part of a “datacenter” business, if you want to think of the edge as an extension of the datacenter. So even this split between DCAI and NEX is somewhat arbitrary.

But it was a place for Intel to put together its Ethernet NICs, FPGA SmartNICs, and full-on DPUs with its Ethernet switches (from its June 2019 acquisition of Barefoot Networks) and with its cell tower and network function virtualization compute engines – and a way to keep network industry luminary Nick McKeown around to help sort its networking strategy.

On the call with Wall Street analysts, Gelsinger said that Intel was mothballing its Ethernet switching business, although it would continue to support existing customers using its “Tofino” family of switch ASICs. This echoes the quiet mothballing of the Omni-Path InfiniBand switching business by Intel in July 2019, but in that case there was enough demand for Omni-Path – and importantly, a competitor to Nvidia’s Mellanox InfiniBand – for Cornelis Networks to pick up the technology and some of the people and to start a new business. (Well, really reprise the old SilverStream/QLogic business that Intel bought back in January 2012 for $125 million.)

Now, the Flex Series GPU accelerators and the Max Series CPUs and GPUs that were part of AXG are going to be rolled into DCAI (where they always belonged), and Gelsinger was clear that these products would continue out into the future and were not part of its massive cuts. (Intel is seeking to remove $3 billion in costs this year and between $8 billion and $10 billion by 2025.) The remaining discrete GPU accelerators that were part of AXG will move to the Client Computing group, where they also always belonged. The amount of revenue these products generate today is fairly small, but the costs of research and development over the past several years have been enormous. And the roadmaps ahead are aggressive. And that means costs will still be running high, and will affect the operating margins for both DCAI and CCG out into the foreseeable future.

This is not a good time for these two groups to be taking on additional costs, as is immediately obvious from the numbers.

Let’s walk through the numbers, and it might be a good idea to put on some rubber boots because this is going to be a bit messy.

Seeing Red

In the quarter ended in December, Intel posted $14.04 billion in sales, down 31.6 percent as it comes under intense pressure from AMD in the PC and server markets for X86 processors at the same time it has pushed a lot of its products into the channel in prior quarters of 2022. Intel swung from an operating income of $4.99 billion in the year ago period to a $1.13 billion operating loss in Q4 2022. Net income swung from a $4.62 billion gain to a $664 million loss year on year, and Intel’s cash hoard shrunk by 20.3 percent to $28.34 billion.

The supply rate into the PC market by Intel was 10 percent above the consumption rate for all of 2022, according to Gelsinger, and it was quite a bit larger in Q4 and will be even higher in the first quarter. In fact, Gelsinger leveled with Wall Street and said the sell in rate into the channel for Q1 2023 for PC chips would be half the consumption rate – that’s how much the channel is choking on what it already has.

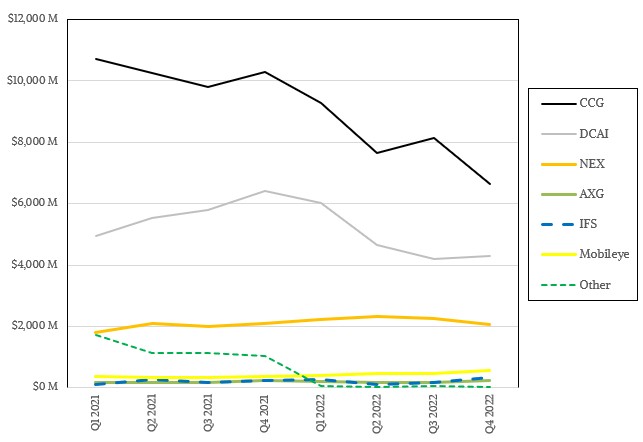

And so, revenues and net income at CCG has taken a predictable dive:

We only really care about that inasmuch as profits from CCG can help cover the capital expenses for fabs and development costs for datacenter compute engines and buy Intel some time to get its act together. But the PC business is not much of a savior, and this is the third point to make in the wake of the Intel reorganization nearly two years ago. Intel was not expecting for the PC business to go up on the rocks. And now, it has to rejigger everything because the profits there are shrinking, too.

