[ad_1]

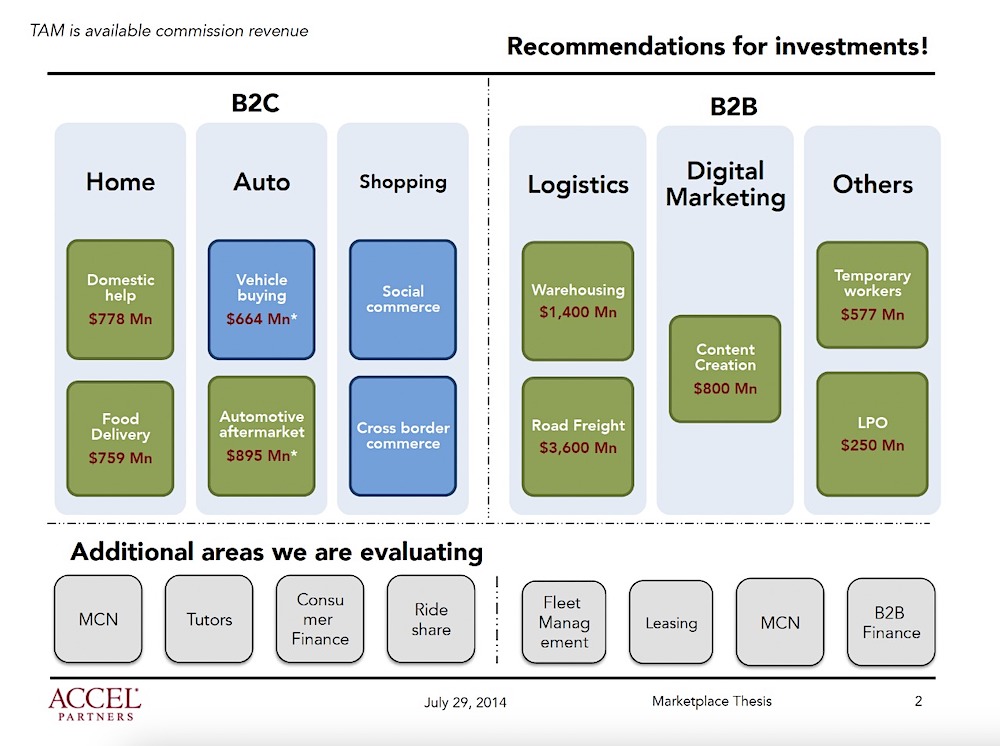

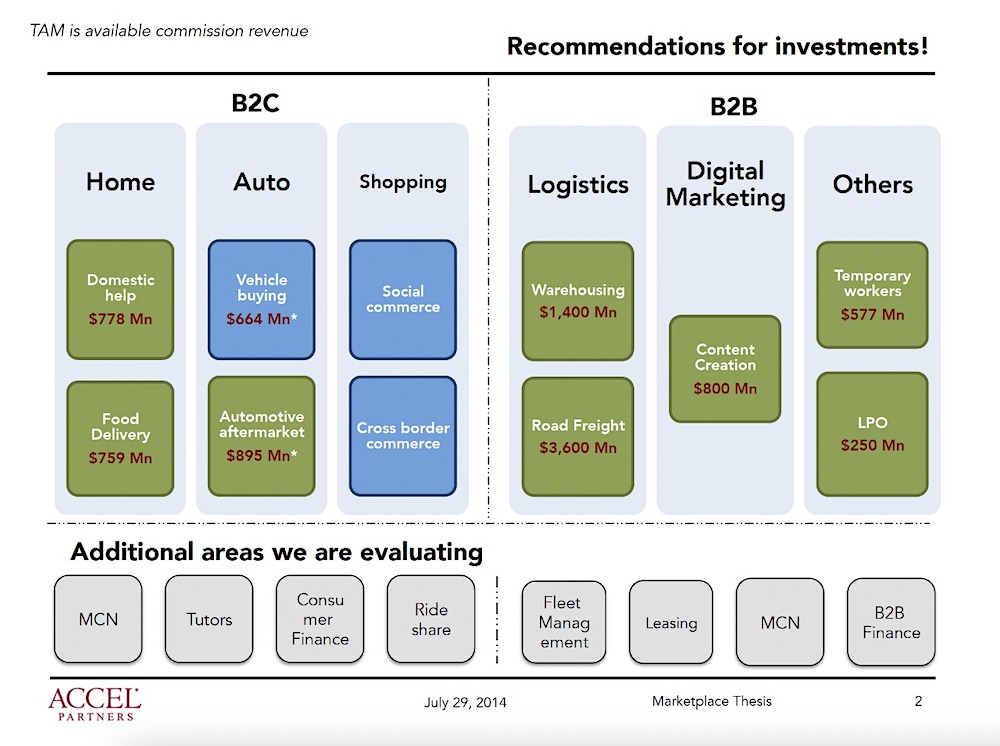

In 2014, Prayank Swaroop also hinted at the future of the marketplace in India at Accel, a storied venture firm where he worked as an associate.

At that time, Flipkart and Snapdeal were the two e-commerce startups that showed similar scale in India. Swaroop says that as more Indians come online, opportunities will emerge in food delivery, the automotive market, warehousing, road freight and social commerce, among many other marketplaces.

