[ad_1]

Harry Wright’s cleverly packaged range of condiments looks like the kind of artisanal food found in any luxury food or charcuterie market. But they have a distinctive ingredient: toasted and toasted crickets.

“Once the crickets are with the herbs and spices, they can’t be tasted, seen or smelled,” Wright said, adding that “there is no vibration of“ Bush Tucker test ”- a reference to a Successful reality TV shows where the most nasty insects are fed to the contestants.

Wright hopes his business, Short-Horn Super Seasonings, can help alter public attitudes toward insect consumption, which proponents see as an inevitable solution to an approaching global food crisis.

As fears about the environmental impact of the agricultural system increase, entrepreneurs are rushing to develop new ways to feed the planet’s growing population. Insects are rich in protein and other essential nutrients and can be raised on a large scale with minimal environmental impact.

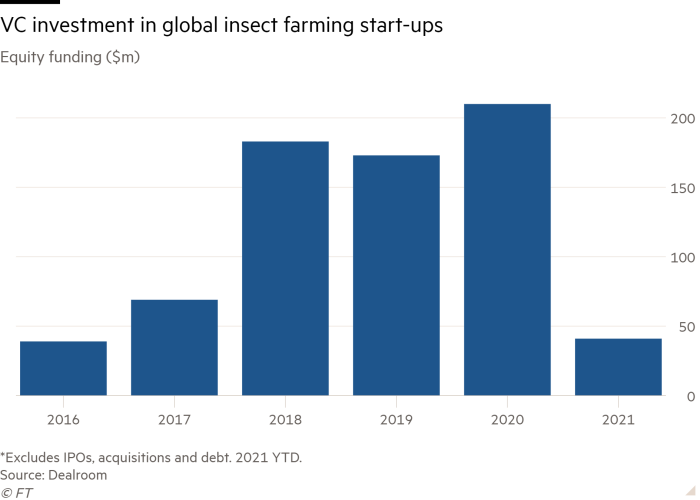

The pace of investments in the initial phase has so far dragged behind what is seen in the most glamorous corners of agritech, where emerging companies that manufacture plant and laboratory meat have attracted venture capital and attention of the public.

But the buzz around the insects grows. VC funding in the sector has increased since 2018, with $ 210 million in equity investments last year, according to the Dealroom data group.

The most important flows have been start-ups focused on feeding livestock, fish and pets.

France’s InnovaFeed, which breeds black soldier flies, raised $ 140 million in its latest round of funding. It has a strategic partnership with Cargill to supply fish and feed, and even processes fly manure for use as fertilizer.

Insects, another French business that cultivates molitor and buffalo flour worms used in pet food, feed and fertilizers, announced last year fundraising of more than $ 350 million in equity and debt.

Insects can replace cereals, soybeans, fish, and vegetable oils in animal and fish-fed pills, providing essential proteins and other nutrients. They can be raised with agricultural organic waste and a minimal amount of water.

Growing environmental issues and ESG investments as well as recent ones regulatory approvals they have opened the door to large-scale financing.

But to become a source of human food in Western markets, insects must overcome the “ick factor”.

Alex Frederick, agriculture and food analyst at corporate data provider PitchBook, said negative perceptions among consumers in markets that have traditionally not consumed insects were a major barrier to acceptance and growth.

Gorjan Nikolik, an analyst at Rabobank, said that if the functional and health benefits of insects were clearly established, they could play “an important role in food”. However, the bank’s latest report on the sector focused solely on non-human consumption of insects. “We had a lot of our customers saying‘ I wouldn’t eat it, ’” he explained.

Short-Horn founders Harry Wright, left, and Matt Dean. Its range of condiments includes grills © Short-Horn

Although pet food is the largest market for insect protein, some manufacturers refuse to use insects. “Most people find insects disgusting and some don’t want their pets to eat them,” Nikolik said.

Rabobank estimates that by 2030 200,000 tonnes of insects will be used annually in fish feed, ie 0.4 per cent of the aquatic food industry, with 150,000 tonnes in pet food, representing 0.5 percent of total pet food. He expects only about 10,000-20,000 tons of insects to be used for human food.

But industry professionals believe that insects will play a role larger paper than some analysts predict.

“More people are starting to think about the consequences of their behavior,” said Kees Aarts, founder and CEO of Dutch insect group Protix. He added that someone who talked about sustainability 20 years ago would have considered himself an anti-capitalist, but now “most young people are thinking about it. I’m impressed with how they are looking at all possible solutions to reduce their footprint.” .

He believes the adverse reaction to insects can be overcome: “if you deliver tasty products with a lower footprint, consumers will buy them.”

Some experts say we may have no choice but to eat insects given the risks climate change, soil erosion, pests and diseases pose to the global agricultural system.

“Consumers in the so-called west will need to embrace insects in their diet, to ensure that their nutrition is rich in essential amino acids, proteins and essential micronutrients such as iron and calcium,” said Asaf Tzachor, associate researcher in food. security at Cambridge University.

The key may be, as with Short-Horn condiments, to move away from eating whole insects to use them as ingredients and additives.

Tzachor believes that processed insects could be used in products such as pasta, porridge and pancakes to improve their nutritional profile or act as antioxidant and anti-inflammatory agents. “Black soldier fly granules contain protein and calcium,” he said. “The dust from worm beetles contains zinc and essential fatty acids.”

Some executives and investors believe that lower volumes of insect-based human food can be offset by higher value and margins.

A meal from Protix, a group of Dutch insects © Protix

Eric Archambeau, of venture capital firm Astanor, an investor in Ynsect, said the insects were nutritious and the ease with which insect proteins can be digested it meant that they could be used in foods aimed at elderly and sick people who could struggle with traditional products. With the supplements of a multimillion-dollar industry, he added, “these categories are a niche, but they are a very large niche.”

Aside from food and feed, researchers are experimenting with other ways to use insects. Some researchers are studying the use of the antibacterial properties of insects to increase the shelf life of food products, while others are investigating their potential role in dealing with environmental problems, for example, raising them in waste such as cardboard and plastics.

While the development of these technologies in commercially scalable operations will take time, “it’s the potential that excites people,” Nikolik said.

The response to the release of Short-Horn earlier this year suggests that perceptions are changing.

“We’ve already grown 20% and had recurring customers,” Wright said. “People have been very receptive, which has been quite a shock.”

[ad_2]

Source link