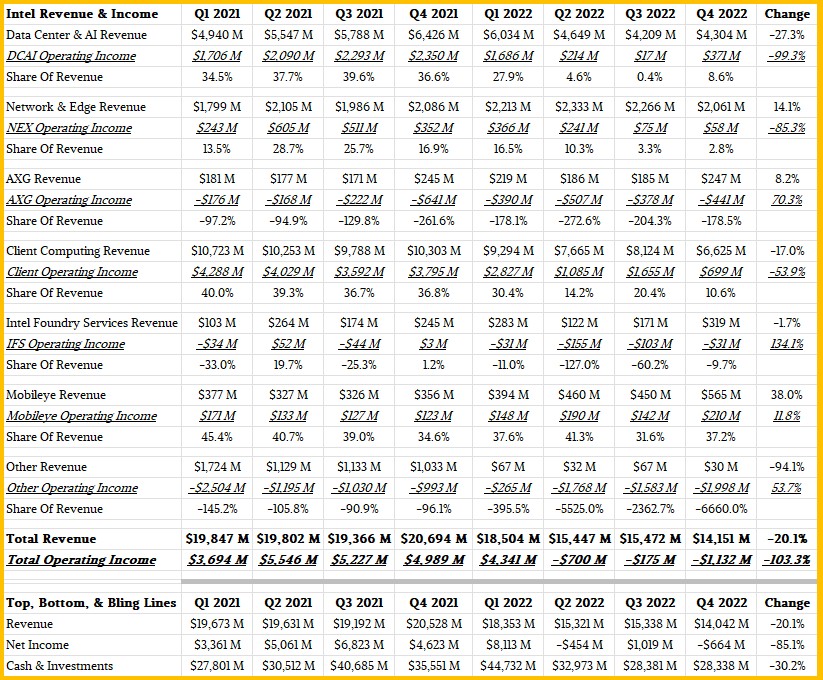

Here is a summary table of the groups with their revenues and operating income, which we have been dying to publish for the past year and now we have a complete data set now that Q4 2022 is over. Take a gander:

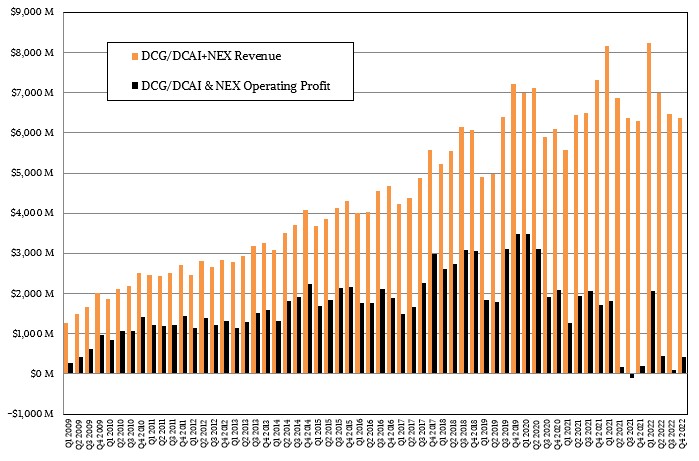

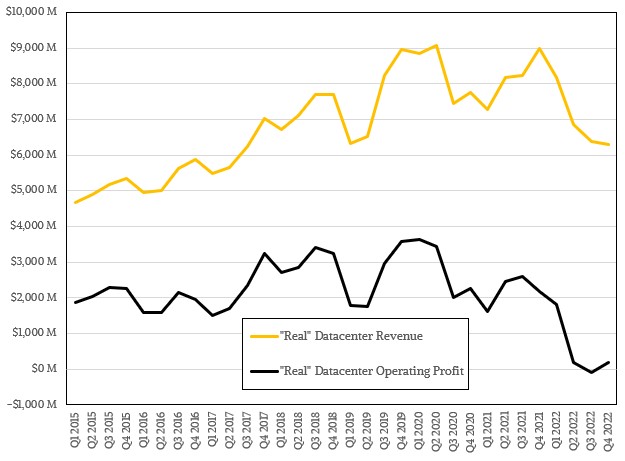

One more chart and then let’s talk. This one plots Data Center Group revenue and operating income through the end of 2021 and then DCAI plus NEX for 2022:

It has been a hell of a run since the Great Recession, but you can see the spikey nature of hyperscaler and cloud builder spending and then the competitive pressure from AMD and the rise of Arm servers in that data. And you can see that the old Data Center Group (created and ran by Gelsinger so many years ago) was either losing money or close to it (at an operating level) in 2021, and even after the new way of doing the books that got AXG costs away from DCAI and NEX, the operating profits have quickly collapsed down to miniscule.