Swaroop, now a partner at the firm, was proved right. The city company, which operates in the domestic aid sector, is worth more than 2 billion dollars. Zomato and Swiggy are serving food to millions of customers every month. Spinny and Cars24 are selling hundreds of thousands of cars every quarter. Social commerce startup DealShare is valued at more than $2 billion. And Meesho is valued at just $5 billion.

Hundreds of millions of Indians have come online in the past decade and more than 100 million are doing online transactions and purchases every month. India, which has doubled its unicorn pool in the past two years, has invested more than $75 billion in tech giants Google, Meta and Amazon and venture funds Sequoia, Tiger Global, SoftBank, Alpha Wave, Lightspeed and Acel in the past half-decade.

Swaroop presentation from 2014. Image Credits: Add

But as the local startup ecosystem comes off one of its most difficult years, it’s now seeing another question that it was able to turn off for good a long time ago.

About half a dozen consumer tech Indian startups have gone public in the past year and a half, all of which have underperformed on local stock exchanges. Paytm this year by 60%, Zomato 58%, Nykaa 56%, Policy Bazaar 52% and Delhivery 38%.

Although Indian stocks have outperformed the S&P 500 index and China’s CSI 300 this year. India’s Sensex – a benchmark of local stocks – is up 3.4% this year, compared to a 19.75% fall in the S&P 500 and a 21% drop in China’s CSI 300.

As the market took a turn this year, many Indian startups, including MobiKwik and Snapdeal, delayed their listing plans. In the year Oyo, which plans to list in January 2023, is unlikely to go ahead with that plan, two people familiar with the matter said.

Flipkart, valued at $37.6 billion and majority owned by Walmart, does not plan to list until at least 2024, a person familiar with the matter said. India’s most valuable startup Baiju is not planning to list in 2023 and is instead moving forward with plans to list one of its subsidiaries, Akash, next year, TechCrunch previously reported.

Those looking to push forward with their plans to go public face another hurdle: Several global public funds, including Invesco, which boldly back pre-IPO rounds, are pulling back from the Indian market after a battering in China and other emerging markets this year, he said. People who know the matter.

LPs have long expressed concern over India’s lack of exits and initial attempts from the industry over the past two years seem to be nothing to write home about.

Indian venture funds have historically had many exits through mergers and acquisitions. But even those exits are becoming harder to come by.

An analyst at one of India’s top venture funds said VCs backing early-stage SaaS startups under $25 million have long-term prospects of a good exit. But as we have seen in some cases in recent months, the outlet itself values the startup at less than $25, which makes it difficult for SaaS investors to make a profit.

At a private gathering of a few dozen industry experts in a five-star hotel in Bengaluru on a recent evening, many investors were exchanging notes about deals they were evaluating. The partners have complained that the quality of starters has gone down as the pitch size has increased.

Two prominent venture funds that run well-known accelerator or cohort programs are struggling to find enough good candidates for their next cohorts, people familiar with the matter said.

I’d argue that it’s not just the quality of new startups that has taken a hit, but also investors’ appetite for and mental models of what they think might work in the future.

Take crypto for example. Most Indian investors have been slow to invest in the Web3 space. (You’ll find very few Indian names in the capital tables of local exchanges CoinSwitch Kuber and CoinDCX and, until recently, blockchain-scaling firm Polygon, a prominent VC in the world’s largest crypto VC fund.)

Now, many firms in India that hired a large number of crypto analysts and partners last year are withdrawing from the Web 3 market and have asked employees to focus on different areas, people familiar with the matter said.

Fintech is another concern for investors. India’s central bank has made a series of changes to how fintechs lend to borrowers this year. The Reserve Bank of India is investigating who will get licenses to operate non-banking financial companies in the country in a move that has shocked investors.

Many investors are now chasing opportunities to support banks instead. Accel and Quona recently backed Shivalik Small Finance Bank. Many are considering investing in SBM Bank India, one of the banks that have partnered with fintechs in the South Asian market, TechCrunch reported earlier this month.

One investor described the trend as “hedging” on fintech exposure.

Investors’ enthusiasm for the edtech market has cooled after schools reopened, with giants Baijus, Unadami and Vedantu.

Indian startups have raised $24.7 billion this year, down from $37 billion last year, according to market data firm Trackx. The funding and market volatility have prompted startups to lay off as many as 20,000 workers this year.

More than a dozen investors I spoke with believe the funding won’t disappear until at least Q3 of next year. Although most investors are sitting on India’s high dry powder.

As we head into the new year, some investors are reassessing their convictions and many are convinced that more unexpected rounds are on the horizon for major startups. But many Star Unicorn founders are reluctant to include haircuts in their reviews, partly because they believe it will drive away some talent. PharmEasy, which is valued at $5.6 billion, raised new capital this year for less than $3 billion, two people familiar with the matter said. (PharmEasy did not respond to a request for comment.)

“2022 has started strongly, and the Indian venture funding market looks like it will be ruled by gravity for some time, unlike the US and China, which have been witnessing dramatic declines, but this is not to be. The Indian market is finally subject to the same macro headwinds as the US and Chinese venture markets, said Bloom Ventures investor Sajit Pai.

Pai said last year’s growth-stage deals accounted for most of the funding, and this year they’re down 40-50%. “The decline was mainly driven by growth fund disinvestment because the multiples in private markets were rich compared to their public peers and the weak unit economics of growth-stage companies.”

[ad_2]

Source link