[ad_1]

For 30.5% of small business owners, inflation is of extreme concern. Not only that, but now small business owners are ranking it as a top concern, with nearly two-thirds or 62.5% saying they have general concerns about inflation, along with rising prices.

This insightful and timely data about the state of small business comes from SCOREthe nation’s largest source of free, expert small business mentoring and a resource partner of the US Small Business Administration.

For its Spring 2022 Megaphone of Main Street: Inflation & the Economy report, SCORE asked more than 1,000 small business owners how they felt about the current economy and inflation, how turbulent economic factors have affected their profitability and what they have done to protect their businesses in response.

Divided into two parts, the SCORE report looks at the economy, inflation and pricing in part one and business impact and resolve in the second part. Only 7% of small businesses are not troubled about inflation impacting their company, according to the SCORE survey; meaning there is a general consensus of concern regarding the cost of rising goods and services.

The price increases are not just data points without real-world ramifications. According to SCORE, “Anecdotal stories about the ways small businesses have struggled with inflation and rising prices are reflected in daily news reports.”

This real-world ramification is best explained by Aaron Mulherin, a SCORE client in Marion, Iowa. Mulherin says every four to six weeks he is hit with 12-15% price increases on materials. “Due to these price increases, AM Glass Repair is forced to purchase materials more than six months ahead of time to lock in lower prices, which causes cash flow issues,” he says.

The Economy, Inflation and Pricing

The economy, inflation and pricing affect all entrepreneurs to a certain degree, and running a business when any of these metrics are high or low can be challenging.

When it comes to the economy there is little consensus as only 9.2% of small business owners feel extremely positive. The vast majority or 76.4% of entrepreneurs feel somewhat negative, neutral or somewhat positive. On the other end of the spectrum, 14.4% feel extremely negative about where the economy is now.

Inflation has 62.5% of business owners generally concerned. This is split between those keeping an eye on things and those that are extremely concerned.

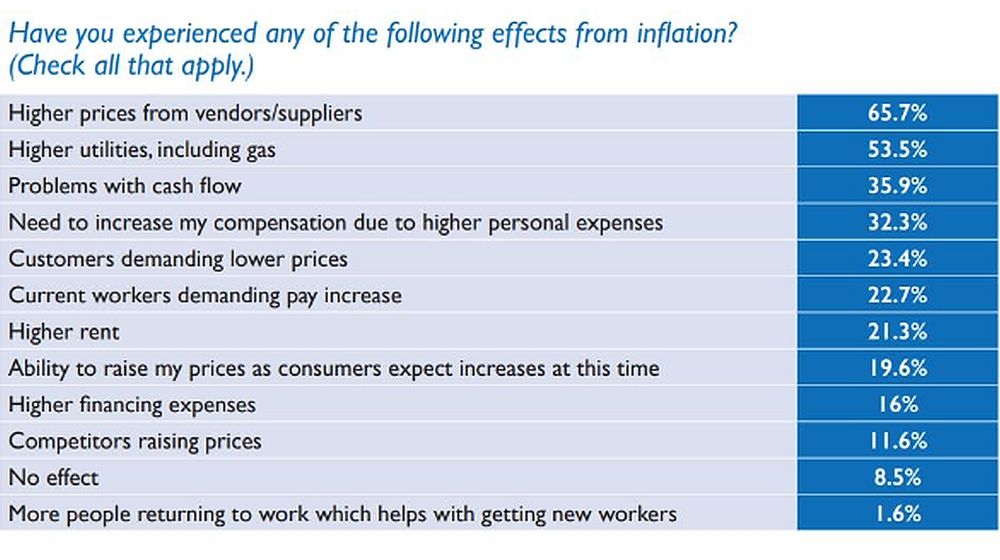

As far as pricing and its related issues, small business owners surveyed said not only are their clients struggling, but so are their employees. This translates to lower demand for products and services because people have less to spend. Add to that 65.7% of vendors and suppliers charging business owners more than they did six months ago, and the ripple effect for small businesses is deafening.

Business Impact and Resolve

The impact of the current economic conditions on small businesses is for the most part negative, to say the least, according to SCORE. The key findings in this part of the report clearly highlight this fact.

- Close to two-thirds (62.7%) of small business owners have seen their profits decline in the past six months with only 15.5% experiencing higher than expected profits.

- The decline in sales has lowered profits for 58.6% of small business owners with expenses rising for 59.5% of them compared to six months ago.

- Cash flow is a problem for 35.9% of small business owners because of rising costs.

- More than half (54.8%) need to raise prices to match prince increases in the market. Almost all surveyed small business owners or 92.2% have raised prices by 5% -20%, with an average of 11%.

The Resolve to Overcome Challenges

When the economy and inflation affect both customers and vendors, price increases are expected. So, the first and obvious action is to increase prices in order to match the marketplace, which 54.8% of the respondents are doing. Beyond increasing prices, small business owners are also taking other measures.

According to SCORE’s report, to combat inflation and rising costs, small business owners are:

- Changing target customer – 39.6%

- Changing product mix – 28.8%

- Increasing productivity by improving processes and automation – 28.2%

- Restructuring financing – 15.5%

- Lowering labor costs – 13.7%

- Renegotiating lower prices from suppliers – 11.2%

- Renegotiating rent / office space – 8.5%

While these steps can help weather this current economic climate, small business owners must look for help from other sources. Whether it is the nationwide network of mentors and resources SCORE provides, including SCORE’s Small Business Resilience Hubwebinars and other education tools, the key is to find these resources and take full advantage of what they offer.

Funded in part through a cooperative agreement with the US Small Business Administration (SBA), SCORE has 10,000 volunteers ready to help. Again, these volunteers provide free mentoring, workshops and educational services in more than 1,500 communities across the US and are here to help your small business start, grow and thrive for years to come. Visit SCORE.org for more information.

The Survey

The SCORE survey was made up of truly small businesses with 90.2% of the respondents employing fewer than 10 people and 63.5% making less than $ 100,000 in sales.

The survey was carried out from Feb. 11, 2022, through Feb. 28, 2022, with 1,327 respondents. Of these, 1,199 are owners that are already in business (86.4%) a startup (8.0%), or exiting (5.6%) their entrepreneurial journey.

[ad_2]

Source link