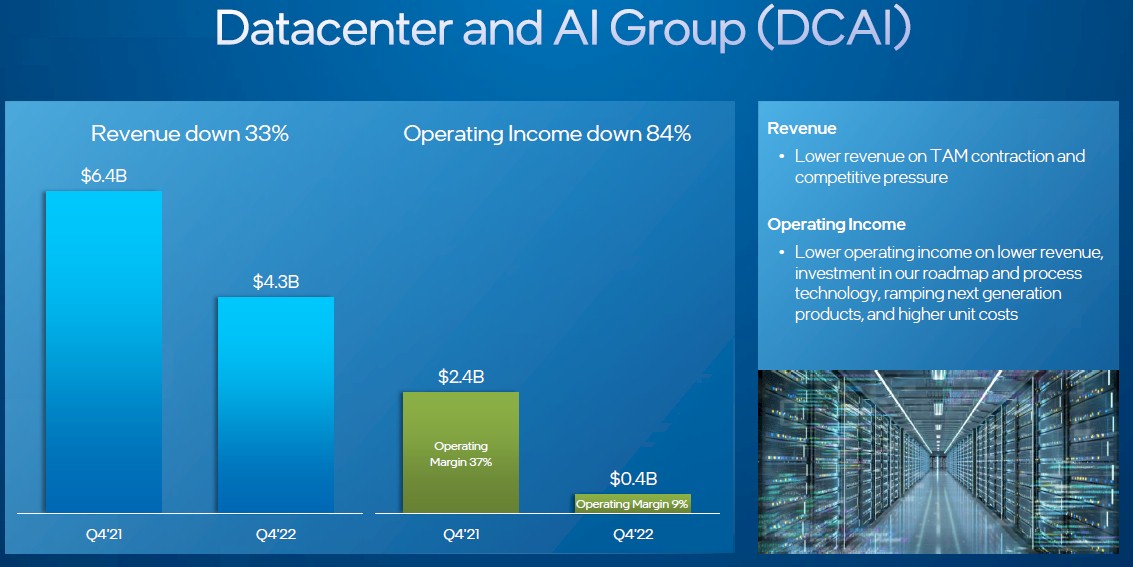

In the fourth quarter, DCAI sales were off 27.3 percent to $4.3 billion and operating income plummeted to $371 million, down from $1.69 billion a year ago and attributable to lower volumes both lower average selling prices. In its 10-K filing with the US Securities and Exchange Commission, Intel said that server CPU shipments were off 16 percent year in 2022 compared to 2021 and that blended ASPs across its Xeon SP line were down 5 percent for all of 2022.

That doesn’t sound so bad until you do the math. Our friend Aaron Rakers over at Wells Fargo Securities noted Intel said that shipments were down 6 percent through the first three quarters of 2022 and that if you do the math then shipments had to be down somewhere “in the low 40 percent y/y range” and our math says 42 percent. The model built by Rakers said Intel was able to get ASPs up by 2 percent in the fourth quarter, year on year, which is good news and thanks to the “Sapphire Rapids” Xeon SP soft launch to the hyperscalers and cloud builders last fall. Rakers puts Intel’s server CPU revenues at around $3.7 billion in the quarter, down 1 percent sequentially and down 41 percent year on year.

Squish. Squish. Squish. Told you it was going to get messy.

As you definitely expected, Pat Gelsinger was a cheerleader for Intel when asked about how Intel would take on AMD when the hyperscalers and cloud builders have made a pretty big shift to AMD chips. In a sense, AMD is the incumbent now, not Intel, among these customers. Or is at the very least, one of two incumbents and the one whose roadmap is being copied (again, like “Nehalem” Xeon E5500s were a copy of the AMD Opterons) and who has the stronger foundry partner is AMD, not Intel.

Here is Gelsinger quoted in full:

“I think the most important thing is what we just did with Sapphire Rapids. Our customers were anxious for a great product from Intel. Obviously, we would have liked it to be earlier, as we had initially estimated, but we are now shipping a very high quality product with significant areas of leadership in areas like AI performance, power performance, security feature function, high performance computing workflows that are 5X the competition and with features in areas like confidential computing and security that are quite differentiated from anything in the marketplace. Obviously, there has been share shift, particularly in the datacenter space. But these designs were one a year ago or two years ago. And so it takes some amount of time. And against that, we’re seeing a very strong outlook for Sapphire Rapids ramp through the year, as I said, 1 million units in the middle of the year, so very strong demand from our customers.”

“And the other thing, as we’ve indicated, is have we rewon our customers’ confidence that they could bet on our road map. And Emerald Rapids, looking very healthy for later this year. Granite Rapids and Sierra Forest looking very healthy for next year. And all of those, I believe, are rebuilding our customers’ confidence. And I believe with that, given the massive incumbency that Intel has – and I would just emphasize that even though we have seen the share shift in recent sell-in, the installed base is Intel. There’s an enormous base. Many of the cloud customers, 95-plus percent of their installed base is Intel and that gives us a very strong incumbency that we get to renew as we rebuild our customers’ confidence.”

“So as you put all of those things together – yes, we realize that we stumbled, right? We lost share. We lost momentum. We think that stabilizes this year, and we’re going to be building a roadmap that allows us to regain leadership for the long term in this critical market.”

The Roadmap Back To Competitiveness

The “Emerald Rapids” Xeon SP rev of Sapphire Rapids, which is being implemented on a refined Intel 7 process (which is a tweak on the 10 nanometer processes used to make Sapphire Rapids Xeon SPs), is sampling and on track to be delivered in the second half of this year, and the “Granite Rapids” P-core and “Sierra Forrest” E-core variants in the Xeon SP line – Intel is splitting its server chip line in two much as AMD is with its “Genoa” and “Bergamo” variations of the Zen 4-based Epyc chips. Gelsinger said that both Granite Rapids and Sierra Forrest were on track for 2024. But of course, AMD will have its “Turin” and derivative Zen 5 chips out by then. (You can see our Intel server roadmap analysis here and our AMD roadmap analysis there.)

Intel might be talking up the benefits of Sapphire Rapids Xeon SPs, and that it will have shipped 1 million of them by the middle of this year. But in a world where maybe 15 million servers this year will be sold and maybe 31 million server CPUs (that is assuming a 20 percent ship rate for single-socket machines, which are rising in popularity as sockets get more and more cores), 1 million is just not a lot of server chips. And we think a lot of customers will wait for Emerald Rapids if they can and take a very hard look at Genoa and “Milan” Epycs if they are priced aggressively (which they will be). Ditto for “Ice Lake” Xeon SPs if the prices for them are slashed.

If anything, what we are witnessing is the utter collapse of 14 nanometer “Cascade Lake” as an option for all but the stingiest of customers, and so Intel is gated by its 10 nanometer production until Intel 3 (roughly analogous to a 5 nanometer process) comes around with Granite Rapids and Sierra Forrest next year. You can argue amongst yourselves if Intel 3 is analogous to TSMC 3N or 3NE. Even Intel says it won’t be at parity until Intel 20A, which is in some respects a 2 nanometer process by the old way of naming it, when it comes in 2025.

So Intel will have to keep getting as many design wins as it can – big NUMA machines, HBM memory acceleration for HPC and some AI workloads, and AI inference on the CPU come immediately to mind – and as many supply wins as it can. Even if Intel can win a server shipment war, we do not think it can do so at anything like a high margin. Not with AMD in the game and not with Arm server chips either being designed by the hyperscalers and cloud builders (such as Amazon Web Services and Alibaba) or bought from Ampere Computing (all of the Super 8 do, we hear, even ByteDance, the owner of TikTok).

The big question is what is going to happen to the server market. Gelsinger said on the call that the server market “grew modestly” in 2022, but at diminishing rates as the year progressed and added that inventory burn drove server CPU shipments down a mid-single digit percent year on year. Hyperscale and cloud builder shipments were up, but were offset by declines in enterprise and government. Gelsinger added that the server TAM in Q1 2023 will decline both year on year and sequentially “at an accelerated rate” and that the server TAM would be down in the first half before returning to growth in the second half.

In such a market, excepting the caveats above, does anyone honestly think Intel can gain any market share at all? Or, prevent further market share losses?

Nothing short of an earthquake in Taiwan, or China invading the country, can change this. And maybe even the latter would not really change much. And if an earthquake happens in Taiwan, everyone will be clamoring for whatever server compute engines they can get and stretching their server lifecycles. And if China does invade, the Middle Kingdom will not be stupid enough to kill the goose that lays golden eggs and we suspect that companies will work with TSMC much as they always did after the substantial political fury dies down. Neither an earthquake or an invasion is likely to happen, of course.

And so, Intel has to buckle up and put on its fireproof suit and helmet and ride this out. Which it will. But it is going to take two more years. And it is not going to be pretty, and when it is done, the market will have what it truly wants: Two really big and tough competitors (Intel and AMD) and a couple of Arm alternatives (Ampere Computing, Nvidia, and the homegrowns).

Last thought: Intel’s “real datacenter” business. Over the years we have estimated the size of Intel’s real datacenter business, including all of the hardware, software, and services it provides for stuff in the datacenter. It involves a bit of witchcraft, we concede, but we want to be able to gauge its real datacenter revenues and operating profits even as it changes groups and buys or sells companies.

Intel has sold off its flash business, which definitely had a datacenter component, and that has caused some decline in revenue but has helped profitability in the past year. In our math, the Programmable Solutions Group was always a contributor to the real datacenter business, too, even when it was kept outside of DCG and then DCAI.

It may look like this real datacenter business has hit bottom, with operating profits up a bit. But as the server TAM squeezes, it is hard to imagine how Intel is not going to be pushed into operating losses – and perhaps fairly large ones given the costs of future processor development and current processor manufacturing. That is why Intel is walking away from the datacenter switching business, but holding onto other parts of networking where it can generate revenues and perhaps not lose money and even do more than break even. We are sad about that. It would be nice if someone bought Barefoot Networks as they did Omni-Path and kept some competition alive against Broadcom, Nvidia (Mellanox), and Marvell (Innovium).

[ad_2]

Source link